Binance and CEO Changpeng Zhao Sued by SEC for Operating Unregistered Digital Asset Exchange

CryptoPress

In Brief:

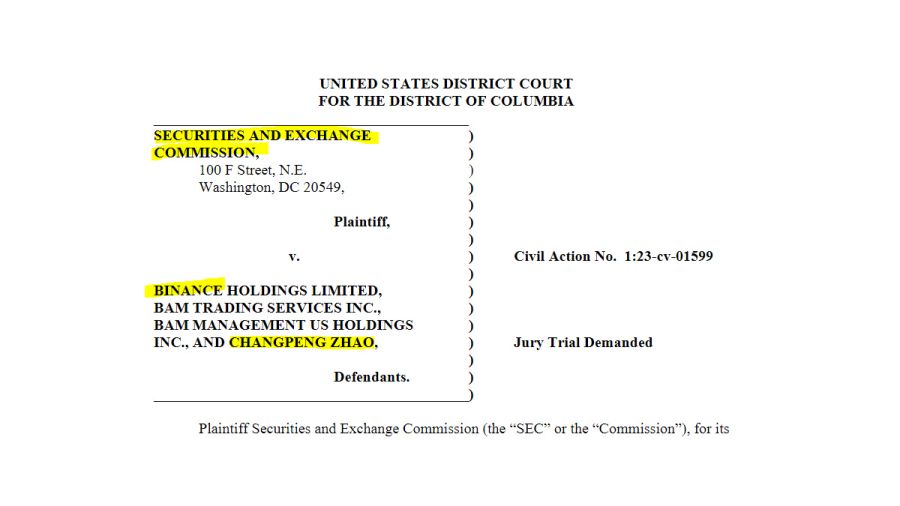

- The SEC has sued Binance and CEO Changpeng Zhao for operating an unregistered digital asset exchange in the United States.

- Binance has allowed U.S. residents to trade on its platform without registering with the SEC.

- Binance has failed to implement adequate anti-money laundering controls.

- The SEC seeks injunctive relief, disgorgement of profits, and civil penalties.

SEC Sues Binance and CEO Changpeng Zhao

The U.S. Securities and Exchange Commission (SEC) has taken legal action against Binance, one of the world’s leading cryptocurrency exchanges, and its CEO Changpeng Zhao (CZ). The SEC filed a lawsuit alleging multiple violations of securities laws. This move marks a significant development in the ongoing regulatory scrutiny faced by the crypto industry.

Allegations and Violations

The SEC’s lawsuit against Binance and CZ includes several allegations regarding securities violations. Firstly, the complaint asserts that Binance offered and sold digital asset securities to U.S. investors without registering the offerings with the SEC, thus violating federal securities laws. This accusation highlights the SEC’s focus on ensuring compliance with regulatory requirements to protect investors.

Additionally, the SEC alleges that Binance misled investors by providing false and misleading statements regarding its operations, including its compliance with Anti-Money Laundering (AML) regulations. Such deceptive practices can erode trust in the market and hinder the development of a transparent and secure crypto ecosystem.

Furthermore, the SEC claims that Binance operates an unregistered exchange, providing trading services for digital asset securities without proper authorization. Operating without the necessary regulatory approvals can expose investors to potential risks, including fraudulent activities and market manipulation.

Implications for the Crypto Industry

The outcome of this lawsuit has the potential to significantly impact the crypto industry and its future regulation. Regulatory bodies, like the SEC, are increasingly scrutinizing the cryptocurrency space to ensure investor protection and market integrity. The lawsuit against Binance and CZ demonstrates the SEC’s commitment to enforcing securities laws within the crypto realm.

If the SEC succeeds in proving its allegations, it could lead to substantial penalties and fines for Binance and CZ. This could set a precedent for future cases involving other crypto exchanges and platforms, potentially leading to more stringent regulatory measures.

Moreover, the lawsuit emphasizes the need for clear guidelines and regulations surrounding cryptocurrencies and their classification as securities. The SEC’s actions highlight the importance of establishing regulatory frameworks that balance innovation and investor protection.

Ongoing Regulatory Scrutiny

The SEC’s lawsuit against Binance and CEO Changpeng Zhao marks a significant step in the ongoing regulatory scrutiny of the crypto industry. The allegations of securities violations, misleading investors, and operating an unregistered exchange raise important questions regarding compliance, transparency, and the role of regulatory bodies in the rapidly evolving crypto landscape.

As the case unfolds, it will be crucial to closely monitor the developments and their potential ramifications for the industry as a whole. The outcome of this lawsuit could shape the future of crypto regulation and impact how exchanges and platforms operate within the United States and beyond.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Crypto Market Update: April 25, 2024

- Renzo’s Restaked ETH Depegs to $700: DeFi Platforms Gearbox and Morpho Face Liquidations

- Crypto Market Update: Insights and Trends for April 23, 2024

- On April 24, the $RTF Token from Oleksandr Usyk’s READY TO FIGHT Project Will be Listed on WhiteBIT

- Crypto Market Update: Key Trends and Insights for April 22, 2024

Related

- CFTC Sues Binance and Its CEO for Alleged Violations of US Trading Laws The Commodity Futures Trading Commission (CFTC) has sued Binance CEO Changpeng Zhao and his crypto empire for allegedly violating US trading and derivatives laws....

- Changpeng Zhao: looking at possibly owning banks Changpeng Zhao is looking to further bridge the gap between conventional banking and cryptocurrency....

- Research by University of Surrey and Arqit reveals Quantum Threat to Digital Assets July 23, 2021 03:25 AM Eastern Daylight Time LONDON–(BUSINESS WIRE) — A University of Surrey report co-authored by Stephen Holmes, Chief Product Officer at Arqit Limited (“Arqit”), a global leader in quantum encryption technology, and Professor Liqun Chen, Professor in Secure Systems...

- SEC investigating Coinbase for listing securities The SEC is investigating whether the exchange Coinbase listed securities....