S&P Downgrades Tether’s USDT to Weakest Stability Rating Amid Bitcoin Exposure Risks

- S&P Global Ratings downgrades Tether’s USDT stability assessment to 5, the weakest score on its 1-7 scale.

- The move stems from increased holdings in volatile assets like bitcoin, now comprising 24% of reserves, up from 17% a year ago.

- Tether CEO Paolo Ardoino dismisses the rating as outdated, emphasizing USDT’s overcapitalization and $10B+ profits in 2025.

- Community reaction mixes concern over depegging risks with defense of Tether’s track record through past crises.

S&P Global Ratings has downgraded the stability assessment of Tether’s USDT stablecoin to its lowest level, warning that the world’s largest dollar-pegged token lacks adequate buffers to withstand a sharp decline in bitcoin’s value. The rating agency assigned a score of 5 on its 1-7 scale—where 1 denotes the strongest stability—citing Tether’s growing exposure to riskier reserve assets and persistent gaps in disclosure practices.

As of September 30, 2025, Tether’s reserves included 24% in higher-risk categories such as bitcoin, gold, secured loans, and corporate bonds, a notable increase from 17% the previous year. S&P highlighted that these assets, valued at billions, could erode USDT’s $1 peg if market volatility spikes, potentially leaving the stablecoin undercollateralized. The firm also criticized Tether’s limited transparency on custodians and asset compositions, which hampers independent verification of reserve quality.

This assessment aligns with broader scrutiny of bitcoin-heavy entities, where S&P has issued speculative-grade ratings due to liquidity vulnerabilities. Despite USDT’s dominant market position—with over $140 billion in circulation and daily trading volumes exceeding $100 billion—the downgrade underscores ongoing regulatory and investor concerns in the stablecoin sector.

Tether swiftly rebutted the report, with CEO Paolo Ardoino posting on X that the company “wears S&P’s loathing with pride.” He argued that traditional rating models fail to grasp digitally native money’s dynamics, pointing to Tether’s extreme profitability—over $10 billion in the first nine months of 2025—and its status as the 17th largest holder of U.S. Treasurys globally. A Tether spokesperson echoed this, calling the analysis “misleading” and overlooking USDT’s proven resilience through events like the FTX collapse.

Analysts note potential upsides for improvement: S&P suggested the score could rise if Tether reduces high-risk exposures and enhances disclosures on banking partners and reserve breakdowns. Secured loans, targeted for phase-out by end-2023 but still at 8% ($14 billion) as of September 2025, remain a flashpoint. For now, the downgrade reignites debates on stablecoin risks, with some traders eyeing alternatives like USDC amid heightened caution.

Community sentiment on X reflects polarization: bullish voices celebrate Tether’s innovation outside legacy finance, while skeptics warn of systemic threats if USDT falters. As bitcoin trades around $90,000—down from October highs—the stablecoin’s peg holds firm at $1.0001, but vigilance persists.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bernstein Reaffirms $150,000 Bitcoin Target, Calling Current Dip ‘Weakest Bear Case’ in History

- Crypto Weekly Snapshot – The Crypto Rebound

- Bitcoin Mining Difficulty Drops 11% in Largest Negative Adjustment Since China’s 2021 Ban

- Bithumb Recovers Majority of $43 Billion in Bitcoin After Promotional Distribution Error

