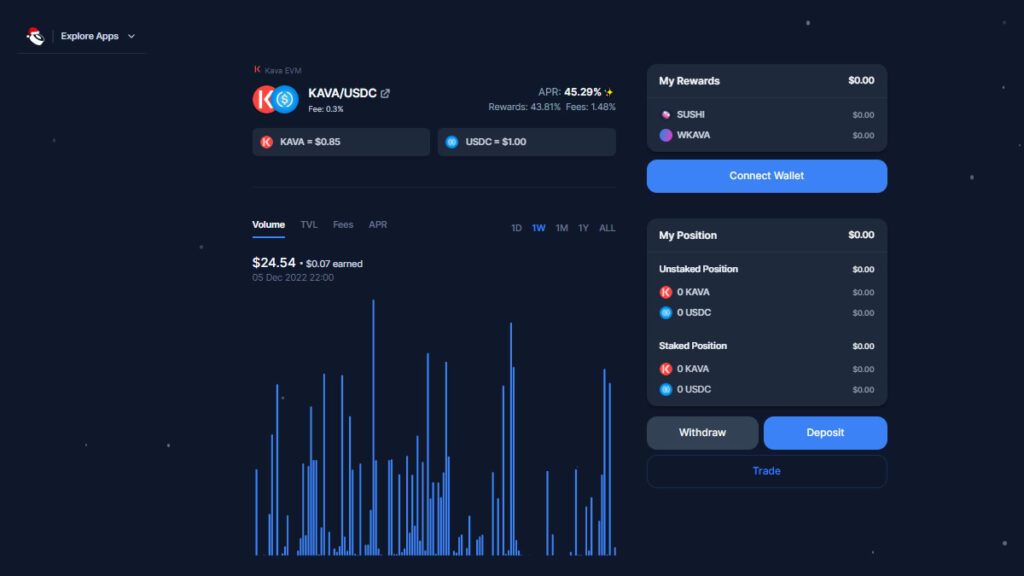

Earn up to ~50% APR With the KAVA/USDC Sushi Pool

About Kava

Kava (kava.io) is a safe and fast Layer-1 blockchain that combines the developer power of Ethereum with the speed and interoperability of Cosmos into a single, scalable network.

The pool pays in USDC, WKAVA, and SUSHI.

The only way to get USDC is to collect trade fees in the USDC/KAVA pool. WKAVA can only be obtained by collecting both trade fees and incentive rewards.

The rewards that are given to the pool each day are 150.00 SUSHI and 233.33 WKAVA, which are split among the liquidity providers in the pool proportionally.

If you wish to supply, you have two potential options. By visiting the pool page or utilizing the new position tool.

Getting Money on the Kava EVM

To use this method, you must move money from a centralized exchange to your Kava address before putting it into the Kava EVM.

To locate your Kava address while logged into MetaMask, copy your 0x address and paste it into Mintscan, where you’ll be able to search for a Kava Ethereum account.

With the help of Multichain, USDC can be moved between Ethereum’s mainnet, Polygon, and Binance’s Smart Chain. With this, KAVA may be used at the EVM to purchase gas.

Option 1: Pool Directly

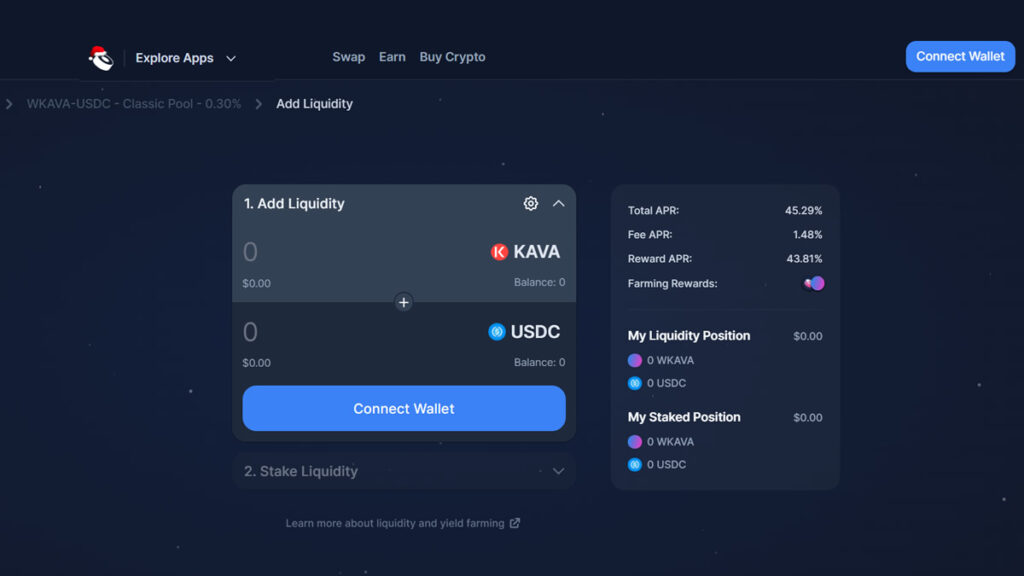

Pooling directly is done by completing two steps: adding liquidity and then staking that liquidity.

