Altcoin market bleeds

JUAN MENDE

The fall

The altcoin market has experienced a notable downturn as of Friday, April 12, 2023, with many altcoins losing a significant portion of their value up to 50% in some cases, especially the riskier ones like meme coins.. This can be seen in the widespread panic selling and the rapid decline in the market capitalization of many altcoins.

A hypothesis of what happened

The hypothesis: It’s difficult to determine whether this market fall is a correction or a fundamental change without further analysis. However, it’s likely a combination of both. The market may be correcting after a period of rapid growth, and at the same time, there could be a fundamental change in the market dynamics due to increased competition, regulatory changes, and changes in investor sentiment.

Here is a theory from some analysts as to why the altcoin market has fallen so steeply.

Excess liquidity: There may be an excess of token liquidity, as many projects have issued their own tokens, leading to a dilution of value and increased volatility.

Too many tokens: There is a vast number of tokens in the market, which can lead to a dilution of value and increased competition. This can make it difficult for individual projects to stand out and attract investment.

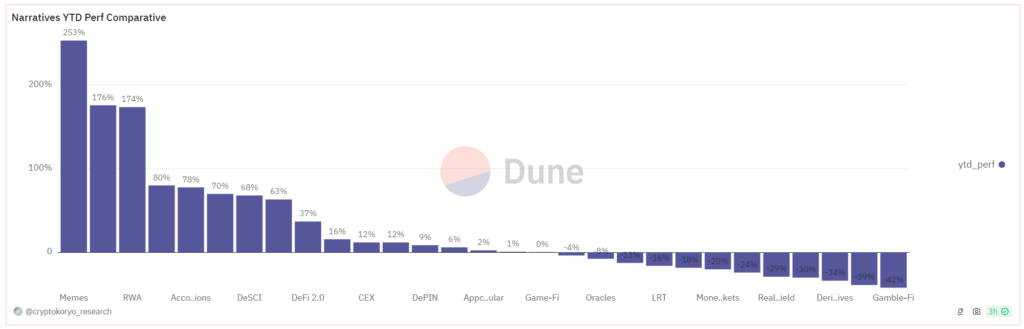

Speculation: The market seems to have lost interest in the fundamentals of the projects and entered into a very speculative, get-rich-quick scheme, as can be seen by the interest in memecoins outweighing the projects that can actually change the world with their technology.

Retail investors: It seems that the retail investor is not as present at this point in the market or does not have enough money to enter with the necessary strength.

The presence of retail investors can be a significant factor in the altcoin market. They are often attracted to the potential for high returns but can also contribute to rapid price movements due to their trading behavior.

Analyzing Google search trends for specific cryptocurrency terms can reveal retail interest. When more people search for terms like “Bitcoin,” “Ethereum,” or altcoin names, it suggests growing retail attention.

How to recover

To recover from this downturn, it’s important for projects to focus on quality and long-term sustainability. This includes having a clear use case, strong fundamentals, and a solid business model. Multi-cycle projects that can weather market fluctuations are more likely to succeed in the long term.

Have a list of projects with good prospects ready to take advantage of the buying momentum. It is essential to take into account technical aspects such as FDV (fully diluted valuation), circulating supply, total supply, etc, because even a good project can drop abruptly in price if they issue too many tokens.

The fall of the altcoin market is a complex issue that can be attributed to a combination of factors. To recover and thrive, it’s essential for projects to focus on quality, sustainability, and long-term value creation.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Related

- MicroStrategy Announces Second Quarter 2021 Financial Results July 29, 2021 04:01 PM Eastern Daylight Time TYSONS CORNER, Va.–(BUSINESS WIRE)–MicroStrategy® (Nasdaq: MSTR), the largest independent publicly-traded business intelligence company, today announced financial results for the three-month period ended June 30, 2021 (the second quarter of its 2021 fiscal year)....

- Why The Crypto Market Crashed: 5 reasons for the fall The crypto market has seen a sharp decline over the past two months, but last week was brutal....

- IDO (Initial DEX offering) An Initial DEX Offering or IDO (Initial DEX Offering) is the start of a decentralized exchange (DEX)....

- Non-Fungible Tokens: The Guide Non-fungible tokens (NFTs) are a new type of token which is represented by unique cryptographic units, meaning that each token has a unique value. ...