Crypto Weekly Snapshot – Key News Shaking Crypto

The crypto market is currently experiencing heightened volatility, with overall capitalization dipping to around $3 trillion amid broader economic uncertainties. Major assets like Bitcoin and Ethereum have seen significant corrections, driven by macroeconomic factors including potential tariffs and Federal Reserve decisions. While some sectors show resilience through institutional buys, the sentiment remains fearful, as indicated by the Fear & Greed Index at 25/100. This environment presents a mix of risks and potential rebound opportunities as regulatory developments unfold.

Trump Tariff Turmoil

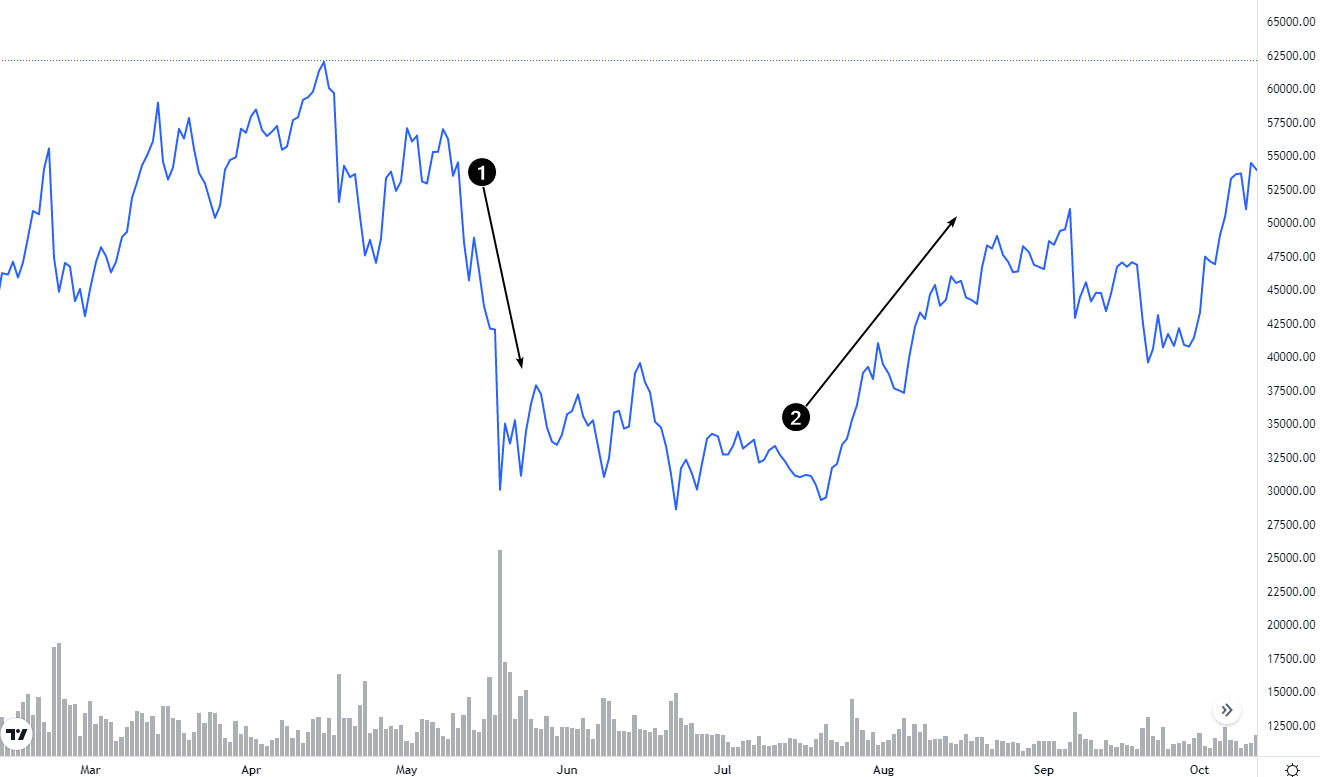

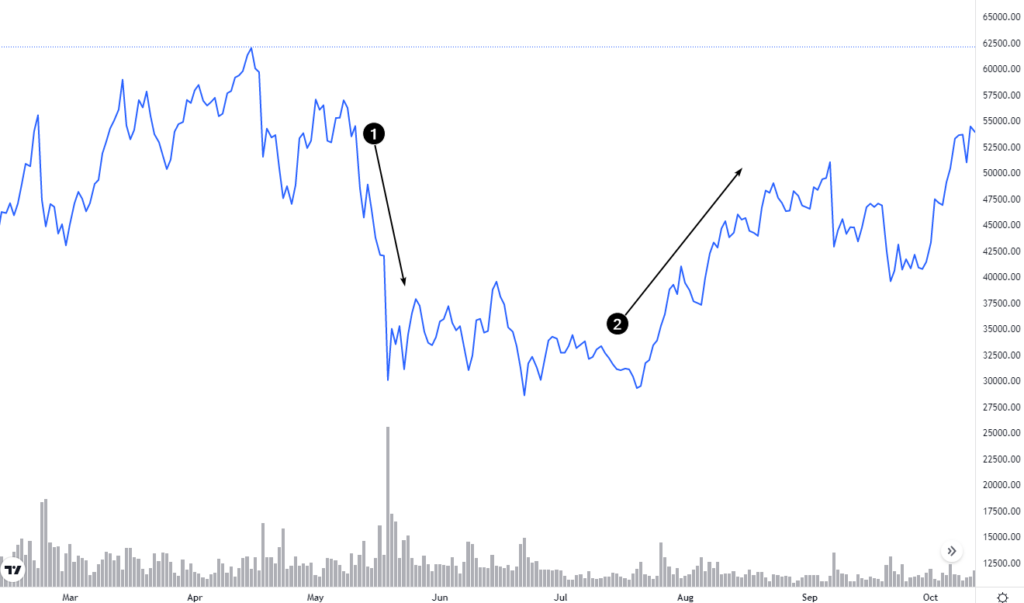

The primary driver this week has been the widespread crypto selloff, fueled by Trump-era tariff turmoil and escalating global risk sentiment. Bitcoin, the market leader, tumbled from above $90,000 to as low as $86,000, triggering over $550 million in liquidations across the ecosystem. This downturn coincides with a U.S. government shutdown risk and anticipation around the Federal Reserve’s rate decision, which could signal a pause in cuts and further pressure risk assets. Ethereum and Solana followed suit, with ETH dropping 5% and SOL 7% in 24 hours, reflecting a broader flight to safety as investors pivot to assets like gold, which hit new highs.

Compounding the selloff, Bitcoin ETFs faced massive outflows of $1.33 billion last week, a stark reversal from prior inflows that had bolstered prices. This cash exodus, amid illusory market depth during “toxic” trading hours, has created a liquidation treadmill where risky positions are hunted, perpetuating the downtrend. Analysts warn that without a dovish Fed pivot or resolution to tariff concerns, the market could face extended consolidation, though historical patterns suggest rebounds following such corrections.

Other news:

Positive 📈

- MicroStrategy bolstered its Bitcoin holdings with a $264 million purchase, signaling continued corporate confidence.

- Ark Invest scooped up $21.5 million in shares of Coinbase, Circle, and Bullish, betting on long-term crypto infrastructure growth.

