What is staking and why it is critical to the crypto economy?

You have probably already heard of cryptocurrencies by now and, although the value of cryptocurrencies is highly volatile and often misunderstood by the masses, cryptocurrencies have maintained growth and interest despite volatility, which sparks interest as a strategy for generating passive income.

While some invest in crypto mining to increase their holdings, others choose to staking cryptocurrencies and earn passive income. But unlike many stocks, not all crypto tokens pay these staking dividends that can provide stable income during periods when stock prices drop.

What is Staking?

Staking is the process of locking cryptocurrency in a digital wallet to support the security and operation of a blockchain network. In exchange for locking up their cryptocurrency, staking participants receive rewards, which are usually more cryptocurrency.

Staking is similar to cryptocurrency mining, but instead of using specialized hardware to solve mathematical problems, staking participants use their cryptocurrency to validate transactions on the blockchain.

Cryptocurrencies that can be staked are those that use a Proof-of-Stake (PoS) consensus mechanism. The most popular cryptocurrencies that can be staked are Cardano, Tezos, Ethereum 2.0, Solana, and Polkadot.

Staking is a way to generate passive income with cryptocurrencies. However, it is important to note that staking also carries risks, such as the loss of cryptocurrency if the digital wallet is compromised.

The cryptocurrency industry has created a new digital economy that provides people with a variety of completely new ways to earn passive income online. Investors who want to earn passive income through cryptocurrencies can do so through interest-bearing cryptocurrency accounts.

Proof-of-Stake (PoS) cryptocurrencies secure their blockchains by having users store coins (locking or holding their coins in a crypto wallet) instead of contributing computing power to the network (as is the case in chains of Proof of Work such as Bitcoin).

This participation or “stake” in cryptocurrencies is the process of “blocking” a part of your cryptocurrency to contribute to the blockchain network in the long term in exchange for a return on your investment.

In many cases, it is not even necessary to block the crypto funds to obtain those dividends that are generated, but the proportional one can be charged only as long as the funds are kept in the account that pays the staking.

In other cases staking is paid in very short periods, sometimes daily, every three days, or weekly, and in others it may be longer periods, such as 21 days or more, to give the system some stability.

Essentially, users put their tokens in for a chance to add a new block to the blockchain in exchange for a reward.

Essentially, users put their tokens in for a chance to add a new block to the blockchain in exchange for a reward.

Before jumping into any of the crypto-driven passive income-generating opportunities mentioned above, it is essential to highlight that none of them are risk-free.

Why is staking critical to the crypto economy?

Staking provides a solution that allows entrepreneurs to use their tokens as collateral, as well as a guarantee of commitment to a community. It is a way for entrepreneurs to develop a reputation and allows token holders to have more say in the growth of their projects.

Digital staking ensures that the system will be protected by multiple checks and balances so that no party can compromise the integrity of a blockchain.

Gambling is a crucial part of a decentralized economy, as it provides a way to establish consensus. When you stake your tokens, you are validating the blockchain and securing the network, which will ultimately ensure the long-term viability of the digital economy.

For the own economy of the holder of the funds, or the staker, staking allows them to moderate their exposure to risk and generate a hedge fund against losses, as well as a way to take profits within the crypto world, which makes it a tool fundamental financial. within the world of cryptocurrencies.

Cryptocurrency staking is like putting your money in a savings account, but locking up your coins to help secure and validate transactions on a blockchain network, and you get rewards in return. It is mainly used in proof-of-stake systems (called POS), where staked coins act as collateral to keep the network running smoothly.

Ethereum (ETH) is often considered the best for staking due to its large network, liquidity, and average returns of 4-6%. Another interesting option is Solana (SOL) for its high efficiency (speed and low transaction costs), but you should always check the current APYs, as they fluctuate.

There are some cryptocurrencies that were created with mechanisms that place a strong emphasis on staking, such as Polkadot (DOT) and Cosmos (ATOM). BNB and Algorand also stand out for their user-friendly staking, with returns of up to 7%. However, the true returns on these high APYs must be adjusted for token inflation, as projects may decide to issue more tokens for various reasons. This is where the governance mechanisms of the different projects/currencies come into play.

