BlackRock bets big on crypto and partners with Coinbase

The cooperation with the exchange aims to make it simpler for institutional investors to manage and trade Bitcoin, marking a significant push into cryptocurrencies by the biggest asset management in the world.

BlackRock has announced the establishment of a spot bitcoin private trust, intensifying its drive into digital assets as the cryptocurrency sector recovers from the financial crisis.

In a blog post published on Thursday, the world’s biggest asset manager said that the private trust will only be offered to institutional customers in the United States, but provided few more specifics.

US authorities have consistently rejected plans to give ordinary investors spot bitcoin exchange-traded funds, citing the necessity for investor safeguards.

We are proud to announce a partnership with @BlackRock. BlackRock’s Aladdin clients will now have direct access to crypto markets through Coinbase Prime.

— Coinbase 🛡️ (@coinbase) August 4, 2022

Read more 👇https://t.co/LA3XeYYbvs

The decision by BlackRock puts the financial firm, whose CEO Larry Fink has openly criticized bitcoin, in competition with Grayscale, the world’s largest cryptocurrency investment vehicle.

The news comes after Fink said earlier this year that customers have shown “growing interest” in digital currencies, including stablecoins and “underlying technology” — commonly known as blockchain.

In recent years, institutional investors who were originally antagonistic to the crypto business have altered their tune, but environmental issues around the bitcoin mining process have remained a hurdle for many.

According to the article, BlackRock has been exploring topics that have the “potential to help our customers and capital markets in general,” such as permissioned blockchains, stablecoins, crypto assets, and tokenization.

BlackRock and Coinbase Join Forces

🔸Blackrock comienza a Ofrecer #Bitcoin a sus clientes:

— Healthy Pockets (@healthy_pockets) August 16, 2022

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧

🟧 🟧

BlackRock #BTC

$10Trillion $0,4 Trillion

BlackRock, which manages around $8.5 trillion in assets, established a collaboration with renowned cryptocurrency exchange Coinbase one week ago to provide cryptocurrencies to its institutional customers. Coinbase teamed with BlackRock to provide its customers access to digital assets and bridge the gap between Coinbase Prime and the Aladdin platform developed by BlackRock.

Aladdin is the investment management platform run by institutional investors and financial institutions on behalf of BlackRock. Their clientele consists of asset managers, corporate treasurers, insurers, and pension fund companies.

Image: Coinbase, Medium.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

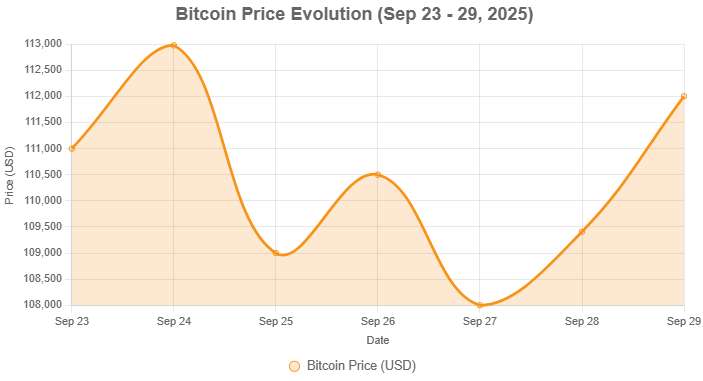

- Bitcoin Rallies to $114,000 as Crypto Market Adds $110 Billion in 24 Hours

- Pepe Traders Wait, Ethereum Holds $4.5K but BlockDAG’s BWT Alpine F1® Team Alliance Creates Crypto’s Next Growth Engine

- 5 Leading Crypto Wallets in 2025: Your Complete Guide to Secure Digital Asset Storage

- Interview with Zayn Kaylan: Luxxfolio’s “Digital Silver” Strategy with Litecoin

- Asset Managers Amend Solana ETF Filings to Include Staking as Approval Looms

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Coinbase Coinbase is the world’s biggest crypto exchange headquartered in the U.S....

- FTX Digital Markets Partners with Solidus Labs for Trade Surveillance and Transaction Monitoring Services Solidus’ HALO platform, an all-in-one crypto market integrity hub, will enable the highest standards of risk monitoring and compliance....

- Investing in Crypto in 2021: Where to Start With thousands of crypto options to choose from in 2021, where do you even start?...