- Bitcoin’s price rose 50% one year after the 4th halving.

- Marking the weakest post-halving performance historically.

- The modest gain is likely due to a bearish macroeconomic environment, including high inflation and rising interest rates.

- Recent data shows Bitcoin recovered above $94,000 in April 2025, with a 14% monthly increase.

- Future trends may depend on institutional adoption and regulatory changes, with mixed analyst predictions.

We’re marking the one-year anniversary of Bitcoin’s 4th halving, which occurred on April 20, 2024. Halvings, happening roughly every four years, halve the mining reward, reducing new Bitcoin supply and historically triggering price rallies due to scarcity.

This cycle, however, has diverged from the norm, prompting a deep dive into Bitcoin’s price evolution, the macroeconomic landscape, and recent trends.

Detailed Price Evolution Since the 4th Halving

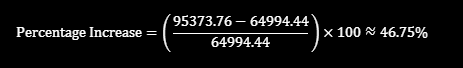

To quantify Bitcoin’s performance, let’s start with the numbers. The halving day, Bitcoin’s price was $64,994.44, as per historical data from StatMuse Money. Today, it’s trading at $95,373.76. This gives us a percentage increase of:

This 46.75% gain is notably the smallest post-halving increase in Bitcoin’s history, as evidenced by comparing it to previous cycles.

| Halving Date | Price Before Halving | Price One Year Later | Percentage Increase |

|---|---|---|---|

| November 28, 2012 | $12 | $1,000 | 8,233% |

| July 9, 2016 | $650 | $2,500 | 284.6% |

| May 11, 2020 | $8,750 | $50,000 | 471.4% |

| April 20, 2024 | $64,994.44 | $95,373.76 | 46.75% |

Analyzing the Modest Performance: Macroeconomic and Market Factors

The subdued performance is likely tied to a bearish macroeconomic backdrop, as suggested by multiple sources.

Inflation and Interest Rates

Central banks globally have tightened monetary policy, with interest rates rising to combat inflation. This makes traditional investments like bonds more attractive, reducing speculative demand for Bitcoin. Forbes notes a historical correlation with M2 suggesting Bitcoin may depreciate as monetary conditions tighten.

Geopolitical Uncertainty

Ongoing conflicts and trade tensions, have added to market uncertainty, making investors cautious about volatile assets.

Regulatory Scrutiny

While the January 2024 approval of Bitcoin ETFs brought institutional interest, ongoing regulatory debates create uncertainty.

Market Maturity

Bitcoin’s increased institutional participation, with ETFs now holding nearly $110 billion in assets, suggests a more mature market, potentially leading to slower, more stable price movements compared to earlier, more volatile cycles.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Base Chain Prepares for Innovation while QuickSwap Deployment Sets Stage for Integration with Next-Gen Protocol StratEx

- US Senate Unveils Updated Crypto Bill with SEC-CFTC Committee, DeFi Safeguards, and Airdrop Guidelines

- XRP Price Prediction: XRP is expected to break out of consolidation and exceed $10, and the dotminers AI intelligent program is born

- Regulatory Boost and Altcoin Speculation Drive Crypto Momentum

- Trump-Backed WLFI Blacklists Justin Sun’s Wallet Amid Token Transfer Controversy

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- Inflation Watch: U.S. CPI and Its Ripple Effect on Bitcoin Prices U.S. CPI Release and Bitcoin: Inflation’s Influence on Crypto Markets....

- Bitcoin Miners Face Post-Halving Challenges as Reserves Hit 14-Year Low Bitcoin miner reserves are at their lowest in 14 years, down 50% from all-time highs....