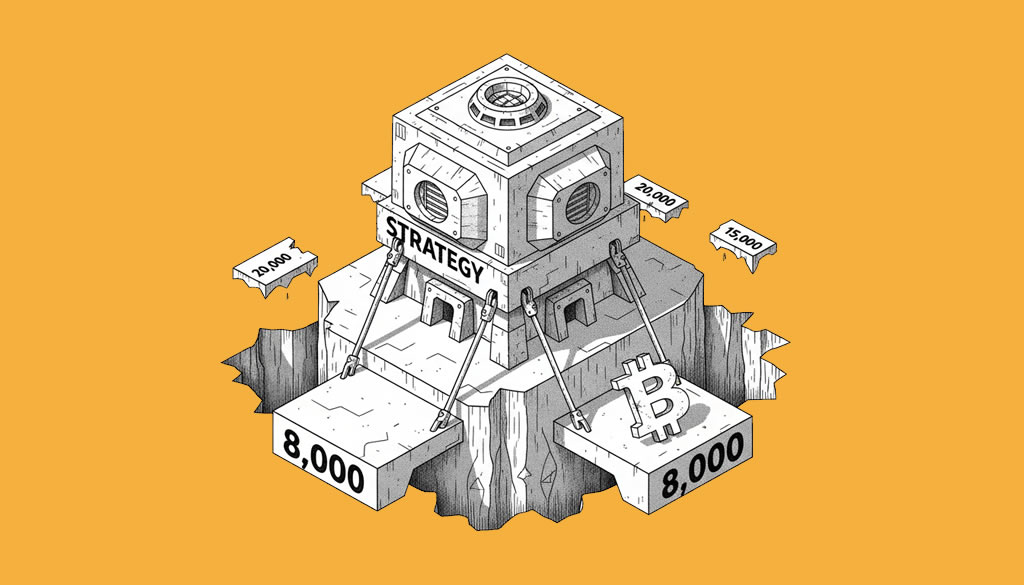

Strategy claims it can withstand Bitcoin prices as low as $8,000

Strategy (formerly MicroStrategy) has reaffirmed the resilience of its Bitcoin-centric balance sheet, stating it can fully cover its approximately $6 billion in net debt even if Bitcoin’s price drops to $8,000—an roughly 88% decline from recent levels around $68,000–$69,000.

The company, led by Michael Saylor, holds 714,644 BTC, currently valued at around $49 billion. At a hypothetical $8,000 per BTC, these holdings would be worth roughly $5.7–$6 billion, sufficient to match or exceed net debt obligations without forced liquidation. This calculation stems from Strategy’s convertible debt structure, which features low interest rates, no margin-call triggers tied to BTC price, and staggered maturities extending to 2032, providing significant runway during prolonged downturns.

Strategy can withstand a drawdown in $BTC price to $8K and still have sufficient assets to fully cover our debt. pic.twitter.com/vrw4z4Ex9q

— Strategy (@Strategy) February 15, 2026

In a recent X post, Strategy emphasized: “Strategy can withstand a drawdown in $BTC price to $8K and still have sufficient assets to fully cover our debt.” The firm plans to “equitize” much of its $6 billion convertible debt over the next 3–6 years by converting it into equity, reducing leverage, eliminating interest burdens, and enhancing long-term flexibility while preserving its Bitcoin acquisition strategy. This approach avoids issuing new senior debt and relies on the company’s cash reserves and equity issuance capabilities.

Analysts note the structure mitigates immediate risks, as no major maturities loom until 2028, and the company has cash to service obligations for years without selling BTC. However, below $8,000, coverage falls below 1x, potentially necessitating restructuring, additional equity raises, or refinancing—though management insists it would pursue these options before any BTC sales. Some observers question the scenario’s realism given Bitcoin’s historical volatility, but the declaration underscores Strategy’s commitment to holding through extreme drawdowns.

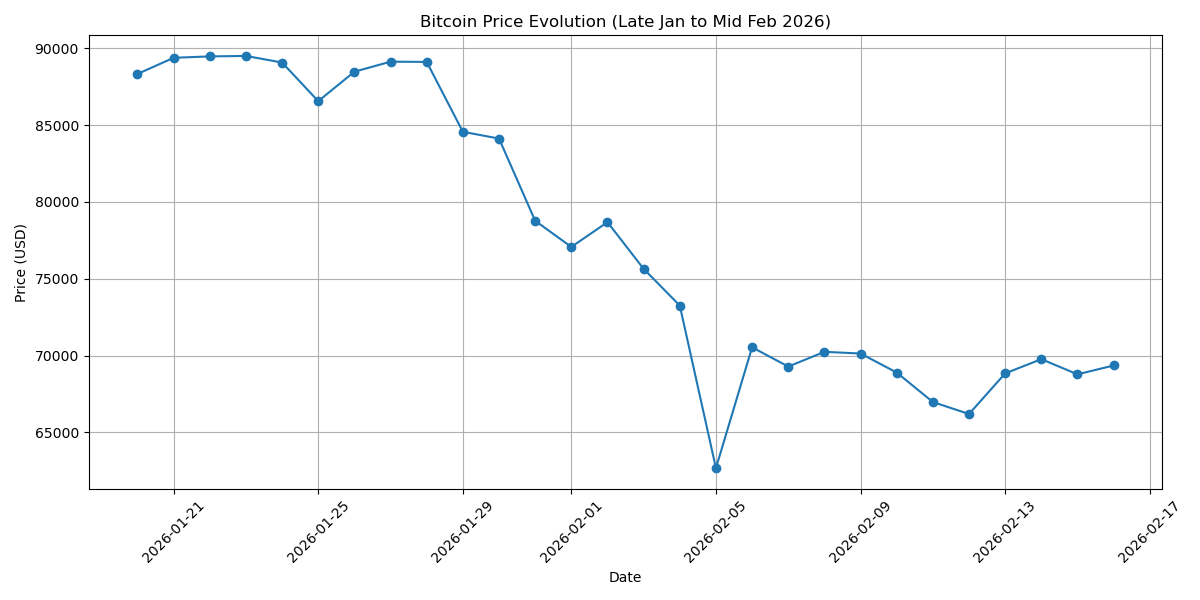

The announcement arrives amid broader market caution, with Bitcoin recently dipping amid outflows and volatility, yet Strategy positions its model as a long-term bet on BTC appreciation, with no intention to liquidate holdings. Michael Saylor has previously described the capital structure as designed to endure multi-year 90% declines.

From https://cryptopress.site/coins/: Bitcoin (BTC) serves as the core reserve asset in corporate treasuries like Strategy’s, while Ethereum (ETH) offers smart contract functionality for diversified exposure.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

Lo Último

- What’s Next for Solana Post-Firedancer

- Michael Saylor’s Unwavering Bet on Bitcoin: Strategy Pushes Forward Despite Market Dips

- Steak ’n Shake Says Bitcoin Has Driven Dramatic Sales Growth in Nine Months

- Crypto Weekly Snapshot – Prolonged Winter or Imminent Bottom?

- Strategy claims it can withstand Bitcoin prices as low as $8,000

Related

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- What is $STRF? What is this investment opportunity and how it works?...

- Interview with Zayn Kaylan: Luxxfolio’s “Digital Silver” Strategy with Litecoin LUXXFOLIO’S LTC GAMBLE: DIGITAL SILVER, $73M RISKS, AND THE REBELLION AGAINST ‘THE EMPIRE’....

- Bitcoin Treasury Trend Gains Momentum Over 135 public companies now hold Bitcoin (BTC) as a treasury reserve, led by Strategy’s aggressive acquisition strategy....