Adding Liquidity

This path requires an equal amount (USD) of KAVA and USDC to supply, although if you have one or the other, you can easily trade half of that asset for the other to create a pair.

When trading, keep a little more value in KAVA than you have in USDC to pay gas fees.

Once you have a pair of KAVA/USDC, simply navigate to the KAVA/USDC Pool page with the title “Deposit,” then enter the amount of USDC you want to supply. The KAVA amount will auto-populate with the amount needed.

Please be aware that the entire amount of your USDC will be recorded if you click “balance” under USDC.

After entering the desired amount in KAVA and USDC, choose “Add Liquidity,” and verify the purchases in your digital wallet.

If you choose this option, Sushiswap will instantly exchange your KAVA into WKAVA and give you a pair of WKAVA/USDC. Your WKAVA will be converted back to KAVA at the time of withdrawal. Since the Cosmos Software Development Kit (SDK) serves as the foundation for KAVA, and the ERC-20 format is required for assets in all EVM-based protocols, this is the case.

To get the most money out of this method, you’ll need to stake your LP tokens once you’ve added liquidity to the KAVA/USDC pool and started getting trading fees (2% APR).

Staking Liquidity

Once you’ve got some extra cash on hand, you may put your assets on the line and reap even bigger benefits (about 50% APR).

Simply visit the liquidity/add page for the USDC/KAVA pool, open the Stake Liquidity panel, click the MAX button, and then click the “Stake Liquidity” button to complete the process.

When you stake your funds, you may track your earnings in KAVA/USDC on the pool’s administrative dashboard.

Option 2: Open a Position

If you want to spend WKAVA from your wallet, you may do so by supplying WKAVA and USDC as a pair, which will increase the available KAVA/USDC.

As was already said, the conversion of KAVA to WKAVA that happens when KAVA is added to the pool lets the transaction skip the KAVA exchange itself. As was already said, the conversion of KAVA to WKAVA that happens when KAVA is added to the pool lets the transaction skip the KAVA exchange itself.

Select USDC as the top asset, WKAVA as the bottom asset, and the quantity of USDC you want to give by entering it on the Open Position page. The pair’s required WKAVA amount will be pre-filled for them.

After entering the desired amount in KAVA and USDC, choose “Add Liquidity” and verify the purchases in your digital wallet.

Just like with the first method, you have to stake your LP tokens if you want an annual return of more than 50%. To achieve this, go to the USDC/KAVA pool’s liquidity/add page, click “Stake Liquidity” to open the Stake Liquidity panel, click “MAX” to expand it, and then click “Stake Liquidity” to finish.

When you stake your funds, you may track your earnings in KAVA/USDC on the pool’s administrative dashboard.

© 2022 Cryptopress. All rights reserved. For informational purposes only, not offered as advice of any kind.

*Get your project published here.

Related Posts

- Kava Adds EVM Support With Alpha Launch of Ethereum Co-Chain Kava Adds EVM Support With Alpha Launch of Ethereum Co-Chain....

- Kava Announces The Loan Wars: $150K IBC Testnet Competition November 15, 2021 08:55 AM Eastern Standard Time SAN FRANCISCO–(BUSINESS WIRE)–Kava, a Layer-1 blockchain and decentralized autonomous organization (DAO), will be hosting an 11-day testnet competition to prepare for the launch of Kava 9 and IBC. “This is the biggest...

- Kava to Add IBC with Jan-19 Mainnet Upgrade Kava to Add IBC with Jan-19 Mainnet Upgrade....

- Kava Labs Sponsors DeFi Innovation Challenge for Cosmos HackAtom VI Hackathon November 03, 2021 08:45 AM Eastern Daylight Time SAN FRANCISCO–(BUSINESS WIRE)–Kava Labs™, an open-source and non-custodial developer of financial products and services for decentralized finance (DeFi), is sponsoring a Cosmos HackAtom VI challenge aimed at driving DeFi innovation using the...