Cryptocurrency staking involves holding and locking specific coins in a wallet to support blockchain operations, such as verifying transactions, in exchange for earning more coins as a reward. It is a way to earn passive income without selling your assets, but it requires coins that are compatible with proof-of-stake, such as ETH or ADA. Coins are usually held with certain mechanisms in place, such as validators, who are technical actors in this process. A common misconception is that it is risk-free, like a bank deposit; in reality, you face severe penalties if validators fail, in addition to market volatility.

Some of the most profitable and “serious” ones include newer projects such as ENA (Ethena), which can pay more than 20% at times. Others that are riskier offer APYs of up to 55% to 600%, but they are high risk due to potential price drops and low liquidity, so let’s say they are “less serious” (I wouldn’t put my money there).

stablished currencies, such as Ethereum and Cardano, provide more stable returns, around 4-7%, taking into account actual reward rates after inflation. But profitability is not just about APY: you have to take into account the risks, the devaluation of tokens due to issuance or loss of confidence, or because the tokens fail to gather a large community to use them. In this last sense, rewards are used to entice users to use the tokens, which is one of the most important variables.

Bitcoin does not natively support staking, as it is based on proof of work (POW) rather than proof of stake, so “staking” usually means using BTC “wrapped” in other chains such as Ethereum to earn returns. BTC is deposited on a platform that converts it into a staking-eligible token, locking it to validate transactions and earn rewards, but it must be unwrapped later to recover the BTC. This carries additional risks, such as smart contract errors (problems in the code that runs a blockchain) or bridge hacking (sites that connect and transfer coins from one blockchain to another).

Staking can generate passive income, but it is unlikely to make you rich unless you start with a large amount, as average returns are 4-10% and are diluted by inflation or price drops. For retail investors, it’s more about steady growth than get-rich-quick schemes: many overestimate the rewards and overlook risks such as market crashes, which can wipe out gains. Success stories are rare and tend to be linked to early adopters; I believe it’s better to focus on long-term holding than to expect to become a millionaire from staking alone.

In 2025, cryptocurrency staking is generally legal around the world, and the U.S. SEC has clarified that certain protocol staking activities are not securities, reducing regulatory hurdles for proof-of-stake networks. It may be prohibited or restricted in countries with more “opaque” and less free legislation, such as China and others. Local laws may apply taxes on earnings, and misconceptions about its lack of regulation can lead to fines.

Staking is not entirely safe, as there are risks such as slashing (loss of coins due to validation errors), smart contract hacks, and liquidity issues during unstaking periods, which can last for weeks. Although it is safer than active trading for long-term holders, volatility can erode rewards, and centralized platforms add custody risks. It is recommended to always use audited protocols and diversify, but they warn that no staking is “risk-free”: you must always be prepared for possible losses.

The United States has recently confirmed that certain activities are not considered securities. It may be prohibited in countries where cryptocurrencies are illegal, such as China and Egypt, as they are considered financial risks and due to capital controls. In most other places, it is permitted but regulated.

For retail investors holding long-term positions, staking can be worthwhile for passive rewards of up to 7% on stable networks such as Ethereum, which match or exceed traditional savings while maintaining the position in cryptocurrency, which may be desirable for some investors. However, it is not ideal if you need quick access to funds, as lock-ups and risks such as price drops or slashing may outweigh the benefits. It is not a way to get rich, and there are extra risks from the cryptocurrency tech world itself, such as hacks, phishing, etc.

Staking opportunities and other passive income

For more information on staking opportunities, check out our Alpha section.

By Juan Mende.

📈 I’m a technology enthusiast with a passion for Bitcoin, blockchain, and cryptocurrencies 🚀. A former lawyer with a degree in marketing. I create content for various digital initiatives. Currently, I’m the editor of Cryptopress and a marketer for cryptocurrency companies.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Global Blockchain Show 2026: Riyadh Becomes the Hub of Decentralized Innovation

