Fed Rate Resumption Drives Crypto Recovery

Fed Rate Cut Resumption Boosts Market

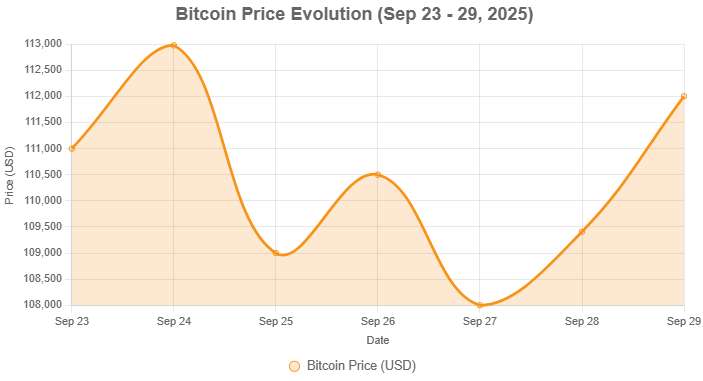

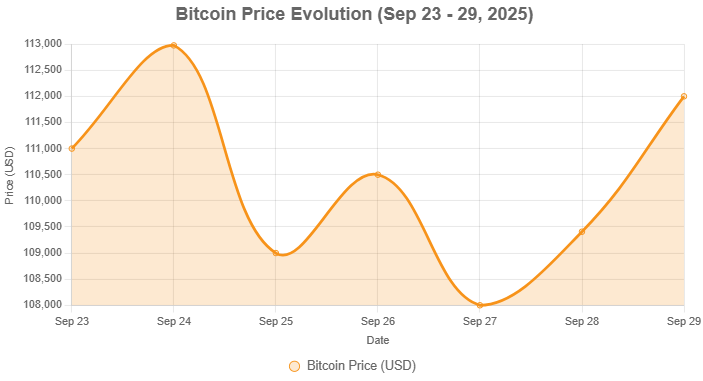

The U.S. Federal Reserve resumed its rate-cut cycle on September 29, 2025, implementing another reduction to bolster a softening labor market, which has positively influenced risk assets including cryptocurrencies. This move led to a 2.3% increase in total crypto market capitalization to $3.95 trillion, with 24-hour trading volume at $134.7 billion, reflecting heightened activity. Bitcoin climbed to $112,975 and Ethereum to $4,177, as lower rates reduce the appeal of traditional yields, drawing capital into crypto. However, analysts note ongoing volatility due to bubble concerns and political risks, with recent liquidations exceeding $1.5 billion underscoring leveraged position vulnerabilities.

This rate adjustment aligns with historical patterns where Q3 has been Bitcoin’s weakest quarter, averaging only 6% gains, yet the resumption signals potential for Q4 momentum. Institutional inflows, such as $977M into Bitcoin and $772M into Ethereum last week, support this outlook, but traders should monitor breakout levels like Bitcoin’s $113,784 resistance. The event has stabilized the market after a 5% September dip, positioning crypto for possible consolidation or upward breaks if macroeconomic data remains favorable.

Other News

Positive 📈

- Sonic Summit Launch: Sonic Summit started Sep 29 with expected announcements for $S, driving ecosystem interest.

- Plasma Mainnet: Plasma launched mainnet and $XPL token on Sep 25, enabling zero-fee USDT transfers and neobank features.

- Hyperliquid Supply Cut: Proposal to reduce HYPE supply by 45%, enhancing scarcity and price potential.

- Institutional Inflows: $1.9B into digital assets last week, with BTC, ETH, SOL, and XRP leading.

- CFTC Tokenized Collateral: CFTC opens consultation for stablecoins as margin in derivatives, boosting adoption.

Neutral ⚖️

- Ethereum Fusaka Testnet: Upcoming launch on Oct 1, introducing upgrades like PeerDAS and blob expansion.

- Ronin Buyback: $RON treasury buyback starts Sep 29, absorbing supply without immediate price spikes.

- Anoma Listing: $XAN initial listing on Sep 29, focusing on privacy features.

Negative 📉

- Market Liquidations: Over $1.5B in liquidations wiped out gains, pushing BTC below $110K and ETH under $4K mid-week.

- UXLINK Exploit: UXLINK dropped 65% after a $11.3M hack, highlighting security risks.

- FTX Distribution Risks: $1.6B creditor payouts on Sep 30 could increase selling pressure.

Top Movers and Market Opportunities

Top Movers:

- Bitcoin: Up 2% to $112K amid Fed cut and inflows, showing resilience.

- Ethereum: Gained 2.6% to $4K, driven by testnet hype and ETF activity.

- BNB: Hit potential highs, favored in prediction markets for September performance.

- Solana: Up amid DeFi boom and inflows, despite weekly dips.

- HYPE: Surged on supply cut proposal.

Buying Opportunities: The market rebound post-Fed cut presents buying opportunities in undervalued assets like Ethereum near $4K support, ahead of Fusaka testnet, and Solana at $196 amid ecosystem growth. Bitcoin’s consolidation above $110K offers entry for long-term holds, but caution on volatility from FTX distributions.

Bitcoin Price Evolution Chart:

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Rallies to $114,000 as Crypto Market Adds $110 Billion in 24 Hours

- Pepe Traders Wait, Ethereum Holds $4.5K but BlockDAG’s BWT Alpine F1® Team Alliance Creates Crypto’s Next Growth Engine

- 5 Leading Crypto Wallets in 2025: Your Complete Guide to Secure Digital Asset Storage

- Interview with Zayn Kaylan: Luxxfolio’s “Digital Silver” Strategy with Litecoin

- Asset Managers Amend Solana ETF Filings to Include Staking as Approval Looms