The Crypto-VC Valuation Game

Venture capitalists (VCs) have played a significant role in the growth of the crypto market, providing funding and expertise to promising startups. However, their involvement has also raised concerns about the valuation of crypto projects and the potential impact on retail investors.

VC Dominance and the Valuation Game

VCs often hold a substantial stake in crypto projects, which can lead to concerns about their influence on valuations. This dominance can create a situation where valuations are driven more by VC interests than by the project’s fundamentals.

Crazy Unrealized Gains

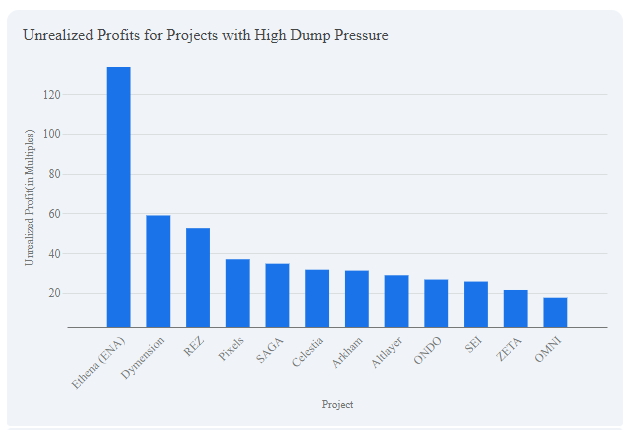

One of the most striking aspects of VC involvement in crypto is the massive, unrealized gains they have accumulated. Our analysis reveals that projects with high VC dominance tend to have exceptionally high unrealized profits, with an average of 31.81 times the initial investment. This raises questions about the sustainability of these valuations and the potential for a market correction if VCs decide to cash out.

This raises questions about the sustainability of these valuations and the potential for a market correction if VCs decide to cash out.

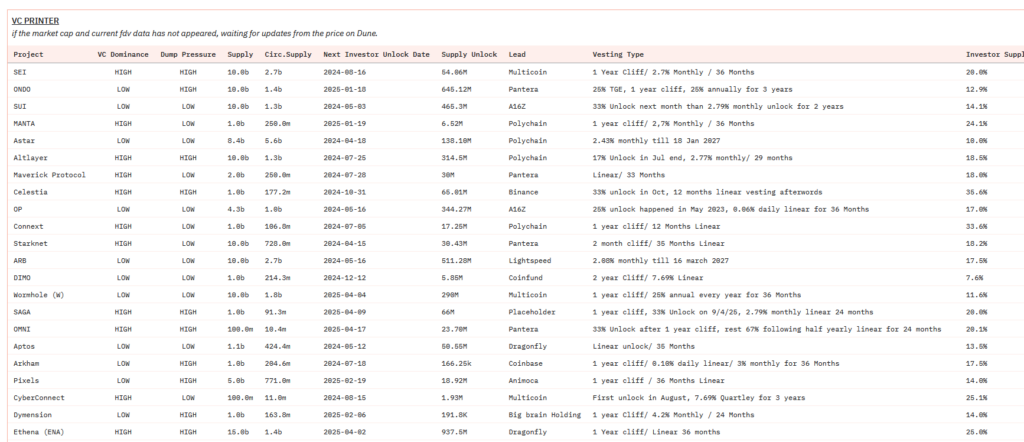

Think Twice! A List of Projects With High Valuations

Retail investors should be particularly cautious of projects with high VC dominance and high dump pressure, as these projects carry a higher risk of experiencing a significant price drop if VCs decide to sell their holdings. This phenomenon, often referred to as “getting rekt” (crypto slang for incurring substantial financial losses), can leave retail investors with significant losses while VCs profit from their early investments. Some examples of projects with high VC dominance and high dump pressure include:

Several projects with high VC dominance have seen their valuations soar.

| Project | Unrealized Profit (in Multiples) |

|---|---|

| Ethena (ENA) | 158.7 x |

| Dymension | 58.93 x |

| REZ | 52.52 x |

| Pixels | 36.87 x |

| SAGA | 34.64 x |

| Celestia | 31.6 x |

| Arkham | 31.14 x |

| Altlayer | 28.79 x |

| ONDO | 26.63 x |

| SEI | 25.62 x |

| ZETA | 21.38 x |

| OMNI | 17.49 x |

These projects illustrate the potential for significant returns in the crypto market, but they also highlight the risks associated with VC-driven valuations.

Exhaustive List of Highly VC-Dominated Projects

You can find a comprehensive list of VC-dominated projects in this impressive work here, @dyorcrypto en Dune Analytics.

Are Crypto Startups Still a Good Investment?

The crypto-VC landscape is constantly evolving. While VCs continue to invest in promising projects, there are signs that the market is maturing. Some VCs are becoming more selective in their investments, focusing on projects with strong fundamentals and a clear path to profitability.

Despite the risks associated with VC dominance, crypto startups can still be a good investment. However, it’s crucial for investors to do their due diligence and carefully evaluate the fundamentals of a project before investing. It’s also important to be aware of the potential for price volatility in projects with high VC dominance.

The future of crypto VC is uncertain, but it’s clear that VCs will continue to play a significant role in the market. As the market matures, we can expect to see VCs becoming more selective in their investments and focusing on projects with long-term potential. We may also see more regulatory scrutiny of VC activities in the crypto space.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Global Blockchain Show 2026: Riyadh Becomes the Hub of Decentralized Innovation

- Fintech Revolution Summit – Abu Dhabi 2025

- Bitwise Spot Solana ETF Debuts with $69.5M Inflows Amid SOL Price Volatility

- SparkDEX Eternal Reignites: Flare’s Perpetuals Arena Returns with Fresh Features After XRP Influx

- Bitcoin Dips Below $110K as Powell Tempers Expectations for December Rate Cut

Related

- Tritemius was born to promote entrepreneurship and business innovation with Web3 and digital assets New businesses around Web3, digital assets, and Blockchain....

- What is staking and why it is critical to the crypto economy? What is staking and why it is critical to the crypto economy?...

- The CONG Token is set to take off The Conglomerate Capital is launching its token presale event on January 16th....

- Altcoin market bleeds The fall of the Altcoin market can be attributed to a variety of factors that have led to a significant decline in the value of many altcoins....