What is Helium?

- Helium is a decentralized wireless network powered by blockchain technology, focusing on IoT and mobile connectivity.

- Users deploy Hotspots to provide coverage and earn HNT tokens for participation.

- The network addresses real-world problems by challenging telecom monopolies with community-owned infrastructure.

- HNT serves as the native cryptocurrency, used for governance, incentives, and burning to create Data Credits for network usage.

- As of September 2025, Helium has over 1.6 million daily users and continues to expand globally.

Helium represents a bold leap in the world of decentralized physical infrastructure networks (DePIN), blending blockchain with real-world utility to create a global wireless ecosystem. Imagine plugging in a small device at home and suddenly becoming part of a network that rivals traditional telecom behemoths—without the hefty bills or corporate gatekeepers. That’s Helium in a nutshell, a project that’s turning everyday people into network operators while generating real revenue. But like any crypto venture, it’s not without its quirks; after all, who knew building the internet of tomorrow could involve something as light as helium? This article dives deep into the mechanics, history, and future of Helium, drawing from reliable sources to provide a balanced view.

What is Helium in Crypto?

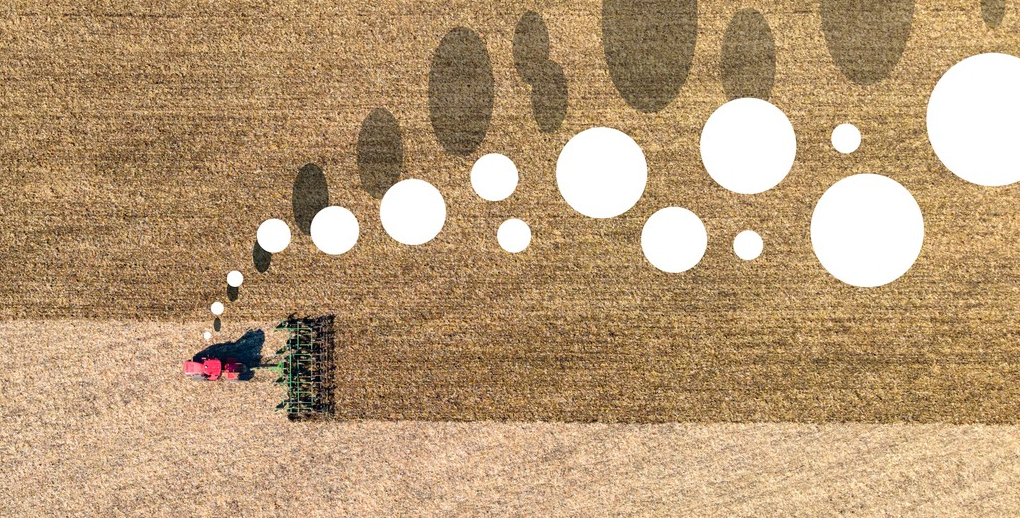

Helium is a blockchain-based network designed for the Internet of Things (IoT) and mobile devices, enabling decentralized wireless connectivity. Launched as a solution to the inefficiencies of centralized telecom infrastructure, it allows individuals to deploy Hotspots—devices that provide low-power, long-range coverage—and earn rewards in the form of its native token, HNT. Unlike traditional networks dominated by giants like Verizon or AT&T, Helium democratizes access, letting users own and operate parts of the infrastructure. As one tweet from Helium’s founder Amir Haleem puts it: “today over 1.6M cellphone subscribers used the @helium network, burning $HNT for every bit of data they sent or received. we will continue to set new ATH’s until morale is improved.” This highlights the network’s growing adoption, with over a million users and millions in revenue generated, as noted in various analyses.

In the broader context of decentralized finance (DeFi) and finance, Helium stands out as a DePIN project that bridges crypto with tangible utility. It’s not just about speculation; the network has facilitated real-world applications, from tracking sensors in smart cities to providing mobile coverage in underserved areas. For instance, Madison Airport recently upgraded to Helium for faster, more secure service, showcasing its practical edge.

How It Works

At its core, Helium operates through a network of Hotspots that use Proof-of-Coverage (PoC) to verify wireless range and data transfer. Users buy or build these devices, plug them in, and connect them to the internet. Hotspots then broadcast signals for IoT devices (via LoRaWAN) or mobile phones (via 5G/Wi-Fi offload), earning HNT based on coverage provided and data handled. To use the network, entities burn HNT to create Data Credits, which pay for connectivity—ensuring a deflationary mechanism as demand grows.

This model flips the script on telecom: instead of paying monopolies, users contribute and profit. As of Q2 2025, new Mobile Hotspots increased by 12.5% quarter-over-quarter to 31,600, per Messari reports, indicating steady expansion. Ironically, while telecom giants charge premiums for spotty service, Helium rewards you for improving it—talk about turning the tables.

