The Untold Story of BlackRock and Bitcoin

CryptoPress

In a recent Twitter thread by the popular technology and cryptocurrency influencer and popular communicator @Techconcatalina, it was revealed that BlackRock and other major banks have been quietly buying Bitcoin even before an ETF was available. While the SEC was busy accusing Binance and Coinbase, these banks were increasing their exposure to cryptocurrency.

🔸 El sexto banco más grande de Canadá 🇨🇦 COMPRO más de medio millón de dólares en acciones de MicroStrategy.

— Tech Con Catalina (@Techconcatalina) June 22, 2023

La pregunta importante es:

"¿Por qué todos estos bancos están haciendo esto a principios de 2023?"

El precio #Bitcoin desde su ATH ha bajado un 58% y ahora ANUNCIAN un… pic.twitter.com/OWjGGXQk1B

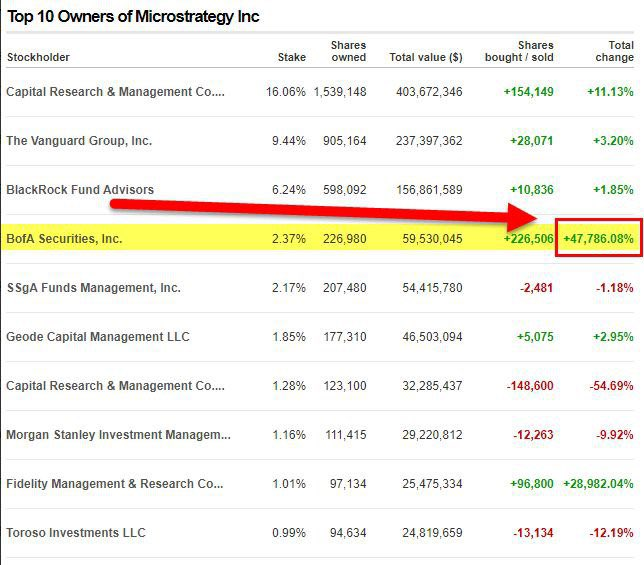

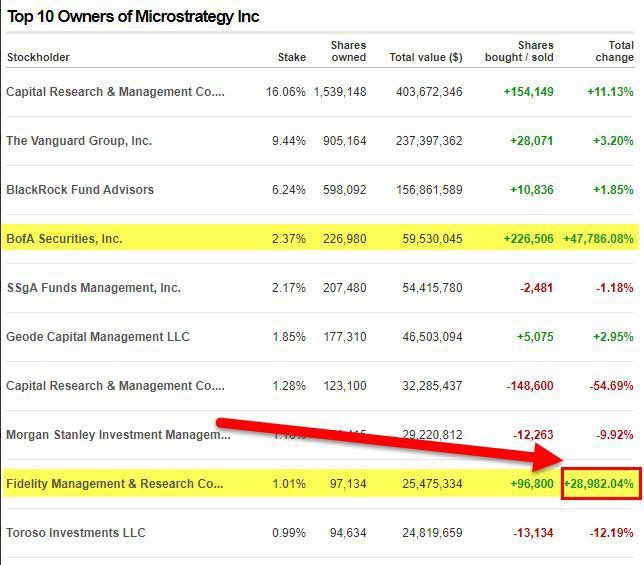

BlackRock, Bank of America, and Fidelity are among the banks mentioned in the thread. These banks are among the largest shareholders in the company of one of Bitcoin’s biggest maximalists, Michael Saylor‘s MicroStrategy (MSTR), which is the largest institutional holder of Bitcoin with a total of 140K BTC.

#Bitcoin is Immortal. pic.twitter.com/DuL6Nao9LG

— Michael Saylor⚡️ (@saylor) June 25, 2023

The thread raises the question of why these banks are buying shares related to the price of Bitcoin if the SEC has recently filed several lawsuits. The answer seems to be that without an ETF in the US, buying MSTR is the easiest way for some American investors to gain exposure to the price of BTC.

Bank of America, for example, increased its exposure to MSTR by 47,800% in the first quarter of 2023. This is the second-largest bank in the US. Meanwhile, BlackRock, the world’s largest asset manager, has a 6% stake in MSTR worth over $156 million.

Fidelity, another giant company with over $4.5 trillion in AUM, also increased its exposure to MicroStrategy by 28,000%, owning a 1% stake in MSTR.

It’s not just US banks that are buying MSTR; there is a global appetite for exposure to Bitcoin in 2023. The sixth-largest bank in Canada bought more than half a million dollars worth of MicroStrategy shares.

The thread concludes by asking why all these banks are doing this at the beginning of 2023. The price of Bitcoin has dropped 58% from its all-time high, and now a Bitcoin ETF is being announced with the intention of boosting the price again.

What do you think? Share your thoughts and conclusions with us at @CryptoPress_ok.

Source: @Techconcatalina

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- REZ Airdrop: Increased Rewards and Early Access for Community

- Philippines Traders Fair 2024: Where Ambition and Expertise Unite

- Crypto Market Update: April 25, 2024

- Renzo’s Restaked ETH Depegs to $700: DeFi Platforms Gearbox and Morpho Face Liquidations

- Crypto Market Update: Insights and Trends for April 23, 2024

Related

- MicroStrategy Announces Second Quarter 2021 Financial Results July 29, 2021 04:01 PM Eastern Daylight Time TYSONS CORNER, Va.–(BUSINESS WIRE)–MicroStrategy® (Nasdaq: MSTR), the largest independent publicly-traded business intelligence company, today announced financial results for the three-month period ended June 30, 2021 (the second quarter of its 2021 fiscal year)....

- BlackRock Files for Spot Bitcoin ETF, a First for the U.S. BlackRock files for spot Bitcoin ETF, Coinbase as crypto custodian....

- Michael Saylor Michael Saylor is an entrepreneur, investor, strategist, author, and speaker on topics of technology, bitcoin, and business strategy. His early life and career are filled with contradictions; an unconventional upbringing on a west coast swing family that embraced individualism and...

- Grayscale Bitcoin Trust Gets a Bullish Bump After BlackRock ETF Filing Grayscale Bitcoin Trust (GBTC) jumped more than 12% on Friday in reaction to BlackRock filing its Bitcoin ETF application....