Tag: Yield farming

sDAI Pool on Aave

Written on .

Defi High Yields 2023

Written on .

Earn up to ~50% APR With the KAVA/USDC Sushi Pool

Written on .

Yield Farming Opportunity on Optimism – Earn up to 9.20% APY on stablecoins MAI and USDC — with Velodrome or Beefy Finance

Written on .

$MAI, $USDC, $VELO, Optimism, Stablecoins, Staking, Yield farming

How to avoid the risks of cryptocurrency yield farms

Written on .

Top Yield Farms on Polygon

Written on .

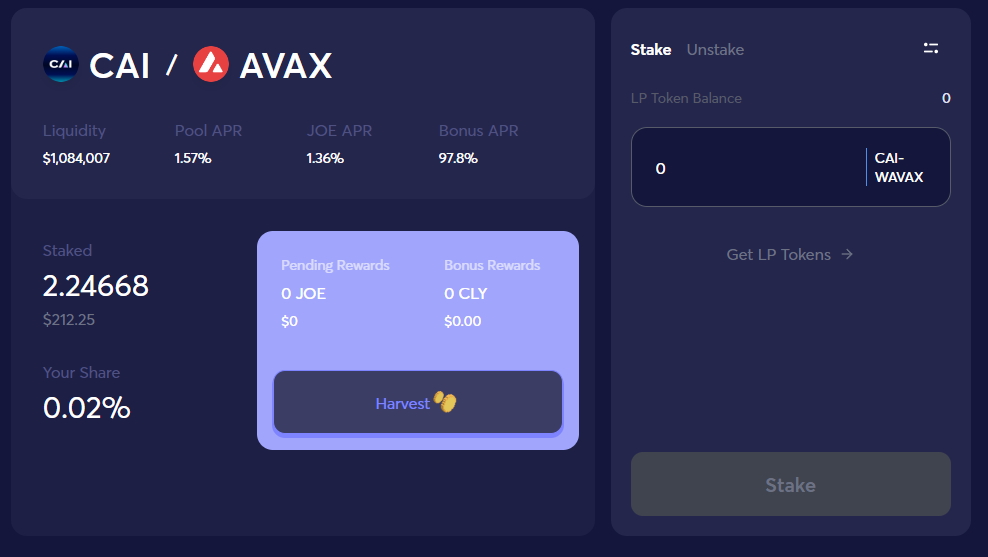

Yield farming: CAI / AVAX for more than 100% APR on TraderJoe

Written on .