Tether Announces Reduction In Commercial Paper Reserves

Tether’s commercial paper holdings have been reduced by 17% as the company seeks to improve the quality of its reserves.

In its Consolidated Reserves Report released Thursday, the company indicated that it had reduced its commercial paper holdings from USD $24.2 billion to USD $20 billion during the first quarter of 2021.

As of March 31, the end of the first quarter, Tether’s reserves were USD $82 billion of which 86% consisted of cash and cash equivalents. The remainder included $4 billion in corporate bonds, $3 billion in secured loans, and $5 billion in other investments such as cryptocurrencies, according to the report.

The cryptocurrency issuer said that it had reduced its cash deposits and increased its holdings of US Treasury bonds. According to the latest reports, Tether’s cash went from USD $4.2 billion to USD $4.1 billion, while bonds from USD $34.5 billion to USD $39.2 billion.

Other assets in the company’s reserve did not seem to vary much. As reviewed by that media outlet, the “Other investments” category, which includes cryptocurrencies, has remained constant, falling slightly from USD$5.02 billion to USD$4.96 billion. Although Tether has not disclosed which assets specifically make up this category, which has generated some uncertainty among investors and traders.

The announcement came just days after Tether delinked itself from its bank accounts at Puerto Rican Noble Bank—a move that raised questions about the company’s financial viability.

Tether said it would be using the funds freed up by this reduction to purchase more U.S. Treasury bonds, as well as put more cash into its reserves that can be accessed in case of emergencies or other issues that arise with its commercial paper program.

Depeg fears

The release and Thursday’s statements from Tether’s CEO Ardoino arguably seek to address widespread investor fears of a potential USDT delinking. The largest stablecoin by market capitalization, which is expected to maintain a stable price of $1, momentarily lost parity last week, touching 97 cents.

The unpegging of Tether came amid the plunge of Terra’s stablecoin algorithmic currency $UST, which lost its parity with the U.S. dollar. Since then, USDT’s market capitalization has fallen by nearly USD$9 billion amid increased liquidations of the asset and a broader correction scenario in the cryptocurrency market.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

- Diversification in Crypto: Building a Resilient Portfolio

- North Dakota Partners to Launch State-Backed Stablecoin

- SEC Chair Atkins Targets Formal Innovation Exemption Rulemaking by End of 2025

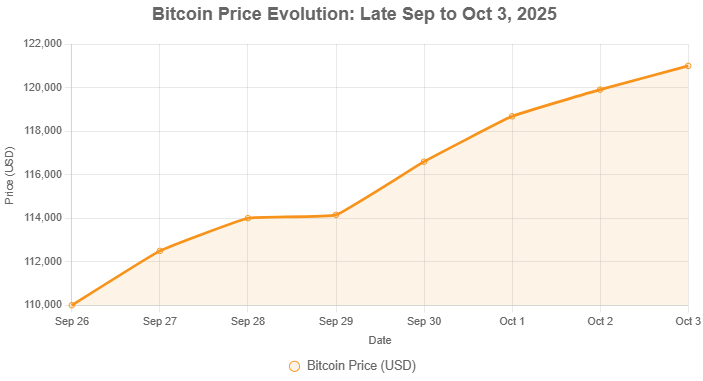

- Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

Related

- Tether could introduce new risks into securities markets Stablecoins like Tether (USDT) may bring new risks into short-term securities markets....

- Bitcoin Cash Vs. Bitcoin: What is the difference? Does Bitcoin cash have advantages over Bitcoin? If you’re new to the crypto world, you might not even know what Bitcoin Cash is. Basically, Bitcoin Cash (BCH) is a cryptocurrency branch created from the original Bitcoin currency. It came into...

- OlympusDAO continues its long-term plan to revive with inverse bonds OlympusDAO is continuing its long-term plan to revive its project....

- Bitcoin as a Legal Tender: What that Means for All of Us? By Elena Obukhova, founder & CEO at FAS | Fintech Advisory Services We all heard the recent news that El Salvador is to become the first country to use Bitcoin as a legal tender. What would that mean for the...