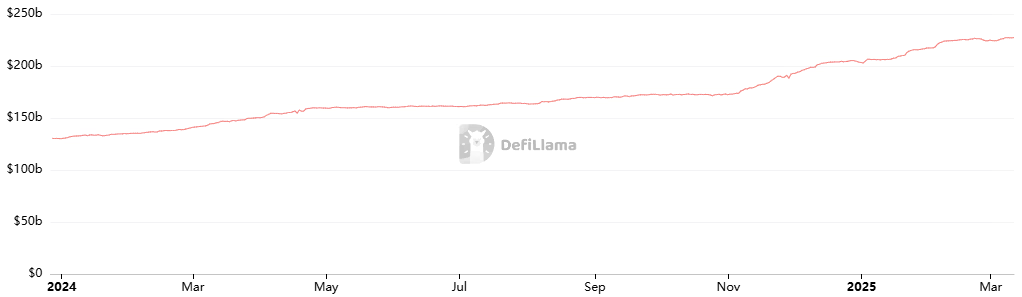

- Stablecoin market cap reaches $234.8 billion, a new all-time high.

- Competition grows with major players like Tether and USDC, and new entrants integrating with traditional finance.

- Stablecoins connect with traditional finance through payments, lending, and institutional adoption.

- This growth suggests increased regulatory scrutiny, innovation, and potential for global financial inclusion.

Stablecoins and Their Rising Prominence

Stablecoins have emerged as a pivotal element in the cryptocurrency landscape, designed to maintain a stable value by being pegged to traditional assets, most commonly the US dollar. This stability makes them a reliable medium for transactions and a store of value, contrasting with the volatility of assets like Bitcoin and Ethereum.

The stablecoin market cap has reportedly reached a new all-time high of $234.8 billion, according to The Defiant, signaling robust growth and increasing adoption.

Reflecting the growing trust and utility of stablecoins in the financial ecosystem. This growth follows a period of consistent expansion, with stablecoins proving their worth in providing a stable medium of exchange and store of value, particularly within the decentralized finance (DeFi) space.

Data from DefiLlama highlights that Tether (USDT) leads with a market cap of over $143 billion, accounting for 63.11% dominance, while Circle’s USD Coin (USDC) follows with approximately $57 billion. Emerging players like Ethena USDe (USDE), with a market cap of $5.45 billion, are also gaining traction.

Integration with Traditional Finance

Stablecoins are increasingly integrating with traditional finance, acting as a bridge between the crypto and fiat worlds.

Payment Systems

Stablecoins facilitate fast and low-cost cross-border transactions, challenging traditional remittance services. For instance, they enable businesses to accept payments in dollars while operating in the crypto space, as noted in CoinPaper.

Lending and Borrowing

In DeFi, stablecoins serve as collateral for loans, providing an alternative to traditional banking. This is particularly popular in lending pools where users can earn interest, as described in CoinDesk.

Institutional Adoption

Some traditional financial institutions are exploring stablecoins for treasury management and digital asset strategies, recognizing their efficiency. This trend is supported by reports from S&P Global Ratings, which assess stablecoin stability for market stakeholders.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- XRP Price Prediction: XRP is expected to break out of consolidation and exceed $10, and the dotminers AI intelligent program is born

- Regulatory Boost and Altcoin Speculation Drive Crypto Momentum

- Trump-Backed WLFI Blacklists Justin Sun’s Wallet Amid Token Transfer Controversy

- What is Helium?

- Ethereum Steadies Above $4.4K & PENGU Price Signals Breakout as 312K Holders Prove BlockDAG is the Next Big Crypto

Related

- Aave GHO Stablecoin Aave GHO Stablecoin: A New Decentralized Stablecoin from the Aave Protocol....

- Tether Transfers Millions to Foreign Banks Tether has been a mystery to many, with concerns over the dependability of its reserves backing the $68 billion stablecoin. ...

- CryptoGames Review: You Can Now Play Keno and Win Big CryptoGames provides new levels of success in the competitive world....

- Blend: an NFT Lending Protocol NFT Lending Blend is revolutionizing the world of cryptocurrency investments by combining the power of non-fungible tokens (NFTs) with innovative lending mechanisms. ...