Metaplanet Shares Hit Three-Month Premium After MSCI Shelves Exclusion Plan for Bitcoin Treasury Firms

- MSCI has opted not to exclude companies with over 50% of assets in digital currencies from its indexes for the February 2026 review.

- Metaplanet’s shares rose 4% in Tokyo trading, boosting its market-to-net asset value ratio to

1.25. - The decision averts immediate selling pressure but flags future consultations on non-operating entities.

Japanese firm Metaplanet saw its stock climb to a three-month premium relative to its bitcoin holdings after index provider MSCI announced it would not exclude digital asset treasury companies from its global benchmarks.

Metaplanet, which holds 35,102 BTC valued at approximately $3.27 billion, closed at 531 yen ($3.4) on January 7, 2026, marking a 4% gain. This pushed its multiple to net asset value (mNAV) to around 1.25, the highest since before the October 2025 crypto market liquidation crisis.

The rally follows MSCI’s January 6 announcement to maintain the status quo for digital asset treasury companies (DATCOs)—defined as firms where digital assets like Bitcoin (BTC) comprise 50% or more of total assets. This removes a near-term overhang that could have triggered billions in passive fund outflows, but MSCI plans a broader review on distinguishing investment-oriented entities from operating companies.

In its official note, MSCI stated, “This broader review is intended to ensure consistency and continued alignment with the overall objectives of the MSCI Indexes, which seek to measure the performance of operating companies and exclude entities whose primary activities are investment-oriented in nature.” The firm cited investor feedback highlighting similarities between DATCOs and ineligible investment funds.

Simon Gerovich, CEO of Metaplanet, welcomed the news on X, posting: “Good news for Bitcoin treasury companies. MSCI has decided not to exclude companies holding large amounts of Bitcoin from the index.” The post, available at X, thanked stakeholders for their input.

ビットコイン・トレジャリー企業にとって朗報です。MSCIは、ビットコインを多く保有する企業を指数から除外しないことを決定しました。

— Simon Gerovich (@gerovich) January 6, 2026

本件について、企業や業界団体、資産運用会社など、幅広い関係者から寄せられた貴重なご意見に感謝します。 https://t.co/2C2Smm1YoT

Other bitcoin treasury firms also benefited. MicroStrategy (MSTR), the largest corporate BTC holder with 673,783 coins, rose 5% in pre-market trading on January 7. Analysts note the decision defers risks rather than eliminates them, as future criteria could include financial-statement indicators to assess operational focus.

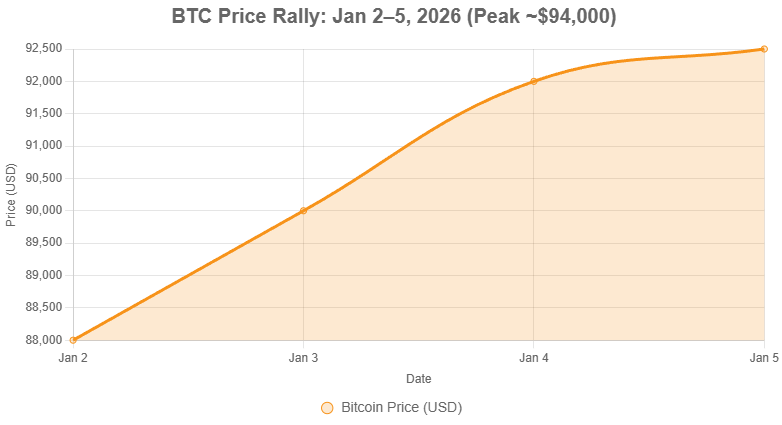

Over 190 public companies now hold Bitcoin on their balance sheets, with treasuries expanding into altcoins like Ethereum (ETH). However, late 2025 price declines raised sustainability questions. For context on Bitcoin’s recent performance, see this related article from Cryptopress.site: Bitcoin Pushes Above $90,000 as Traders Eye Change in Pattern.

The trend underscores growing institutional adoption, but experts caution that regulatory shifts could impact liquidity and KYC compliance for treasury strategies.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Understanding XRP and Its Ecosystem

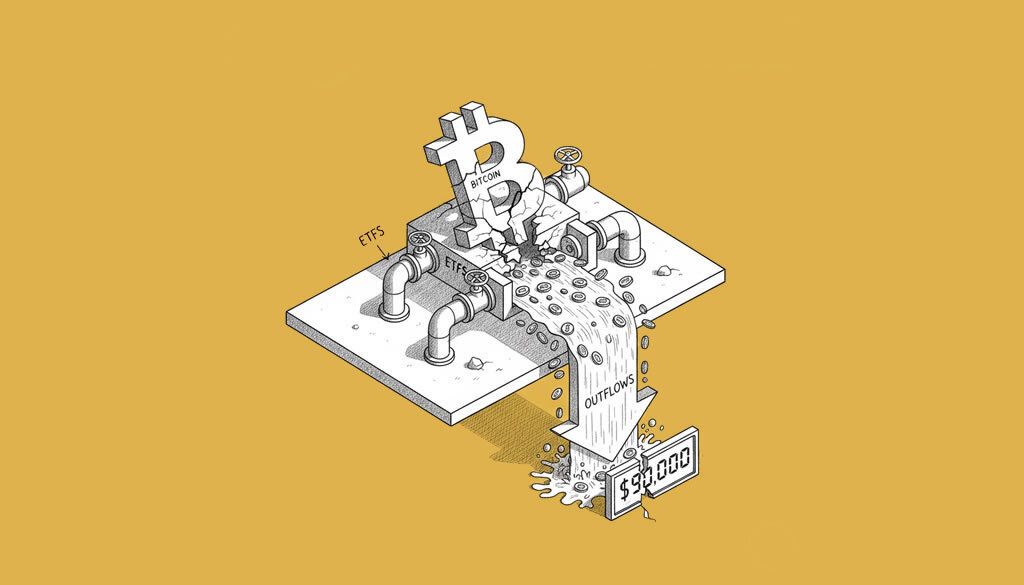

- Bitcoin ETFs See Substantial Outflows as Price Dips Below $90,000

- Dogecoin Leads Meme Coin Surge as Sector Kicks Off 2026 with Strong Gains

- Metaplanet Shares Hit Three-Month Premium After MSCI Shelves Exclusion Plan for Bitcoin Treasury Firms

- XRP Rockets 11% to $2.40 as ETF Inflows Hit Record Highs and RLUSD Gains Regulatory Edge

Related

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- Metaplanet Boosts Bitcoin Holdings with $451M Q4 Purchase Japanese investment firm Metaplanet has acquired an additional 4,279 BTC in the fourth quarter of 2025, achieving a remarkable 568.2% BTC yield year-to-date as it continues its aggressive treasury strategy....

- JPMorgan Warns Strategy Faces Billions in Outflows if MSCI Excludes It From Indices Strategy could see up to $2.8 billion in passive outflows from MSCI exclusion alone, with risks rising to $8.8 billion if other indices follow, amid a January 15 decision on digital asset treasury firms....

- Strategy fights MSCI exclusion threat Strategy engages MSCI on index status as fears of exclusion due to Bitcoin holdings persist, while crypto markets recover with Bitcoin surpassing $90,000....