DeFi TVL Plummets In May

CryptoPress

The current crypto market fall has harmed retail investor morale, but it has also harmed the decentralized financial area. As a result of this drop in value, many companies have been forced to lay off employees or shut down entirely.

This is not only bad news for investors and entrepreneurs, but also for cryptocurrency users as well. For example, if there are fewer dApps being built on top of the Ethereum network because they’re not profitable anymore, then this will lead to less innovation and fewer opportunities for users to interact with decentralized technologies online.

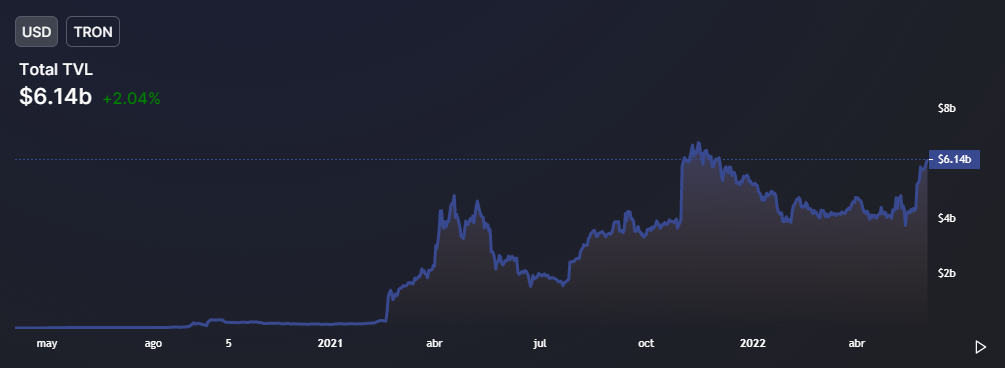

The value locked across several DeFi protocols has plummeted to levels last seen in mid-2021.

The value locked across several DeFi protocols has plummeted to levels last seen in mid-2021, according to Avalanche data.

The overall value locked across several chains has dropped to $6.49 billion, down from an all-time high of $13.7 billion in December last year. Bitcoin, for example, has entered the “Extreme Fear” zone, with the BTC Fear and Greed Index registering its lowest in more than two years this week.

The latest figures come amid a period of unprecedented volatility for crypto markets, which have seen a sharp decline since the start of March due to regulatory uncertainty and the ongoing bear market.

From a peak of $13.7 billion in December, Avalanche blockchain’s DeFi TVL has fallen to $6.49 billion.

The layer 1 blockchain protocol’s TVL has unable to break out of its annual lows of $4.5 billion, despite the mitigating efforts proposed by the programmers.

Fraudulent actions

There has been a rise in the number of fraudulent actions in the DeFi industry this year.

Recently, Web3 and blockchain security company CertiK disclosed that more than $1.6 billion in crypto has been stolen from DeFi subscribers, much above the total amount lost in 2020 and 2021 combined.

The bright spot

According to DeFi Llama, Tron’s TVL has gained 43% in the previous two weeks and is currently the third-largest smart contract network. The network’s top protocol, JustLend, has expanded by 65 percent in one month despite the brutalization of most DeFi initiatives in May.

In terms of Tron’s total value, JustLend’s $2.95B TVL accounts for 49% of that total, making it the ninth-largest protocol overall.

Image: Unknown photographer, Public domain, via Wikimedia Commons.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- REZ Airdrop: Increased Rewards and Early Access for Community

- Philippines Traders Fair 2024: Where Ambition and Expertise Unite

- Crypto Market Update: April 25, 2024

- Renzo’s Restaked ETH Depegs to $700: DeFi Platforms Gearbox and Morpho Face Liquidations

- Crypto Market Update: Insights and Trends for April 23, 2024

Related

- Why Terra grew to number two in DeFi For what reasons did Terra become the second DeFi platform?...

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- MicroStrategy Announces Second Quarter 2021 Financial Results July 29, 2021 04:01 PM Eastern Daylight Time TYSONS CORNER, Va.–(BUSINESS WIRE)–MicroStrategy® (Nasdaq: MSTR), the largest independent publicly-traded business intelligence company, today announced financial results for the three-month period ended June 30, 2021 (the second quarter of its 2021 fiscal year)....

- Wonderland DAO – The Saga of Defi 2.0 The Wonderland saga continues in what seems to be the most interesting and relevant story in the Defi world....