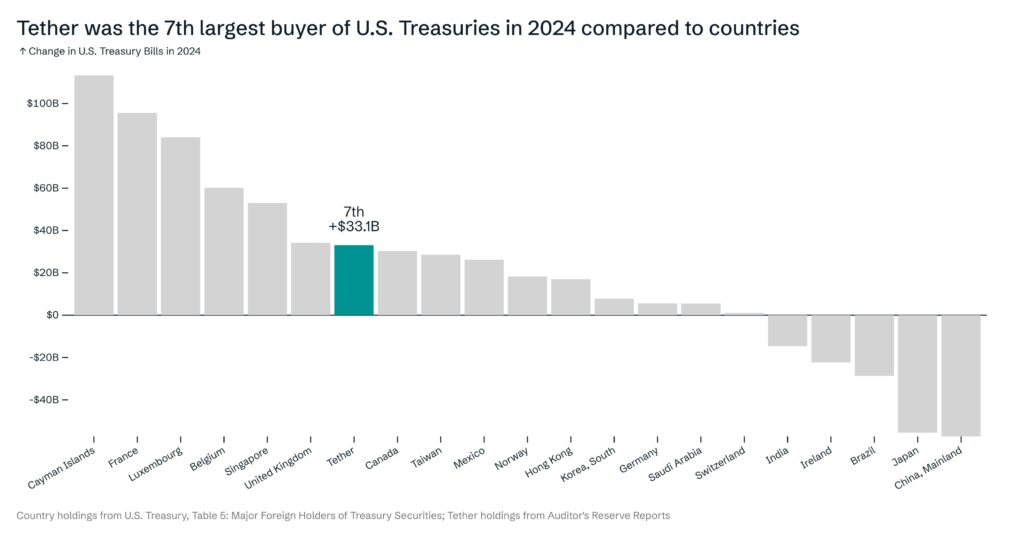

Tether 7th Largest Buyer of U.S. Treasury Purchases

- Tether was the 7th largest buyer of U.S. Treasuries in 2024.

- With $33.1 billion in purchases, surpassing countries like Canada and Mexico.

- This reflects Tether’s growing financial influence, enhancing its credibility by investing in transparent assets like U.S. Treasuries.

- The evidence leans toward this move integrating cryptocurrencies with traditional finance, potentially impacting market dynamics.

Tether, the issuer of the stablecoin $USDT, has emerged as the 7th largest buyer of U.S. Treasuries in 2024, with purchases totaling $33.1 billion. This positions Tether ahead of several countries, including Canada and Mexico, in terms of net purchases.

Understanding Tether and U.S. Treasuries

Tether is a stablecoin designed to maintain a stable value relative to the U.S. dollar, issued by Tether Limited. As of recent reports, its market capitalization stands at over $143 billion, making it the largest stablecoin by market cap. U.S. Treasuries, on the other hand, are short-term debt instruments issued by the U.S. government to finance its operations, considered among the safest investments due to their backing by the full faith and credit of the United States. Tether’s strategy involves investing its reserves in such assets to ensure the stability of its stablecoin, USDT.

Tether’s $33.1 billion purchase in 2024 places it among major economies, suggesting increased transparency and credibility. This could influence treasury market dynamics and highlights the growing intersection of crypto and traditional finance, a notable development for financial ecosystems.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Trump-Backed World Liberty Financial Launches WLFI Token Amid Market Volatility and Token Burn

- Fintech Revolution Summit – Abu Dhabi 2025

- Trump-Backed WLFI Token Launches with High Volatility and Multi-Billion Valuation Amid Unlock Event

- Best Altcoins to Buy Now: BlockDAG Leads DOGE, ETH, and SOL

- Trump-Linked WLFI Token Derivatives Surge to Near $1B Open Interest Ahead of Unlock

Related

- Aave GHO Stablecoin Aave GHO Stablecoin: A New Decentralized Stablecoin from the Aave Protocol....

- Tether Transfers Millions to Foreign Banks Tether has been a mystery to many, with concerns over the dependability of its reserves backing the $68 billion stablecoin. ...

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Tether swaps CP for US Treasuries Tether, the corporation behind the $69 billion USDT stablecoin, liquidated its commercial paper....