What is Solend?

CryptoPress

Solend is a decentralized lending and borrowing protocol built on the Solana network. It’s an autonomous platform that enables users to borrow or lend assets on the Solana network. The protocol uses an algorithm to determine interest rates and collaterals, allowing users to earn interest and leverage crypto assets long or short on the platform.

How does it work? 🛠️

At its core, Solend allows users to engage in decentralized lending on the Solana network. Users deposit assets into their accounts on Solend and earn interest. Moreover, they can also collateralize their deposits to get loans without justifying their means to repay. Solend, an autonomous app, eliminates the need for borrowers to go through a complex underwriting process to determine the financial risk for an institution when sanctioning a loan.

Solend operates on the principle of pooled lending. Users deposit their assets into a global liquidity pool, from which borrowers can take out loans. The interest rate for each asset is determined algorithmically based on the supply and demand for that asset. When users deposit assets, they receive interest-earning tokens in return. These tokens represent the user’s share of the total pool and accrue interest over time.

Solend is a decentralized application (dApp) operating within the blockchain space, aiming to revolutionize the lending process. It empowers users to act as online mini-banks by becoming liquidity providers. To engage with Solend, users connect to the Solend dApp using a Solana native wallet such as Phantom. They then have the option to lend or borrow funds, particularly in stablecoins or SOL (Solana’s native cryptocurrency, equivalent to Ethereum’s ETH). Lenders deposit funds into liquidity pools, effectively becoming liquidity providers. Borrowers, on the other hand, deposit collateral and access liquidity from these pools, provided by lenders, and in return, they pay interest for the liquidity-providing service.

- Solend is a decentralized application (dApp) in the blockchain space, focused on transforming the lending process.

- Users act as online mini-banks by becoming liquidity providers.

- Solana’s native wallet, such as Phantom, is used to connect to the Solend dApp.

- Users can choose to lend or borrow funds, primarily in stablecoins or SOL (Solana’s native cryptocurrency).

- Lenders become liquidity providers by depositing funds into liquidity pools.

- Borrowers deposit collateral and access liquidity from these pools, provided by lenders, paying interest for the service.

How do I join or use it? 🤝

For lending and borrowing on Solend, users require a Solana wallet with enough funds to pay the gas fees. They need SOL, the native cryptocurrency of Solana, to access the functionality of the network.

- Acquire a Solana wallet with adequate funds to cover gas fees.

- Ensure possession of SOL, the native cryptocurrency of Solana, to access the network’s functionality.

Project features 🌟

Solend is lauded for expanding the methods available for Solana users to boost financial gains. It filled a large gap in the Solana ecosystem, drawing a staggering $100 million in deposits in just over a month post-launch. Solend rode the high scalability of the Solana blockchain, which had built its reputation for being fast and with low transaction fees.

Tokenomics: Is there a Coin? prices? 💰

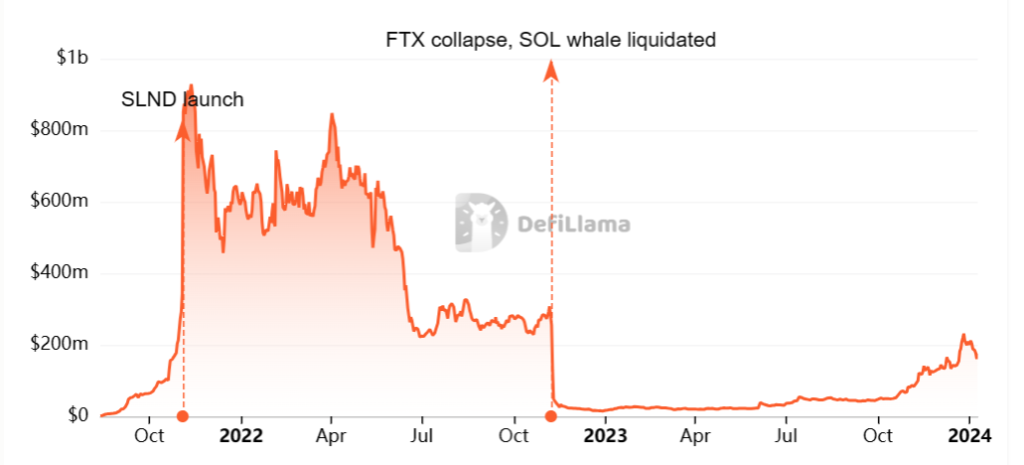

SLND, the native token of Solend, provides exposure to Solana’s decentralized finance (DeFi) market. When Solend launched in August 2021, its total value locked (TVL) was less than $20 million. Around three months later, its TVL skyrocketed to approximately $1 billion.

Remarkable things about the project 🎉

Solend is noted for its high scalability and composability. It has established itself as Solana’s largest lending and borrowing platform, with over $140 million in total value locked (TVL) and support for more than 70 assets across 170,000 users.

Project risks and controversies ⚠️

A Solana whale nearly drained a liquidity pool, and it would have caused some major ripples. The protocol announced that the whale borrower had moved $25 million worth of USDC debt to Mango Markets, another Solana-based lending protocol, thereby alleviating Solend of some of the burden and reducing the protocol’s risk.

Factsheet

| Information | Details |

|---|---|

| Official Website | Solend Official Website |

| Audits | Solend has been audited by Kudelski |

| Market Cap | $71,234,496 |

| ICO date | November 1, 2021 – November 3, 2021 |

| Documentation, Whitepaper | Solend Documentation |

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- REZ Airdrop: Increased Rewards and Early Access for Community

- Philippines Traders Fair 2024: Where Ambition and Expertise Unite

- Crypto Market Update: April 25, 2024

- Renzo’s Restaked ETH Depegs to $700: DeFi Platforms Gearbox and Morpho Face Liquidations

- Crypto Market Update: Insights and Trends for April 23, 2024

Related

- Blend: an NFT Lending Protocol NFT Lending Blend is revolutionizing the world of cryptocurrency investments by combining the power of non-fungible tokens (NFTs) with innovative lending mechanisms. ...

- Airdrop: Term Finance Term Finance Airdrop: A New DeFi Lending Protocol That Offers Fixed Rates....

- Top Yield Farms on Polygon Here are Polygon's greatest Yield Farms for mining or earn passive earnings....

- Are DeFi 2.0 going to change everything? DeFi 2.0 solves the problem of intense farming and the drop in the price of the token, since it is the protocol itself that provides the liquidity....