Brief History of the Project and Team

Founded in 2013 by Amir Haleem (CEO), Shawn Fanning (of Napster fame), and Sean Carey, Helium started as a hardware-focused startup before pivoting to blockchain. The genesis block was mined on July 29, 2019, with no pre-mine or ICO; instead, it raised over $364 million through venture rounds, including $200 million in Series D in 2022. The team brings expertise in radio hardware, distributed systems, and peer-to-peer tech. A key milestone was migrating to the Solana blockchain in April 2023 for better scalability and low fees, boosting its DeFi integration. Today, the Helium Foundation stewards the project, focusing on open-source development and grants.

Project’s Features

Helium’s standout features include:

- Decentralized Ownership: Anyone can host a Hotspot and earn up to 30% of rewards from data transfers.

- Dual Networks: IoT for sensors (over 1 million devices connected) and Mobile for cellular, with partnerships like Movistar in Mexico adding 2 million subscribers.

- Token Incentives: HNT for mining, governance, and burning—capped at 223 million supply.

- Scalability via Solana: Handles massive transactions with ultra-low fees, enabling seamless DeFi interactions.

Data from CoinGecko shows HNT’s utility in action, with a 24-hour trading volume of $14 million.

Project’s Risks

No crypto project is risk-free, and Helium has faced scrutiny. Early criticisms included allegations of insiders hoarding tokens, though the SEC dropped its investigation in April 2025. Volatility is high—HNT’s price has swung from an all-time high of $54.88 in 2021 to around $2.38 today. Other risks: competition from traditional telecoms, regulatory hurdles in wireless spectrum, and technical vulnerabilities, like those found in similar devices by Kudelski IoT Labs. Plus, mining hardware costs (around $500 per Hotspot) and dependence on user adoption could falter if growth stalls—because nothing says “decentralized” like relying on your neighbor’s Wi-Fi.

What Makes This Project Unique?

Helium’s edge lies in its DePIN model: it’s not just crypto hype but solves a $2 trillion telecom problem by crowdsourcing infrastructure. Unlike pure DeFi protocols, it generates real revenue—millions from data usage—while integrating with Solana for liquidity. Quotes from community members, like on Reddit, highlight frustrations but also loyalty: “After spending a few years… I’ve decided to step away,” yet others praise its innovation. Its open-source nature and grants program (e.g., $50 million for coverage) set it apart, fostering a community-driven ecosystem.

Project’s Governance

Governance is community-led via Helium Improvement Proposals (HIPs), where staked HNT (veHNT) grants voting power. The Helium Foundation oversees the process, hosting calls and working groups. This token-weighted system has sparked debates, like HIP 138’s failure due to whale influence, underscoring the irony of “decentralized” decisions sometimes hinging on big holders.

Outlook

Current Status

As of September 2025, Helium boasts 1.6 million daily users, with hotspots numbering in the hundreds of thousands. Market cap stands at $442 million, with FDV at $530 million (ratio 0.83). Recent expansions include partnerships in Mexico and U.S. airports.

Potential for the Future

Analysts predict growth in DePIN, with Helium potentially doubling demand by 2035 amid IoT boom. Price forecasts vary, but with halvings and increasing burns, HNT could reach $10+ if adoption hits 10 million users. Challenges like helium shortages (the gas, not the network—hilarious coincidence) could indirectly affect hardware, but overall, the outlook is optimistic for disrupting finance through utility-driven crypto.

Conclusion

Helium exemplifies how crypto can extend beyond speculation into real-world finance and DeFi, empowering users while challenging entrenched industries. Whether you’re a tech enthusiast or investor, it’s a project worth watching—just don’t let the hype float away like a balloon.

For more on crypto trends, check out related insights at https://cryptopress.site.

Factsheet

| Information | Details |

|---|---|

| Project Smart Contract | HNT token on Solana (SPL standard); main address: hntyVP6YFm1E9D3LQVbJdmUL1qUbgsoXZbw8UePQ6V3W |

| Official Website | https://www.helium.com/ |

| Audits | Hardware audits for Hotspot makers; smart contract audit by Cyberscope |

| Market Cap/FDV Ratio | 0.83 (CoinGecko) |

| Market Price Chart and Exchanges | Current price: $2.38 (down 5.7% in 24h); ATH: $54.88 (Nov 2021); ATL: $0.1132 (Apr 2020); Exchanges: Binance, Coinbase, Kraken (pairs like HNT/USDT, HNT/USD). Price chart shows volatility with a 68.8% 1-year decline but recent stabilization. |

| ICO Date | No ICO; Genesis block: July 29, 2019 |

| Documentation, Whitepaper | https://docs.helium.com/ (comprehensive docs, no traditional whitepaper but protocol reports available) |

| Social Accounts | X: @helium; Instagram: @helium; Facebook: heliumsystems; Discord: https://discord.gg/5jagnt8W; Linktree: https://linktr.ee/heliumnetwork |

Helium, often hailed as a DePIN giant, is fundamentally a decentralized wireless network that empowers individuals to own and operate infrastructure for IoT and mobile connectivity, bypassing traditional telecom monopolies. This extended survey explores its intricacies, drawing from primary sources like official documentation and market analyses, to provide a comprehensive, layered understanding of its role in decentralized finance and beyond.

