Regulatory Boost and Altcoin Speculation Drive Crypto Momentum

SEC-CFTC Regulatory Clarity Sparks Optimism

The crypto market received a significant boost this week as the SEC and CFTC issued a joint statement under Project Crypto-Crypto Sprint, outlining coordinated efforts to provide regulatory clarity for spot crypto asset trading and exchange operations. This development, announced on September 2, 2025, addresses long-standing uncertainties around leveraged and margined crypto transactions, fostering confidence among institutional and retail investors alike. The clearer regulatory framework is expected to reduce compliance risks for exchanges and encourage broader adoption, particularly as the market anticipates a Federal Reserve rate cut, which could further amplify bullish sentiment.

This regulatory progress aligns with a broader macroeconomic rebound, including a weaker U.S. dollar and expectations of dovish Federal Reserve policies. The market’s positive response is evident in the 1.3% increase in total crypto market capitalization to $3.96 trillion, with 90 of the top 100 coins turning green on September 5. However, the volatility potential remains high due to $4.5B in token unlocks scheduled for September, which could pressure prices if not absorbed by demand. The regulatory clarity is a pivotal step, but its long-term impact will depend on how exchanges and investors adapt to the new rules.

Other News Positive 📈

- Bitcoin ETF Inflows: US Bitcoin spot ETFs recorded $301.32M in inflows, signaling strong institutional interest.

- Remittix Presale Success: Remittix raised $20.7M, with a planned wallet beta launch in Q3 2025, positioning it as a potential DeFi leader.

- Bitcoin Week Bali: The September 5-11 event showcased BTC adoption in emerging markets, boosting grassroots momentum.

- Altcoin Speculation: Altcoin open interest dominance hit a high since January 2023, reflecting growing investor interest.

Neutral ⚖️

- Ethereum Foundation Sell-Off: The Ethereum Foundation plans to convert 10,000 ETH ($43M) to fund R&D and grants, potentially stabilizing ETH’s ecosystem.

- Market Stabilization: The global crypto market cap held steady at $3.9 trillion on September 4, with Bitcoin and Ethereum maintaining dominance at 56.4% and 13.5%.

- Bitcoin’s Gold Correlation: Bitcoin is increasingly moving in step with gold, reflecting its maturing role as a store of value.

Negative 📉

- Ethereum ETF Outflows: US Ethereum spot ETFs saw $38.24M in outflows, indicating weaker institutional demand compared to Bitcoin.

- Historical September Slump: Despite current gains, September’s historical bearish trend raises caution, with Bitcoin briefly dipping below $112,000.

- High Liquidations: Total crypto market liquidations reached $370-805M in 24 hours on September 3, highlighting ongoing volatility.

Movers and Buying Opportunities

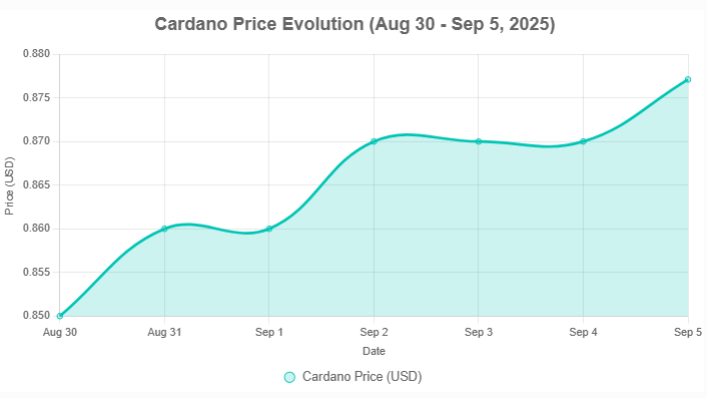

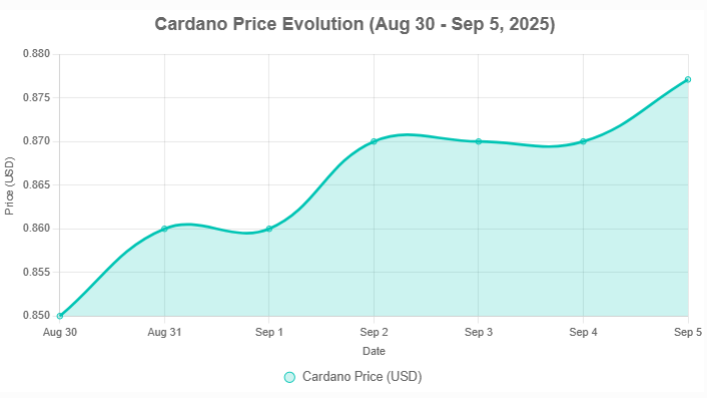

The most significant movers this week include Bitcoin (+1.9%, $112,672), Cardano (+3.14%, $0.8771), and XRP (+0.89%, $2.90). Cardano stands out as a potential buying opportunity due to its robust 3.14% gain, EU MiCA compliance, and $349M DeFi TVL, suggesting strong fundamentals and undervaluation. Ethereum, despite a modest 0.3% gain, faces headwinds from ETF outflows and a critical $4,250 support level, making it less attractive for immediate buys. Bitcoin’s steady performance and ETF inflows make it a safer bet but lack the short-term upside of Cardano.

Below is a chart illustrating Cardano’s price evolution over the past week, reflecting its upward momentum.

Latest Content

- XRP Price Prediction: XRP is expected to break out of consolidation and exceed $10, and the dotminers AI intelligent program is born

- Regulatory Boost and Altcoin Speculation Drive Crypto Momentum

- Trump-Backed WLFI Blacklists Justin Sun’s Wallet Amid Token Transfer Controversy

- What is Helium?

- Ethereum Steadies Above $4.4K & PENGU Price Signals Breakout as 312K Holders Prove BlockDAG is the Next Big Crypto