North Dakota Partners to Launch State-Backed Stablecoin

- The Bank of North Dakota and Fiserv are launching a U.S. dollar-backed stablecoin called Roughrider Coin in 2026.

- The token will facilitate interbank transactions, merchant payments, and global money movement for North Dakota’s financial institutions.

- This initiative positions North Dakota as the second U.S. state to issue a stablecoin, highlighting growing regulatory support for digital assets.

North Dakota is embracing blockchain technology with the announcement of its first state-backed stablecoin.

The Bank of North Dakota (BND), the only state-owned bank in the U.S., has partnered with payments firm Fiserv to develop the Roughrider Coin, a cryptocurrency fully backed by U.S. dollars. Set for launch in 2026, the token will be available to banks and credit unions in the state to streamline transactions.

Platform and Interoperability

The Roughrider Coin will run on Fiserv’s FIUSD digital asset platform, which was unveiled in June 2025 along with a white-label stablecoin solution. It is designed to be interoperable with other stablecoins, allowing seamless integration into existing financial systems.

Fiserv processes over 90 billion transactions annually, positioning it as a key player in bridging traditional finance and digital assets.

Historical and Regulatory Context

Named after Theodore Roosevelt’s Rough Riders cavalry unit, the coin honors the former president’s ties to North Dakota, where he lived as a rancher in the late 1800s.

The launch capitalizes on the GENIUS Act, signed into law by President Donald Trump in July 2025, which established the first federal framework for stablecoin issuers. North Dakota follows Wyoming, which introduced its Frontier Stable Token (FRNT) in August 2025.

Stakeholder Perspectives

BND CEO Don Morgan highlighted the bank’s long-standing role in supporting the state’s economy. “We have a 106-yearhistory of commitment to North Dakota agriculture, commerce, and industry through our financial institution partnerships,” Morgan said. “The development of the Roughrider coin reflects that commitment… and ensures the continued health, resilience, and relevancy of the North Dakota financial industry.”

Governor Kelly Armstrong praised the initiative as innovative. “As one of the first states to issue our own stablecoin backed by real money, North Dakota is taking a cutting-edge approach to creating a secure and efficient financial ecosystem for our citizens,” he stated.

Fiserv COO Takis Georgakopoulos added: “We’re entering a new era where payments are instant, interoperable, and borderless… North Dakota’s vision and leadership in launching this initiative show how forward-thinking policy can drive real progress in digital finance.”

Market Implications andRisks

Stablecoins have grown to a $293 billion market cap in 2025, serving as stable alternatives in crypto trading and payments. Examples include Tether (USDT) and Circle’s USDC, key players in the ecosystem (see Cryptopresscoins list).

While the Roughrider Coin could enhance efficiency, experts caution about potential cybersecurity risks and the need for robust KYC compliance in a regulated environment.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Diversification in Crypto: Building a Resilient Portfolio

- North Dakota Partners to Launch State-Backed Stablecoin

- SEC Chair Atkins Targets Formal Innovation Exemption Rulemaking by End of 2025

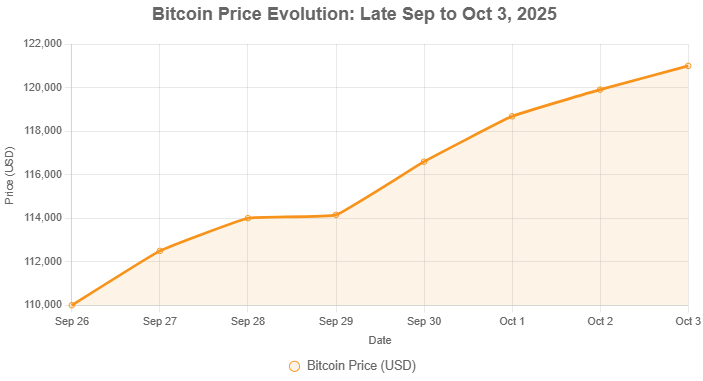

- Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

- Crypto Weekly Recap: Uptober ATH Blitz

Related

- Aave GHO Stablecoin Aave GHO Stablecoin: A New Decentralized Stablecoin from the Aave Protocol....

- Plasma: The Blockchain Challenging DeFi’s Stablecoin Status Quo Plasma aims to offer zero-fee USDT transactions and lightning-fast settlement by leveraging Bitcoin's security and an EVM-compatible environment....

- Ripple to Issue USD-backed Stablecoin Bringing More Utility and Liquidity to XRP Ledger Ripple, the leading provider of enterprise blockchain and crypto solutions, announced its plans to launch a stablecoin, pegged 1:1 to the US dollar (USD)....

- Circle’s Wall Street Debut: Is the USDC Issuer Overvalued After Explosive IPO? Circle's (CRCL) Financials and Future in the Trillion-Dollar Stablecoin Market....