CryptoPress

In a nutshell, liquidation is the process of turning an asset into cash. Liquidation can happen for various reasons, but in the case of cryptocurrencies, it’s usually because someone is trying to sell off their holdings during a time when the price is too low for them to get any money out of them.

The most common reason for this is when someone holds cryptocurrency as an investment and decides that they need cash now. This can happen due to an emergency or because they need money to pay bills or buy something specific. In this situation, they will sell off their holdings at whatever price they can get in order to access their funds right away.

What are crypto liquidations?

When you trade cryptocurrencies, you’re not just investing in the coins themselves—you’re also buying into an entire ecosystem. That means that when you buy a crypto asset, you’re buying into a network of other people who want to use that coin. And when they use it, they will make it worth more.

But what happens if there aren’t enough people using your cryptocurrency? What happens if the network of users dwindles down to just one person?

That’s where liquidations come in. Liquidation is a process by which the price of a crypto token is lowered until it reaches zero, which means that users can no longer purchase it with their own money. This is done because there isn’t any demand for the token anymore—there’s no one who wants to buy it from you.

When you trade cryptocurrencies, you’re not just investing in the coins themselves—you’re also buying into an entire ecosystem.

This process isn’t as rare as you might think: in fact, it happens more often than not with small-cap coins and tokens that have little or no market presence at all (or have never been traded on an exchange).

Cryptocurrency is a volatile market, and that can be both exciting and scary for investors. While it’s possible to make a lot of money in the short term, you also have to be prepared for the possibility that things won’t go your way.

In the cryptocurrency world, liquidation is a transaction that occurs when a trader’s position is closed by their broker. The broker will do this because they believe the price of the cryptocurrency is going to move against their client, and they want to protect them from losing money.

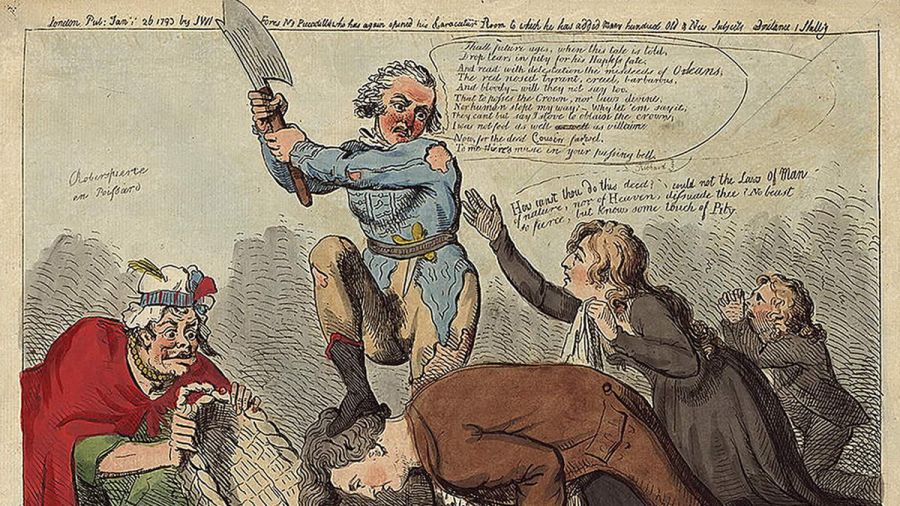

Image: “The near in blood, the nearer bloody LCCN2004669792” by Fæ is licensed under CC BY 2.0.

Liquidations FAQ

A liquidation trade is a transaction in which the person in the purchased or sold position under a futures contract acquires an offsetting sold or bought position, as the case may be, under another futures contract in order to close out the futures contract.

Traders may keep their positions open by looking at the “Liquidation Price” in their account’s Open Positions section. Your position will be liquidated if the contract mark price falls below this price (when long) or rises above this price (when short).

Through the use of Stop-Loss Orders.

Using a stop loss is the most simple way to prevent liquidation. A stop loss is a trading feature offered by Binance Futures that enables traders to establish a price at which a transaction will automatically end if the price of an asset reaches this predefined threshold.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Related

- What is the metaverse? The crypto Metaverse is a decentralized network of multiple blockchains and digital assets....

- Lowest Cost Bitcoin-Linked ETF to Launch on November 16: VanEck Bitcoin Strategy ETF (XBTF) Lowest Cost Bitcoin-Linked ETF to Launch on November 16: VanEck Bitcoin Strategy ETF (XBTF)...

- How Bitcoin Transactions Work Transactions are the most important aspect of the Bitcoin network. Everything else is built and organized in such a manner that transactions can be effectively sent, validated, and confirmed. Transactions are made up of inputs and outputs; inputs are what...

- A Primer and the Possibilities of BitClout WORLDWIDE Jul 16 2021 (Blockchain Wire) Stories about BitClout have been making the rounds on new sites and have sparked lively conversations across social media. Before we dive into what BitClout is, it’s worth taking the time to understand another trending technology...