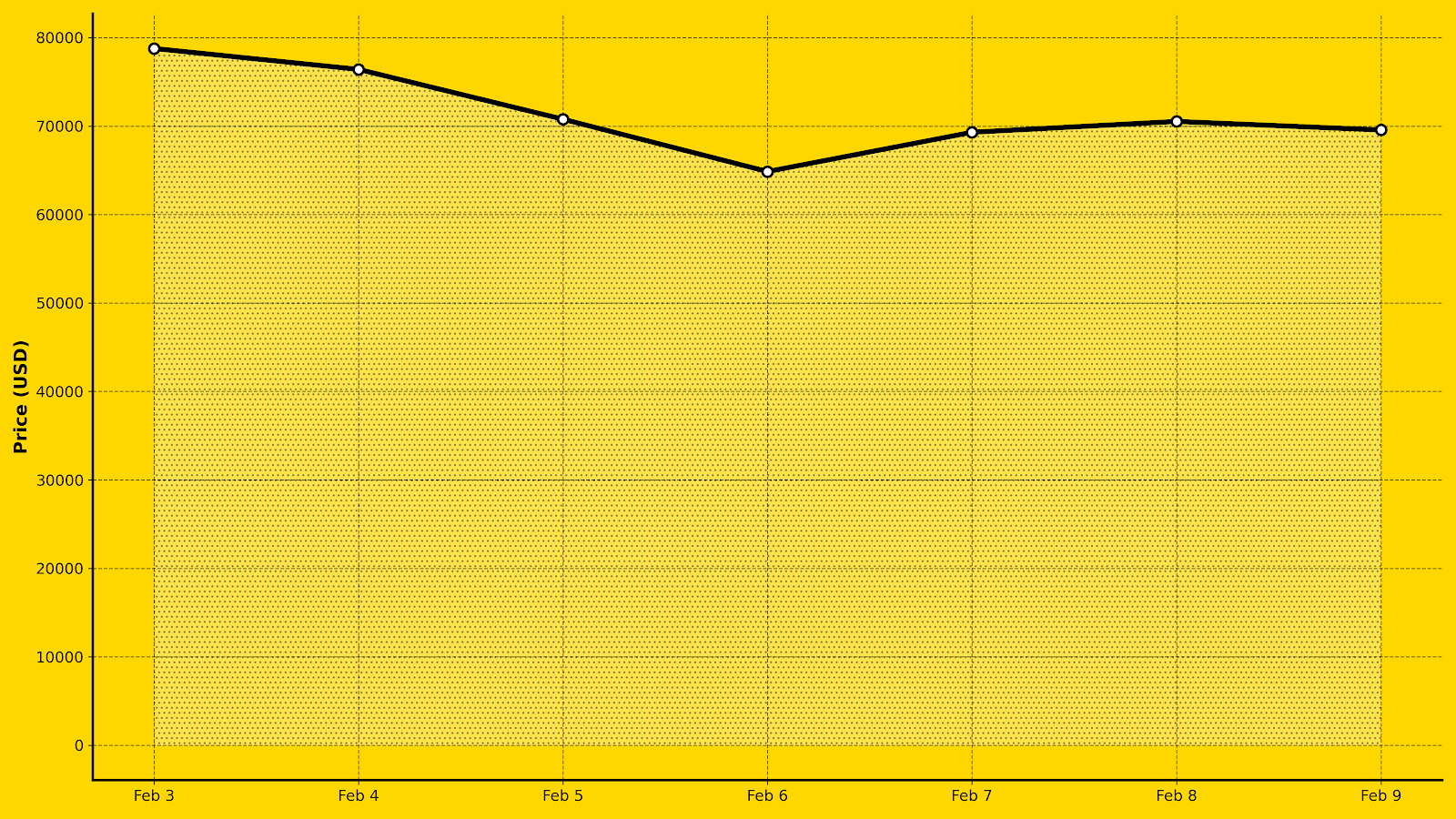

- Bitcoin Recovers to $70,000 As Altcoins Rally

Related

- Aave GHO Stablecoin Aave GHO Stablecoin: A New Decentralized Stablecoin from the Aave Protocol....

- Plasma: The Blockchain Challenging DeFi’s Stablecoin Status Quo Plasma aims to offer zero-fee USDT transactions and lightning-fast settlement by leveraging Bitcoin's security and an EVM-compatible environment....

- Tether could introduce new risks into securities markets Stablecoins like Tether (USDT) may bring new risks into short-term securities markets....

- Tether (USDT) What is Tether?...