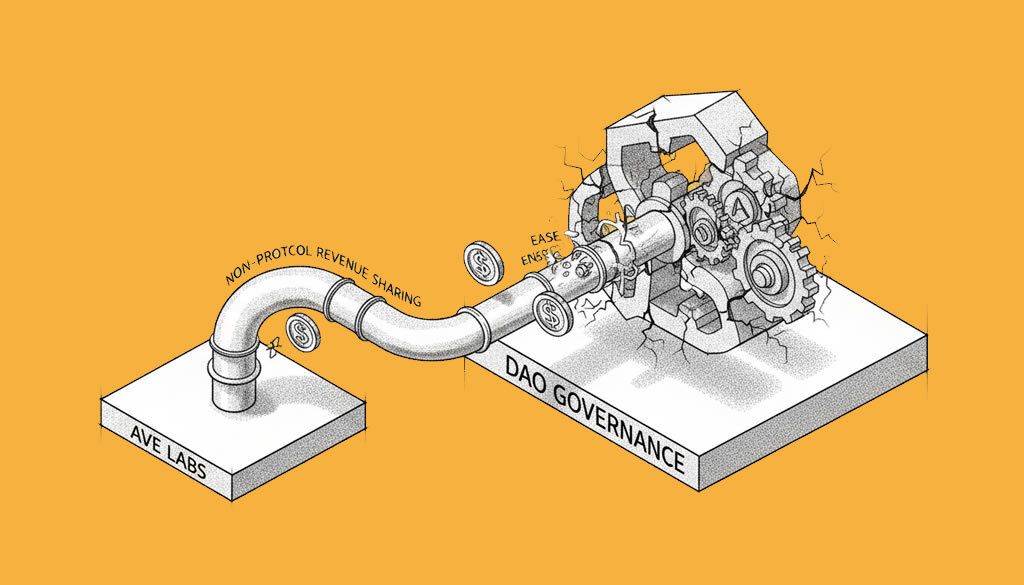

Aave Labs Proposes Non-Protocol Revenue Sharing to Ease DAO Governance Tensions

- Aave Labs has proposed sharing non-protocol revenue with AAVE token holders to address recent governance disputes.

- The move follows a failed vote on transferring brand assets to the Aave DAO, highlighting tensions over fee allocation.

- Founder Stani Kulechov outlines a vision for expansion into real-world assets and institutional lending, potentially unlocking new growth avenues.

Aave Labs, the development firm behind the leading DeFi lending protocol, has moved to defuse escalating governance tensions by committing to share revenue generated outside the core protocol with AAVE token holders. This proposal comes in the wake of a contentious vote that rejected transferring control of Aave’s intellectual property and brand assets to the decentralized autonomous organization (DAO). The initiative aims to align incentives between developers and the community, fostering a more collaborative path forward.

Key Dispute Details: The conflict arose from concerns over frontend fees from cryptocurrency swaps via CoW Swap, a decentralized exchange integrated with Aave. Community members argued these revenues should flow to the DAO, while Aave Labs maintained control, sparking debates on privatization and fair distribution. A recent governance vote on Monday saw the proposal to shift IP control to the DAO defeated, exacerbating the divide.

In a governance forum post, Aave founder and CEO Stani Kulechov emphasized the need for resolution. “Given the recent conversations in the community, at Aave Labs we are committed to sharing revenue generated outside the protocol with token holders,” Kulechov stated, adding that a formal proposal with implementation details will follow soon.

Strategic Vision: Beyond revenue sharing, Kulechov advocated for expanding Aave’s scope to include real-world assets (RWAs), consumer-facing products, and institutional lending. He highlighted RWAs as a potential $500 trillion market opportunity, noting that DeFi’s growth depends on venturing beyond crypto-native use cases. This could involve supporting new asset classes and allowing independent teams to build on the permissionless protocol, with the DAO capturing upside through increased usage.

The AAVE token, central to governance, saw a 10.42% price increase to $164.14 amid the developments. Aave remains the largest DeFi lending protocol, with over $45 billion in total value locked (TVL). However, Kulechov’s recent purchase of approximately $15 million in AAVE tokens drew scrutiny, with some alleging vote influence—claims he denied, attributing it to personal conviction in the protocol.

Balanced Perspective: While the proposal offers an olive branch, it underscores ongoing challenges in DeFi governance, including balancing developer autonomy with community control.

Analysts note potential risks, such as implementation hurdles and market uncertainties, but see it as a step toward sustainable growth. Community feedback on the upcoming formal proposal will be crucial in resolving these tensions.

Aave operates primarily on the Ethereum blockchain, leveraging smart contracts for lending and borrowing. As the protocol eyes broader adoption, stakeholders emphasize the importance of KYC compliance in institutional segments to mitigate regulatory risks.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Crypto Weekly Snapshot – Strong Start to 2026

- US Forces Capture Maduro in Swift Raid. Activity on Polymarket Skyrockets Over Possible Outcomes

- Cross-Chain Bridges: The Gateways of Blockchain Interoperability

- Shiny Coins #3 – Bloodbath Survivors Rise from the Ashes

- Aave Labs Proposes Non-Protocol Revenue Sharing to Ease DAO Governance Tensions

Related

- Aave GHO Stablecoin Aave GHO Stablecoin: A New Decentralized Stablecoin from the Aave Protocol....

- What is the Revenue Meta in Crypto? In search of sustainable profits in blockchain....

- AAVE What is AAVE and how it works?...

- The Most Secure Crypto Yield Opportunities in 2025 These projects offer good yields for lending, yield farming, and staking in crypto as of March 2025....