DXY Drops to 4-Month Low: Potential Tailwind for Bitcoin Prices

- The US Dollar Index (DXY) fell to its lowest level in four months, nearing the 97 mark.

- Dollar weakness often acts as a catalyst for Bitcoin and other risk assets.

- Bitcoin’s current price action is mixed, pressured by major crypto ETP outflows ($1.7 billion) and general risk-off sentiment.

- Gold has significantly outperformed crypto, surging past $5,000 amid macro uncertainty.

The US Dollar Index (DXY) continued its descent, reaching a four-month low near 97 on January 26, 2026. This dip signals growing market anticipation that the Federal Reserve may adopt a more dovish monetary policy stance soon.

The index’s decline below key technical levels has historically created a favorable environment for risk assets, including Bitcoin, as a weaker dollar typically drives capital toward alternatives perceived as inflation hedges. A soft dollar often correlates inversely with BTC prices.

💵 DXY Hits 4-Month Low

— Cryptopress (@CryptoPress_ok) January 26, 2026

The US Dollar Index dropped to its lowest in four months, potentially supporting upward momentum for Bitcoin.

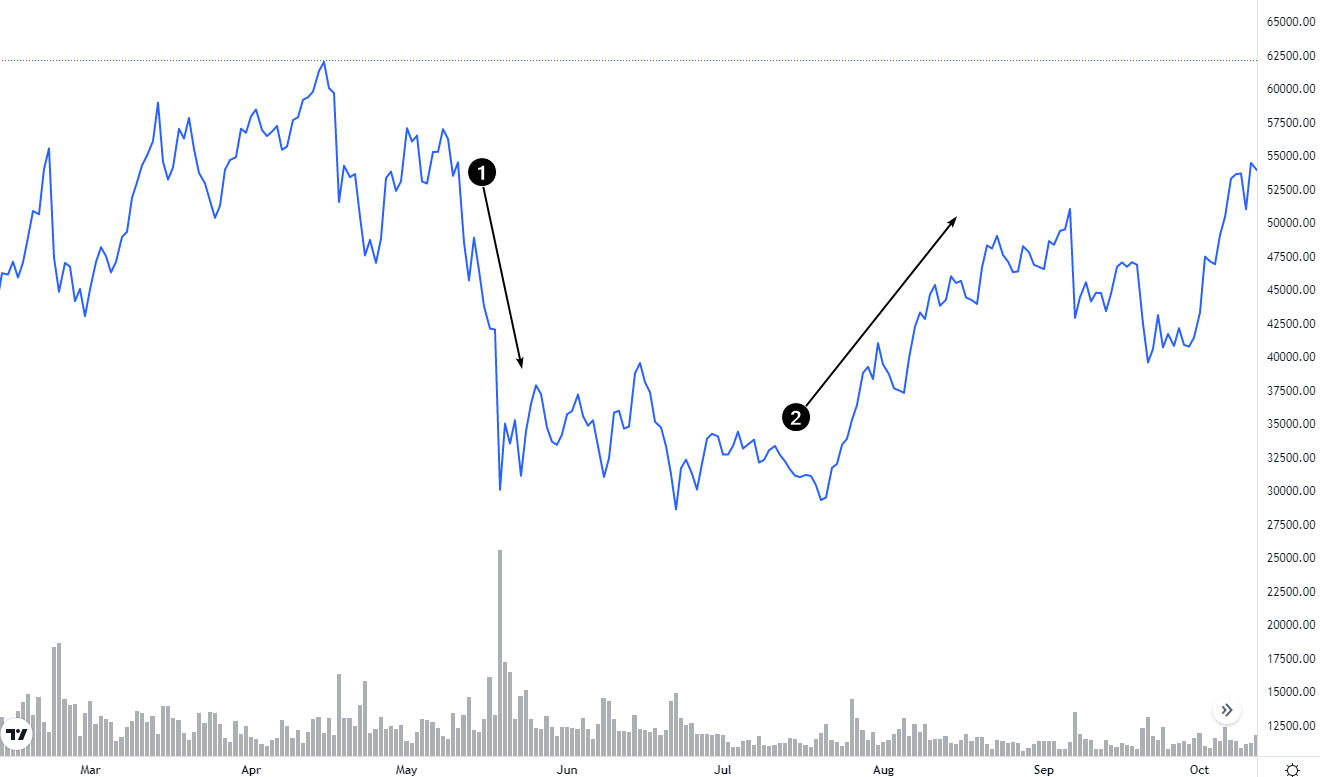

However, Bitcoin’s response has been underwhelming. Trading near $87,000, BTC is struggling under the weight of recent negative flows; exchange-traded products (ETPs) saw net outflows totaling $1.7 billion last week, the largest such exodus since November 2025. This indicates persistent risk aversion in the market.

In a notable divergence, traditional safe-haven assets like gold have surged, crossing the $5,000 threshold. This suggests investors are favoring established hard assets over digital assets during this period of macroeconomic and geopolitical apprehension.

While the DXY’s technical breakdown provides a potential long-term tailwind for Bitcoin (BTC), immediate price action remains constrained by derivatives positioning and broader market sentiment. Traders are keenly awaiting the Fed’s policy update for definitive direction.

Major altcoins, including Ethereum (ETH), are mirroring the cautious trading pattern observed in the flagship cryptocurrency.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- DXY Drops to 4-Month Low: Potential Tailwind for Bitcoin Prices

- Crypto Weekly Snapshot – Key News Shaking Crypto

- 85% of Institutions Testing or Using Distributed Validators, Obol Survey Finds

- Why Solana’s Seeker Phone Is Selling Fast

- Solana Mobile’s SKR Token Surges 300% Following Seeker Smartphone Airdrop

Related

- Inflation Watch: U.S. CPI and Its Ripple Effect on Bitcoin Prices U.S. CPI Release and Bitcoin: Inflation’s Influence on Crypto Markets....

- Bitcoin and Ethereum Lead 2025’s $7.5B Crypto Fund Rally Crypto Funds Hit $7.5B in 2025 Inflows as Institutional Appetite Grows....

- The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure On October 10, 2025, the crypto market suffered its largest-ever liquidation event, wiping out $19 billion amid Trump's China tariff shock. This in-depth retrospective unpacks the mechanics, impacts, and lessons for investors—why it happened, what it means, and how to...

- McKay Brothers Launches Fastest London-Stockholm Private Bandwidth McKay Brothers International (MBI) launched the lowest latency private bandwidth between London and Stockholm....