Major Crypto Hacks in 2023

- The popularity of cryptocurrencies has led to an increase in hacking incidents.

- Major crypto hacks in 2023 have resulted in significant losses.

- Common vulnerabilities in crypto systems are often exploited by hackers.

- Preventive measures can help protect crypto assets from hacks.

- Regulatory efforts and industry responses are crucial in addressing these issues.

The growing popularity of cryptocurrencies has brought with it an increasing number of hacking incidents. As more people invest in these digital assets, the risks associated with them have become more apparent. One of the most significant risks is the potential for hacking, which can result in substantial financial losses. In 2023, several major crypto hacks occurred, highlighting the importance of understanding and mitigating these risks.

Common Vulnerabilities Exploited

Hackers often exploit common vulnerabilities in crypto systems. These include insecure wallet management, smart contract vulnerabilities, and phishing attacks.

Top 10 hacks in 2023:

| Rank | Hacked Project | Stolen Amount | Recovered Amount |

| 1 | Mixin | $200 Million | Unknown |

| 2 | Euler Finance | $197 Million | $197 Million |

| 3 | Viper/Curve | $73.6 Million | $52.3 Million |

| 4 | Coinex | $70 Million | Unknown |

| 5 | Atomic Wallet | $65 Million | Unknown |

| 6 | Stake | $41 Million | Unknown |

| 7 | Coinspaid | $37.7 Million | Unknown |

| 8 | Polynetwork | $26 Million | Unknown |

| 9 | Low-Carb-Crusader | $25 Million | Unknown |

| 10 | Phising Attack | $24 Million | Unknown |

Preventive Measures

Protecting crypto assets from hacks involves several preventive measures. These include using hardware wallets for storing cryptocurrencies, enabling two-factor authentication for added security, and conducting thorough research before investing in any crypto assets.

Regulatory Efforts and Industry Response

Regulatory bodies worldwide have been working to address the risks associated with cryptocurrencies. These efforts include introducing Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements for crypto exchanges. Despite these efforts, achieving global coordination on crypto regulation remains a challenge.

Understanding the risks associated with cryptocurrencies and the measures to mitigate these risks is crucial for anyone involved in the crypto industry. As the industry continues to evolve, so too will the strategies employed by hackers. Therefore, staying informed and taking the necessary precautions is key to protecting your investments.

Source: https://twitter.com/PeckShieldAlert/status/1706256486991863833

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitwise Files for 11 Altcoin Strategy ETFs with SEC, Targeting AI and DeFi Tokens