Starting with the basics: Helium was conceived in 2013 amid frustrations with centralized wireless systems. Founders Amir Haleem, Shawn Fanning, and Sean Carey envisioned a peer-to-peer network where users could deploy affordable Hotspots to create global coverage. By 2019, the network launched without an ICO, relying on venture funding totaling $364.8 million across rounds, including a $200 million Series D in 2022. The migration to Solana in 2023 marked a pivotal shift, leveraging its scalability to handle high-throughput transactions at minimal costs—essential for a network processing millions of data packets daily.

Mechanically, Helium functions via two sub-networks: the IoT network using LoRaWAN for low-power devices like sensors, and the Mobile network for 5G and Wi-Fi offload. Hotspots, which can be indoor/outdoor models costing $300–$600, perform Proof-of-Coverage challenges to prove their utility, earning HNT proportionally. Network users burn HNT to mint Data Credits (non-transferable, pegged to $0.00001 USD per credit), creating a burn-and-mint equilibrium that drives deflationary tokenomics. With a max supply of 223 million HNT and halvings every two years, this model aligns incentives: as of Q2 2025, Mobile Hotspots grew 12.5% to 31,600, per Messari, while daily users hit 1.6 million, as tweeted by Haleem.

Helium’s features extend into DeFi synergies, where HNT can be staked for veHNT to participate in governance, or integrated with Solana’s liquidity pools. Unique aspects include its community grants—$50 million pledged for coverage expansion—and open-source tools like the Helium Explorer for tracking hotspots. What sets it apart? In a sea of speculative tokens, Helium generates tangible revenue: millions from data burns, with partnerships like Movistar onboarding 2 million Mexican users. Yet, irony abounds—early hype led to over 1 million hotspots, but criticisms emerged over low earnings in saturated areas, prompting some to label it a “scam” on forums like Reddit, though SEC scrutiny ended without charges.

Risks are multifaceted: price volatility (68.8% down year-over-year to $2.38), regulatory uncertainties in wireless spectrum, and security vulnerabilities, as audits by Kudelski revealed in similar devices. Governance, while democratic via HIPs, has faced whale dominance, as seen in HIP 138’s rejection. Tokenomics promote long-term holding—30% of rewards to data handlers—but competition from rivals like Polkadot’s DePIN projects or traditional 5G rollouts poses threats.

Currently, Helium thrives with a market cap of $442 million and FDV of $530 million (ratio 0.83), trading on major exchanges like Binance. Outlook? Bullish in DePIN’s rise, with forecasts suggesting doubled helium demand (the element) by 2035 aiding hardware, and crypto analysts eyeing $10+ HNT if user growth triples. In conclusion, Helium weaves complex interconnections between blockchain, finance, and infrastructure, offering a nuanced case study in crypto’s real-world potential—balanced by the need for vigilant, critical analysis.

To illustrate market trends, here’s a table summarizing HNT price history from CoinGecko data:

| Time Period | Price Change | Key Value |

|---|---|---|

| 24 Hours | -5.7% | $2.38 |

| 7 Days | -10.0% | Range: $2.38–$2.69 |

| 30 Days | -11.8% | N/A |

| 1 Year | -68.8% | N/A |

| All-Time High | N/A | $54.88 (Nov 2021) |

| All-Time Low | N/A | $0.1132 (Apr 2020) |

This data underscores volatility but also resilience in a maturing market.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Senate Democrats Reaffirm Commitment to Crypto Market Bill

- BlockDAG Nears $600M Goal as DOGE Targets $0.30 and HBAR Builds Momentum Toward $1 Breakout

- Beluga and Veera join hands to Power Next-Generation Crypto Experiences

- Coinbase Acquires Onchain Fundraising Platform Echo for $375 Million

- Web3 AI Conference: Blockchain Hub Announces «Crypto Yolka» event to Launch Community-Voted Investment Fund

Related

- Helium to Migrate to Solana in March, SOL Price Surges 10% Helium, the decentralized wireless network, has announced that it will be migrating to Solana in March. ...

- Crypto Market Update: September 3, 2024 Top Cryptocurrencies Gain Ground....

- Top Recommended Crypto Wallets of 2025 Which One is Right for You?...

- McKay Brothers Launches Fastest London-Stockholm Private Bandwidth McKay Brothers International (MBI) launched the lowest latency private bandwidth between London and Stockholm....