- Fintech Revolution Summit – Abu Dhabi 2025

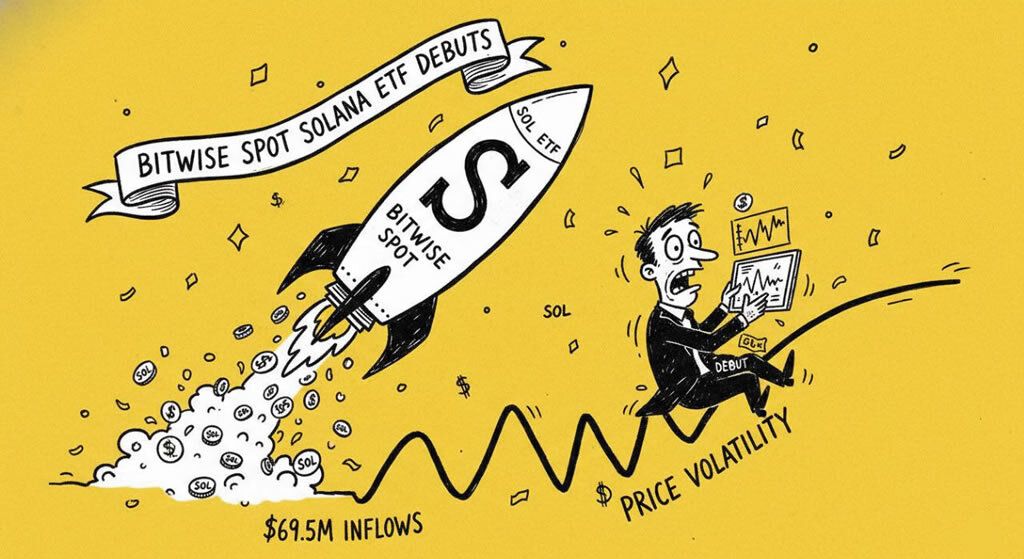

- Bitwise Spot Solana ETF Debuts with $69.5M Inflows Amid SOL Price Volatility

- SparkDEX Eternal Reignites: Flare’s Perpetuals Arena Returns with Fresh Features After XRP Influx

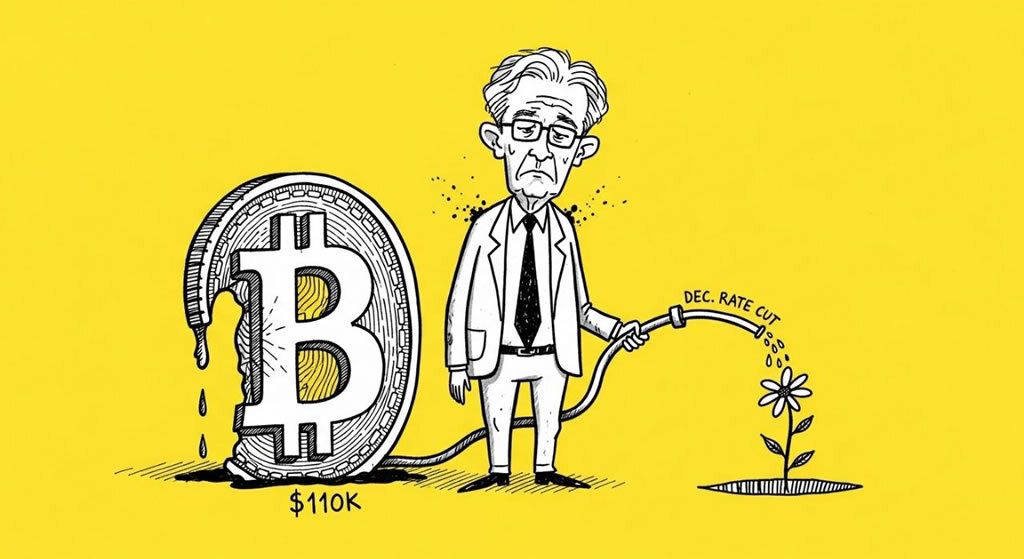

- Bitcoin Dips Below $110K as Powell Tempers Expectations for December Rate Cut

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Countdown to Ethereum 2.0 The countdown to Ethereum 2.0 has started....

- Play to Earn Traditional video games, or as we knew them until now, did not give any type of reward. But with the crypto revolution, a new type of game was created, play to earn. Actually, the concept of a game close to playing...

- Play-To-Earn: greatest games to play and win crypto today With Play-to-earn players can earn real money by playing. Here is a list of the best games of the moment....