Aave GHO Stablecoin

CryptoPress

In the rapidly evolving world of cryptocurrencies, stablecoins have gained immense popularity for their ability to provide stability and utility in a volatile market. One such stablecoin making waves is the Aave GHO Stablecoin, which combines the advantages of decentralized finance (DeFi) with a secure and stable digital asset. In this article, we will explore the concept of stablecoins, delve into the Aave Protocol, and dive deep into the Aave GHO Stablecoin, examining its features, use cases, security, and regulatory compliance.

Aave Protocol Overview

Before delving into Aave GHO Stablecoin, it’s essential to understand the underlying Aave Protocol. Aave is a decentralized lending and borrowing platform built on the Ethereum blockchain. It allows users to lend and borrow a wide range of cryptocurrencies in a secure and permissionless manner. The protocol utilizes smart contracts to automate lending and borrowing operations, eliminating the need for intermediaries and ensuring transparency.

With its unique features such as flash loans, collateral swapping, and yield farming, the Aave Protocol has become a prominent player in the DeFi space, providing users with efficient and innovative financial services.

What is GHO?

GHO is a new stablecoin that is being created by the Aave protocol. It is a decentralized stablecoin, which means that it is not controlled by any one company or organization. Instead, it is managed by the Aave DAO, which is a group of Aave users who vote on how the protocol should be run.

GHO is backed by a variety of different assets, including ETH, USDC, and DAI. This means that its value is always pegged to the US dollar. When you mint GHO, you are essentially borrowing it against the value of the assets that you have deposited as collateral.

You can use GHO to borrow money, make payments, or simply store your value. It is a very versatile asset that can be used for a variety of different purposes.

Key features of GHO:

- It is a decentralized stablecoin.

- It is backed by a variety of different assets.

- It is transparent and cannot be changed.

- Interest rates are defined by the Aave DAO.

- Discounts are available to borrowers staking AAVE in the Safety Module.

- GHO can be minted and borrowed on the Aave protocol.

- The GHO supply is managed by the Aave DAO.

- The interest paid on GHO is redirected to the Aave DAO treasury.

- GHO can be used to make payments, store value, or borrow money.

Aave GHO Stablecoin Explained

Now, let’s turn our attention to Aave GHO Stablecoin. This is a stablecoin built on the Aave Protocol, leveraging its robust infrastructure and features. The GHO Stablecoin aims to provide users with a reliable and stable digital asset that can be used for various purposes within the decentralized ecosystem.

The GHO Stablecoin achieves its price stability by utilizing a combination of collateralization, algorithmic mechanisms, and external market data. This ensures that the value of the stablecoin remains relatively constant, mitigating the volatility commonly associated with cryptocurrencies.

To mint Aave GHO Stablecoin, users need to lock collateral assets into the Aave Protocol. These collateral assets serve as a guarantee for the stablecoin’s value and provide security to the ecosystem. Once the collateral is locked, users can mint GHO Stablecoins, which can be used for transactions, investments, or as a store of value.

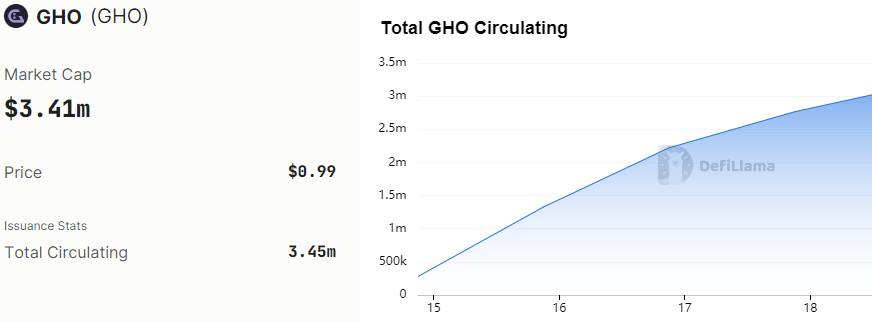

Current Circulating Supply

Use Cases of Aave GHO Stablecoin

GHO provides a stable and reliable medium of exchange for decentralized applications (dApps) and DeFi platforms. This stability allows developers and users to transact with confidence, without the fear of price fluctuations eroding the value of their assets.

Another advantage of Aave GHO Stablecoin is its ability to act as a risk mitigation tool and a hedge against market volatility. By utilizing stablecoins, users can shield their assets from the drastic price swings often witnessed in the cryptocurrency market. This stability is particularly valuable during times of economic uncertainty or when preserving the value of assets is of utmost importance.

Other use cases of Aave GHO Stablecoin:

- Medium of exchange: GHO can be used as a stable and reliable medium of exchange for decentralized applications (dApps) and DeFi platforms. This stability allows developers and users to transact with confidence, without the fear of price fluctuations eroding the value of their assets.

- Staking: GHO can be staked to earn rewards. This is a way to generate passive income and support the growth of the Aave ecosystem.

- Lending: GHO can be used to borrow other assets on the Aave platform. This can be a way to access liquidity or to amplify investment returns.

