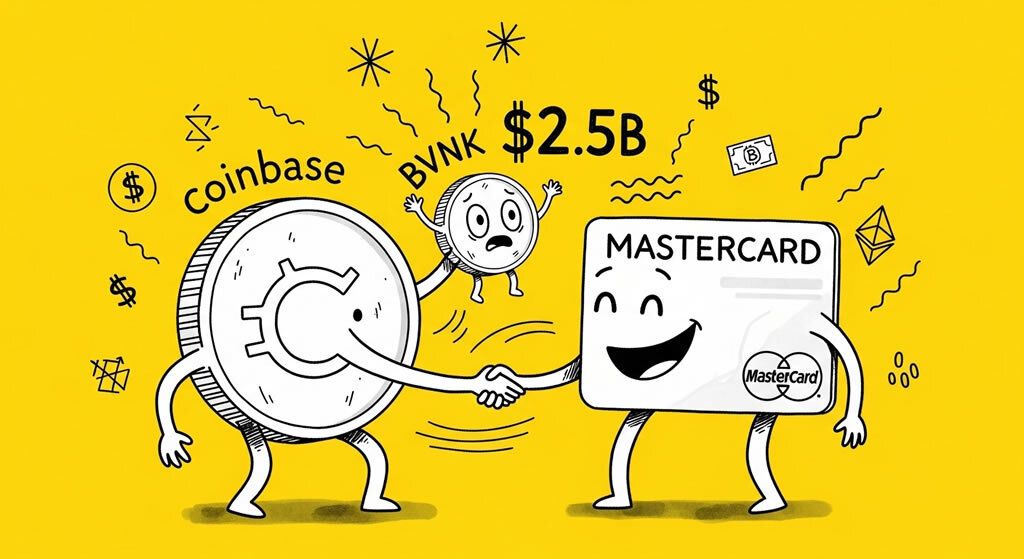

Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

- Coinbase and Mastercard have held advanced acquisition talks with BVNK, a stablecoin fintech.

- The potential deal could value BVNK at between $1.5 billion and $2.5 billion.

- If completed, this would represent the largest stablecoin-related acquisition to date.

Coinbase and Mastercard are competing to acquire BVNK, a London-based firm specializing in stablecoin payments and infrastructure, according to multiple sources.

The talks are advanced but not yet finalized, with the deal potentially valuing BVNK at $1.5 billion to $2.5 billion.

This would make it the biggest acquisition in the stablecoin space, highlighting growing interest from traditional finance and crypto giants in stablecoin technology.

BVNK’s platform enables businesses to integrate stablecoins like USDC and USDT for cross-border payments and treasury management. Founded in 2021, the company has raised over $40 million and serves clients in payments and banking.

Coinbase, which co-issues the USDC stablecoin with Circle, could use BVNK to expand its stablecoin offerings and enhance global payment rails.

Mastercard, meanwhile, has been pushing into crypto through partnerships and its own stablecoin pilots, seeing BVNK as a way to bolster its digital asset capabilities.

The acquisition race underscores the booming stablecoin market, now exceeding $200 billion in total supply. Stablecoins have become critical for crypto trading, remittances, and DeFi, but face regulatory scrutiny over reserves and compliance.

Analysts note potential risks, including antitrust concerns and integration challenges. A deal of this size could attract review from regulators in the US and UK, especially amid heightened focus on crypto mergers.

Industry impact: If Coinbase wins the bid, it would strengthen its position against rivals like Binance in stablecoin dominance. For Mastercard, acquiring BVNK could accelerate its blockchain payment initiatives, bridging traditional cards with on-chain assets.

The news comes as stablecoin adoption surges, with firms like PayPal and Ripple expanding their offerings. However, experts warn of volatility risks tied to underlying assets like Bitcoin and Ethereum.

No official comments from the companies involved, but sources indicate a decision could come soon.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

- Diversification in Crypto: Building a Resilient Portfolio

- North Dakota Partners to Launch State-Backed Stablecoin

- SEC Chair Atkins Targets Formal Innovation Exemption Rulemaking by End of 2025

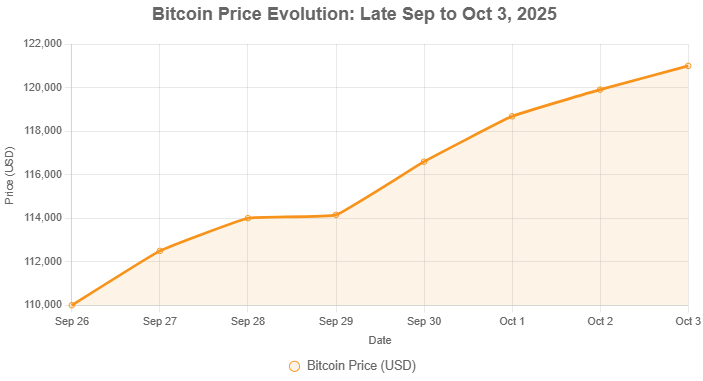

- Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

Related

- Aave GHO Stablecoin Aave GHO Stablecoin: A New Decentralized Stablecoin from the Aave Protocol....

- Plasma: The Blockchain Challenging DeFi’s Stablecoin Status Quo Plasma aims to offer zero-fee USDT transactions and lightning-fast settlement by leveraging Bitcoin's security and an EVM-compatible environment....

- Big Tech’s Exploration of Stablecoin Integration for Payments It seems likely that stablecoins, pegged to assets like the US dollar, could reduce transaction costs and improve cross-border payments....

- Transatlantic Talks Signal Unified Crypto Rules for Stablecoins and Beyond Discussions emphasize cross-border oversight, financial stability, and consumer protection, with stablecoins and CBDCs as key priorities....