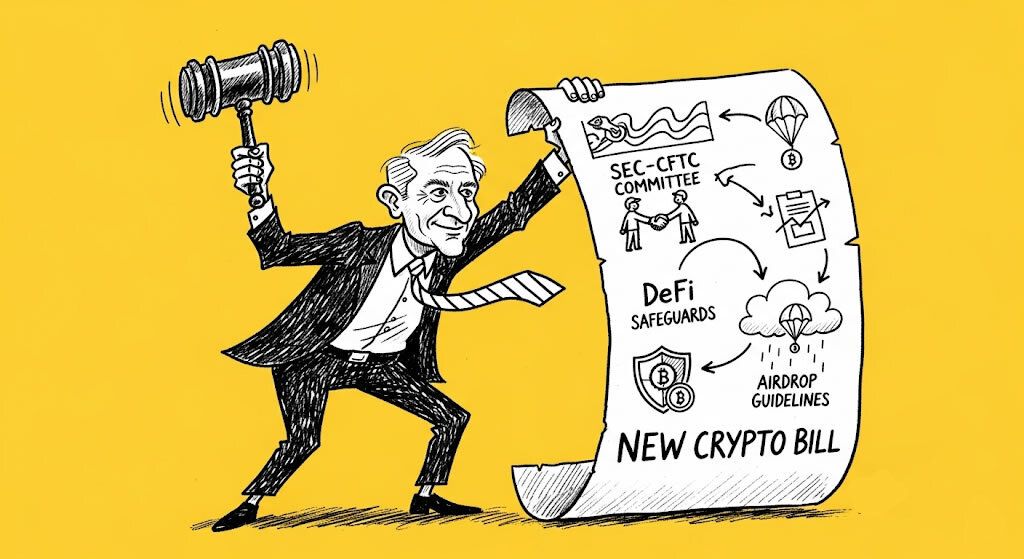

US Senate Unveils Updated Crypto Bill with SEC-CFTC Committee, DeFi Safeguards, and Airdrop Guidelines

- The Senate Banking Committee’s latest draft establishes a joint advisory committee between the SEC and CFTC to resolve regulatory overlaps in digital assets.

- DeFi developers gain explicit protections, shielding them from broker-dealer regulations for decentralized protocols.

- Airdrops, staking rewards, and DePIN tokens are exempted from securities classification under specific conditions, providing much-needed clarity.

- The bill mandates a study on tokenized real-world assets to guide future enforcement and standards.

The US Senate Banking Committee has circulated an updated draft of its crypto market structure bill, introducing measures to harmonize regulation between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). This 182-page document addresses long-standing industry concerns over jurisdictional conflicts, often referred to as “turf wars” between the two agencies.

Key to the bill is the creation of a Joint Advisory Committee under Section 701, which would facilitate coordination on digital asset oversight, including dispute resolution procedures outlined in Section 702. This move aligns with recent agency efforts, such as the planned joint roundtable on September 29, 2025, to discuss regulatory harmonization.

In a significant win for decentralized finance (DeFi), the draft provides explicit protections for developers and users involved in protocols like decentralized exchanges, liquidity pools, and validator nodes. These entities would not face the same anti-money laundering or broker-dealer requirements as centralized platforms, so long as they remain truly decentralized.

The bill also clarifies the treatment of airdrops and staking, defining them as “gratuitous distributions” exempt from securities laws unless involving fraud. This exemption extends to liquid staking tokens, reducing legal risks for participants in networks like Ethereum.

Decentralized Physical Infrastructure Networks (DePIN), which power real-world services such as wireless networks or cloud storage via blockchain, receive a carve-out in Section 504. Tokens in these networks are not considered securities if no single entity controls more than 20% of the supply, fostering innovation in this emerging sector.

Additionally, the legislation addresses tokenized real-world assets (RWAs), stating that tokenization does not automatically convert non-securities into securities. It calls for a joint SEC-CFTC study on verification, custody, and enforcement standards for RWAs.

“By working together to align our regulatory frameworks, the SEC and CFTC can reduce unnecessary barriers, enhance market efficiency, and create space for innovation to thrive. Our shared goal is to ensure that America remains the global leader in capital markets,” said SEC Chairman Paul S. Atkins and CFTC Acting Chairman Caroline D. Pham in a joint statement.

Community sentiment on X reflects optimism, with users noting the bill’s potential to boost US competitiveness in crypto. For instance, @botanika_sol highlighted its positive signal for Web3 and infrastructure projects, emphasizing exclusions for staking and DePIN (https://x.com/botanika\_sol/status/1964922700952228320).

On Sept 6, 2025, the US Senate Banking Committee introduced a bill draft excluding staking, airdrops, and DePIN from securities regulation.

— BOTANIKA | We Pioneer Data (@botanika_sol) September 8, 2025

→ A signal to ease the biggest uncertainty for Web3 & infra projects in the US. pic.twitter.com/hNkdHeyS8v

Similarly, @ElypsisLabs praised the proposal for unlocking innovation while maintaining regulatory harmony (https://x.com/ElypsisLabs/status/1964752022038872493).

🚨 More big news from DC on crypto regulation

— ELYPSIS.xyz (@ElypsisLabs) September 7, 2025

The Senate’s new market structure bill proposes:

⚖️ A joint SEC–CFTC Advisory Committee to end turf wars

🛡️ Explicit protections for DeFi devs & validators

🎁 Clarity on airdrops, staking rewards & LSTs

🔌 Exemption for DePIN tokens…

While the bill could attract more institutional investment into assets like Bitcoin, Ethereum, and XRP by providing clarity, critics warn it may impose higher compliance costs on smaller projects. Bipartisan support remains uncertain, with a potential markup deadline of September 30, 2025.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Base Chain Prepares for Innovation while QuickSwap Deployment Sets Stage for Integration with Next-Gen Protocol StratEx

- US Senate Unveils Updated Crypto Bill with SEC-CFTC Committee, DeFi Safeguards, and Airdrop Guidelines

- XRP Price Prediction: XRP is expected to break out of consolidation and exceed $10, and the dotminers AI intelligent program is born

- Regulatory Boost and Altcoin Speculation Drive Crypto Momentum

- Trump-Backed WLFI Blacklists Justin Sun’s Wallet Amid Token Transfer Controversy

Related

- Bitcoin Payments Get Green Light in California California Assembly Passes Bitcoin Payment Bill, Paving the Way for Crypto in Government Transactions....

- CFTC Chair Declares 70% of Crypto Assets as Commodities CFTC Chair Rostin Behnam declares 70% of crypto assets are not securities....

- What is staking and why it is critical to the crypto economy? What is staking and why it is critical to the crypto economy?...

- US Lawmakers Introduce Bill to Fire SEC Chair Gary Gensler Crypto-friendly lawmakers introduce legislation to remove SEC Chair Gary Gensler, whom they say has been "incompetent" in governing the crypto market....