- Payments: GHO can be used to make payments for goods and services. This is a way to use cryptocurrency in the real world and to benefit from the speed, security, and convenience of blockchain technology.

Aave GHO Stablecoin vs. Traditional Stablecoins

When comparing Aave GHO Stablecoin with traditional stablecoins, several key differences and advantages emerge. Traditional stablecoins, such as those pegged to fiat currencies like USD or EUR, often rely on centralized entities or custodians to ensure price stability. In contrast, Aave GHO Stablecoin operates within a decentralized ecosystem, leveraging the power of smart contracts and algorithmic mechanisms.

Furthermore, traditional stablecoins may require users to trust centralized entities, such as banks or financial institutions, for the backing and management of the stablecoin’s collateral. Aave GHO Stablecoin eliminates this reliance on intermediaries by using decentralized collateral assets and transparent protocols.

The decentralized nature of Aave GHO Stablecoin not only enhances security but also reduces the counterparty risks associated with centralized stablecoins. By leveraging the Aave Protocol’s robust infrastructure, Aave GHO Stablecoin offers users a more transparent, secure, and censorship-resistant stablecoin solution.

Security and Risks of Aave GHO Stablecoin

As with any financial instrument, it is essential to understand the security measures and potential risks associated with Aave GHO Stablecoin. The Aave Protocol has implemented various security measures to ensure the integrity and safety of user funds. These include smart contract audits, bug bounty programs, and continuous monitoring and improvement of the protocol.

However, it is crucial to acknowledge that no system is entirely risk-free. Aave GHO Stablecoin’s value can be subject to market risks and fluctuations, although its stability mechanisms aim to minimize these risks. Users should also be cautious when selecting collateral assets and consider the potential risks associated with the underlying cryptocurrencies.

To mitigate risks, users can stay informed about the latest security best practices, perform due diligence on collateral assets, and utilize external risk management tools within the DeFi ecosystem.

Future Developments and Roadmap

Looking ahead, Aave GHO Stablecoin has ambitious plans to enhance its features and expand its use cases. The team is actively exploring partnerships with other DeFi projects, aiming to create interoperability and unlock new possibilities within the decentralized ecosystem. Moreover, they are continuously researching and developing innovative mechanisms to further improve the stability and functionality of Aave GHO Stablecoin.

The roadmap includes potential upgrades such as enhanced collateralization methods, integration with external oracle systems for real-time market data, and exploring cross-chain compatibility to expand Aave GHO Stablecoin’s reach beyond the Ethereum blockchain.

Conclusion

In conclusion, Aave GHO Stablecoin offers a promising solution for users seeking stability and utility in the decentralized finance space. By leveraging the Aave Protocol’s infrastructure, Aave GHO Stablecoin combines the advantages of decentralized systems with the stability of a pegged digital asset. Its use cases span from providing a reliable medium of exchange to facilitating cross-border transactions and risk mitigation.

FAQs

To acquire Aave GHO Stablecoin, you can visit supported decentralized exchanges or platforms that offer access to the Aave Protocol. You can use your collateral assets to mint Aave GHO Stablecoin within the protocol.

The fees associated with using Aave GHO Stablecoin may vary depending on the specific platform or exchange you utilize. These fees can include transaction fees, gas fees on the Ethereum network, and potential fees for minting or redeeming stablecoins.

Aave GHO Stablecoin is collateralized by digital assets locked within the Aave Protocol. These collateral assets provide the stability and backing for the stablecoin’s value, but they are not physical assets.

Yes, Aave GHO Stablecoin can be used for everyday transactions within the decentralized finance ecosystem. Its stable value makes it a reliable medium of exchange for various purposes, including purchasing goods and services or participating in DeFi applications.

Aave GHO Stablecoin maintains price stability through a combination of collateralization, algorithmic mechanisms, and external market data. These mechanisms ensure that the stablecoin’s value remains relatively constant, minimizing the impact of market volatility.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- REZ Airdrop: Increased Rewards and Early Access for Community

- Philippines Traders Fair 2024: Where Ambition and Expertise Unite

- Crypto Market Update: April 25, 2024

- Renzo’s Restaked ETH Depegs to $700: DeFi Platforms Gearbox and Morpho Face Liquidations

- Crypto Market Update: Insights and Trends for April 23, 2024

Related

- Blend: an NFT Lending Protocol NFT Lending Blend is revolutionizing the world of cryptocurrency investments by combining the power of non-fungible tokens (NFTs) with innovative lending mechanisms. ...

- Top Yield Farms on Polygon Here are Polygon's greatest Yield Farms for mining or earn passive earnings....

- 5 Cardano Projects You Need to Check Out Cardano is one of the cryptocurrencies that are making waves in the market today....

- Lowest Cost Bitcoin-Linked ETF to Launch on November 16: VanEck Bitcoin Strategy ETF (XBTF) Lowest Cost Bitcoin-Linked ETF to Launch on November 16: VanEck Bitcoin Strategy ETF (XBTF)...