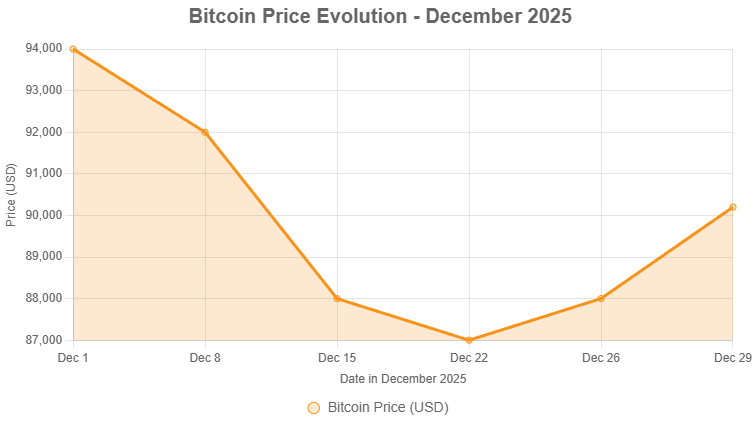

- Bitcoin and Ether Plunge Over 22% in Q4 2025 Amid Failed Santa Rally

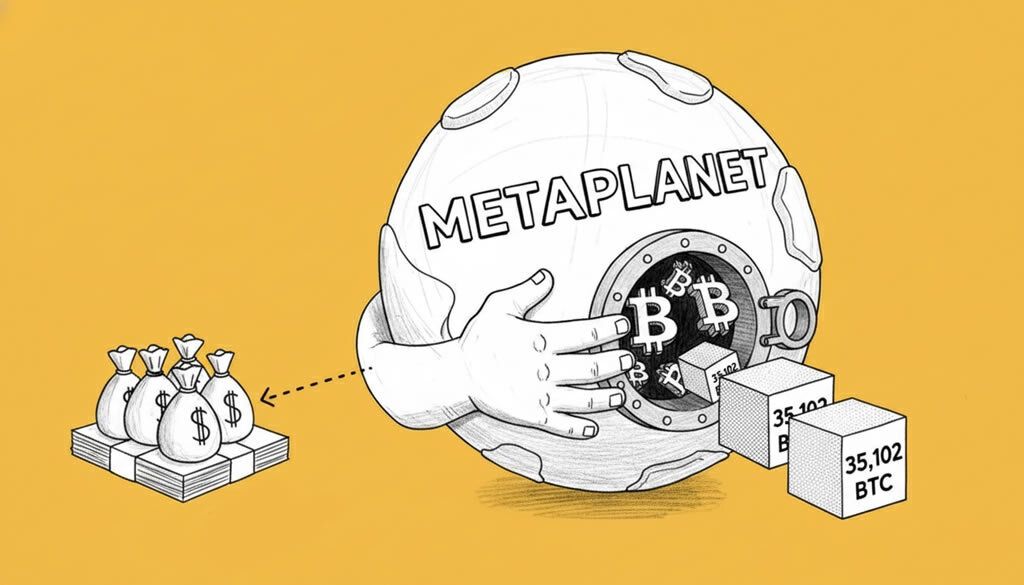

- Metaplanet Boosts Bitcoin Holdings with $451M Q4 Purchase

- Crypto Weekly Snapshot – End-of-Year Consolidation

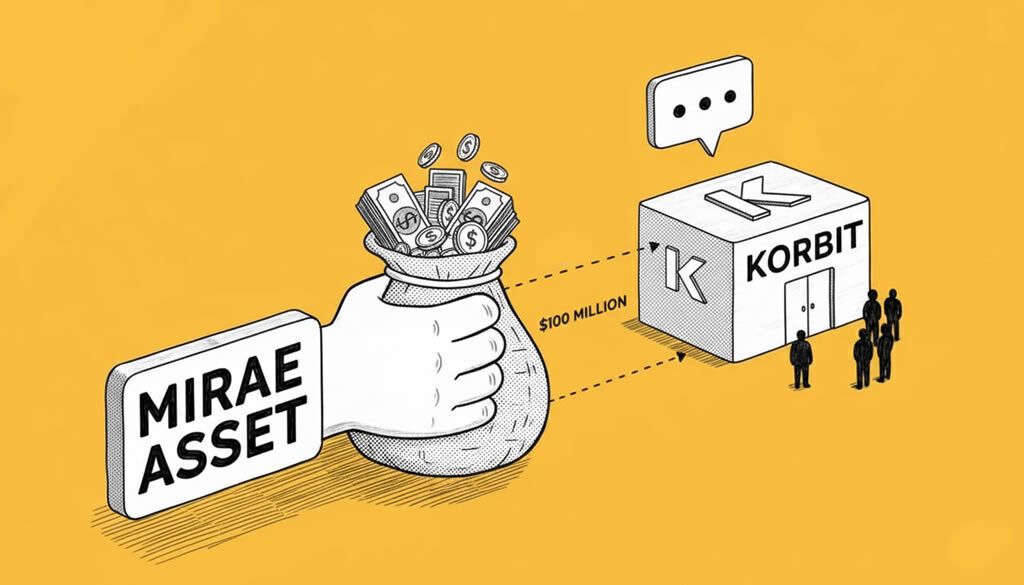

- Mirae Asset in Talks to Acquire South Korean Crypto Exchange Korbit for Up to $100 Million

Related

- The biggest hack in DeFi history This week, hackers stole about $600 million worth of cryptocurrency from a Decentralized Finances (DeFi) network that specialized in enabling users to move digital assets linked to one blockchain to another. PolyNetwork, a multi-chain interoperability technology, is at the heart...

- What is staking and why it is critical to the crypto economy? What is staking and why it is critical to the crypto economy?...

- Hacking “Hacking” is the act of a hostile third-party cyber-criminal breaking into a computer system or network without authorization. Hacking may be done to steal sensitive data, make money, or for other reasons. Hacking may also be used to deter thieves...

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....