- Japan’s upcoming crypto ETFs by 2028 could inject $6.4 billion, expanding institutional access.

- Metaplanet upwardly revised its FY2026 revenue forecast to over $100 million, driven by Bitcoin-related income.

Neutral ⚖️

- A long-dormant Ethereum whale moved $145 million in ETH, potentially indicating strategic repositioning without clear market impact.

- Solana’s ecosystem is pivoting toward finance applications, as stated by Backpack CEO, aiming for deeper integration.

- Ledger is plotting a $4 billion NYSE IPO, highlighting maturation in crypto hardware sector.

- BlackRock ceded tokenized Treasury market lead to Circle due to mechanical factors in settlement processes.

Negative 📉

- Solana faces a critical flaw that could enable hackers to stall the network, eroding trust in its scalability.

- Privacy coins like Monero and Zcash plunged, with losses up to 11.4%, amid broader regulatory scrutiny fears.

- Deloitte highlighted risks in tokenized settlements that could facilitate undetectable market manipulation.

- Failing crypto exchanges may face new regulations preventing withdrawal delays, exposing operational weaknesses.

Big Movers

The most notable movers in the past 24 hours include ZetaChain surging 27.84% as a top gainer, potentially driven by ecosystem expansions, alongside River up 27.6% and Axie Infinity rising 11.29% amid gaming sector revival. On the downside, MYX Finance led losses with a 13.4% drop, followed by pump.fun at 12.2% and Monero at 11.4%, reflecting privacy coin vulnerabilities. Buying opportunities may exist in major dips, such as Bitcoin’s current oversold state below $88,000, offering entry points for long-term holders anticipating Fed clarity; Ethereum at $2,800 presents similar value amid whale activity.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- DXY Drops to 4-Month Low: Potential Tailwind for Bitcoin Prices

- Crypto Weekly Snapshot – Key News Shaking Crypto

- 85% of Institutions Testing or Using Distributed Validators, Obol Survey Finds

- Why Solana’s Seeker Phone Is Selling Fast

- Solana Mobile’s SKR Token Surges 300% Following Seeker Smartphone Airdrop