Top Crypto Trading Mistakes You Need to Avoid

- Emotional and Impulsive Decisions: FOMO, panic selling, and overtrading can lead to significant losses. Stick to your strategy and make rational choices.

- Lack of Research and Analysis: Thoroughly research any cryptocurrency before investing, and utilize both fundamental and technical analysis.

- Risk Management and Security Oversights: Prioritize security measures to protect your assets and employ risk management techniques like stop-loss orders. Never invest more than you can afford to lose.

- Beginner Mistakes and Additional Considerations: Understand the basics of blockchain technology, diversify your portfolio, and learn from your mistakes.

Trading in cryptocurrency can yield considerable profits, but it also involves significant risks. Navigating the crypto market successfully requires not only understanding its potential rewards, but also being aware of the numerous pitfalls that can lead to substantial losses.

Common Psychological and Strategic Errors

- FOMO (Fear of Missing Out): Avoid buying into hype and invest based on sound research. The fear of missing out often drives impulsive decisions, leading traders to buy high and sell low.

- Panicking and Overtrading: Stay calm during market swings and avoid excessive trading. Emotional reactions to market volatility can result in poor decision-making and unnecessary losses due to transaction fees.

- Emotional Investing: Don’t let fear or greed dictate your trades. Stick to your strategy and make rational decisions.

- Wishful Thinking: Avoid holding onto losing positions hoping they will rebound. Cut your losses and move on.

Research and Analysis Mistakes

- Lack of Research: Thoroughly research any cryptocurrency before investing. Understand its technology, team, and market potential.

- Ignoring Fundamental Analysis: Don’t just look at price charts. Analyze the project’s fundamentals, such as its technology, team, and adoption rate.

- Ignoring Technical Analysis: Technical analysis can provide valuable insights into market trends and potential entry/exit points.

- Not Forming Your Own Opinion: Don’t blindly follow the crowd. Do your own research and form your own investment thesis.

Risk Management and Security Mistakes

- Security and Scams: Prioritize security measures, use strong passwords and two-factor authentication, and stay vigilant against scams. The crypto space is rife with fraudulent schemes designed to steal your funds.

- Blackmail Scams: Be wary of unsolicited messages or emails threatening to expose personal information unless you pay a ransom in cryptocurrency.

- Neglecting Risk Management: Always use stop-loss orders to limit potential losses and never invest more than you can afford to lose.

- Leverage: Be extremely cautious with leverage. It can amplify gains, but it can also magnify losses.

- Ignoring Trading Costs: Factor in trading fees when calculating potential profits. High fees can eat into your returns.

- Investing More Than You Can Afford: Never invest money you need for essential expenses. Crypto investments should only be made with disposable income.

- Overtrading: Avoid excessive trading, which can lead to increased fees and impulsive decisions.

- Ignoring Security: Protect your crypto assets with strong passwords, two-factor authentication, and hardware wallets.

- Not Using a Stop Loss: A stop-loss order automatically sells your crypto if it reaches a certain price, limiting your losses.

Beginner Mistakes and Additional Considerations

- Lack of Crypto Knowledge: Take the time to understand the basics of blockchain technology and how cryptocurrencies work.

- Neglecting Market Context: Be aware of broader market trends and news that could impact crypto prices.

- Beginner Mistakes When Trading Crypto: Start with small amounts, learn from your mistakes, and don’t be afraid to seek guidance from experienced traders.

- Coins: Diversify your portfolio to spread risk. Don’t put all your eggs in one basket.

Final Thoughts

Importance of the Issue

Understanding and avoiding these common mistakes is crucial for any crypto trader. By maintaining a disciplined approach, focusing on security, and resisting emotional impulses, traders can improve their chances of success in the highly volatile crypto market.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Metals Rally to Records as Crypto ETFs See Strong Inflows Amid U.S.-Europe Trade Tensions Over Greenland

- NYSE Develops Blockchain Platform for 24/7 Tokenized Securities Trading

- Crypto Weekly Snapshot – Tariff Fears Hammer Crypto as Inflows Provide Relief

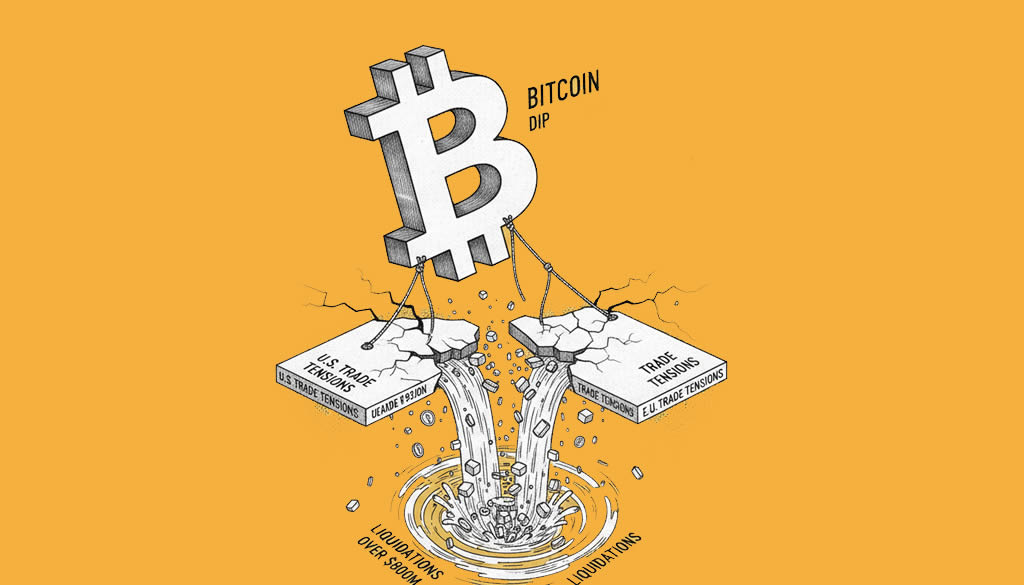

- Bitcoin Dips Below $93,000 Amid U.S.-EU Trade Tensions

- Ethereum Daily Transactions Surge to All-Time High as Gas Fees Fall to Record Lows

Related

- What are crypto liquidations? Liquidation is the process of turning an asset into cash....

- How to avoid the risks of cryptocurrency yield farms Crypto Yield Farms can be a great way to earn passive income, but they are not without their risks....

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Investing in Crypto in 2021: Where to Start With thousands of crypto options to choose from in 2021, where do you even start?...