Crypto Weekly Recap: Uptober ATH Blitz

Bitcoin’s Record Rally in Turbulent Times

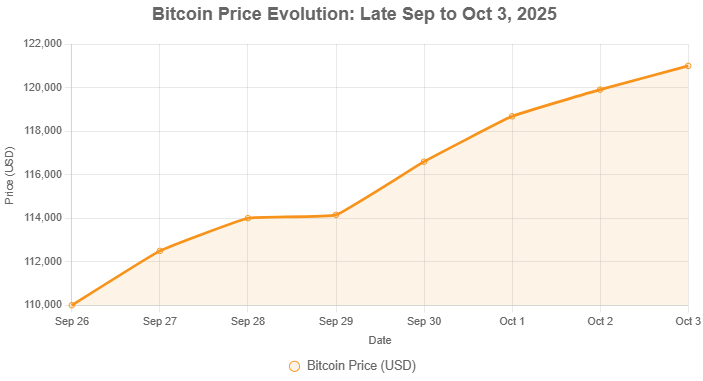

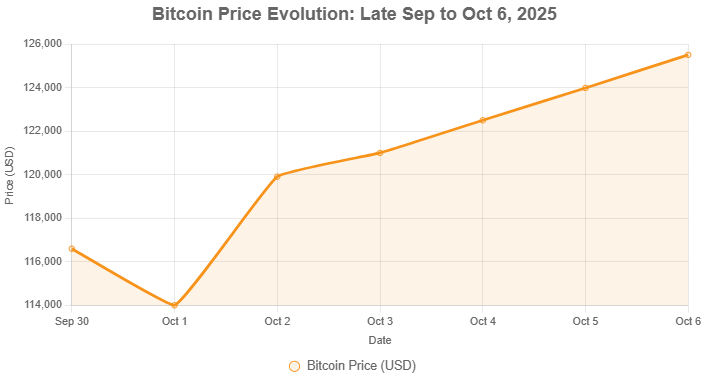

The crypto market cap neared $4.2 trillion by October 6, with Bitcoin (BTC) spearheading a risk-on rebound despite U.S. government shutdown extensions delaying key economic data. BTC climbed 2.5% over the weekend to a fresh all-time high of $125,506, extending its October gains to 10% from $114,000 starts, as Q4 seasonality—averaging 22% BTC returns historically—intersects with Fed rate cut bets at 99%. Institutional conviction shone through ETF inflows totaling +7,553 BTC ($743M) for the week, led by BlackRock’s +6,447 BTC haul, while the Fear & Greed Index hit 62, flirting with extreme greed. Yet, with dense resistance at $126,000, analysts eye potential pullbacks to $120,000 if equity correlations reemerge, especially sans Friday’s jobs report.

Bitcoin’s $125K ATH Signals Safe-Haven Maturation

Bitcoin’s breach above $125,000 on October 6 underscores its pivot from speculative asset to global safe haven, mirroring gold’s parallel climb to $4,000 amid U.S. political gridlock and China’s stimulus whispers. The rally, up 1.5% intraday per CoinDesk 20, decoupled from muted equities as shutdown-induced data voids amplified BTC’s 24/7 appeal—whale selling from September’s $54K Germany dump aftermath eased, freeing $3.6B in latent profits for reinvestment. As Fortune highlighted, this “Uptober” surge aligns with easing SEC ETF rules, potentially catalyzing $1T+ market cap by year-end, with Tim Draper’s $250K call gaining traction on sovereign nods like Sweden’s reserve probes. BlackRock’s ETF dominance, now holding 783K BTC ($97.9B), reflects TradFi’s bet on BTC as “digital gold 2.0,” but volatility looms: a sub-$122K close risks $800M liquidations, per Bitunix.

This milestone isn’t mere hype—it’s validation amid abundance forecasts from influencers like Kaleo, where BTC’s ascent drags alts like ETH (6% from ATHs) and SOL (pumping on Mert’s “asymmetrical” vision). For traders, the ascending triangle breakout signals $150K targets if inflows persist, but scale entries near $123K dips; prolonged shutdown could turbocharge adoption, turning fiscal paralysis into crypto’s ultimate bull catalyst.

Other News:

Positive 📈

- Grayscale pioneers U.S. staking for ETH and SOL trusts, boosting yields and institutional appeal.

- BNB surges past $1,200 ATH on treasury buys and network growth, targeting $2,000 upside.

- China group secures $11M fund for crypto ventures, hinting at regulatory softening.

Neutral ⚖️

- SEC explores tokenized stocks on exchanges, balancing innovation with compliance frameworks.

- Thailand advances multi-token ETFs for 2026 launch, expanding beyond BTC/ETH.

- September crypto hires tally 46, signaling talent influx amid Q4 prep.

Negative 📉

- Germany laments $3.6B missed BTC gains from $54K sales, spotlighting policy missteps.

- September whale dumps muted BTC action, though pressure now wanes.

- Solana lags in stables/perps development, per dev critiques, risking competitive edge.

Top Movers and Opportunities

Week’s top movers: Bitcoin (BTC) +10% to $125K on ATH momentum; Ethereum (ETH) +7% to $4,650 amid whale buys and ETF flows; Solana (SOL) +8% to $235; BNB (BNB) +12% to $1,237 post-ATH; Pyth Network +15% on oracle integrations.

Prime buys: SOL under $290 offers high-upside entry for its “internet capital market” potential, with 2-3x room if perps catch up—scale in on dips. ETH at $4,400 undervalues ETF staking yields; whales’ frenzy signals 10% pop to ATHs. Avoid overexposure amid greed spikes.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Crypto Weekly Recap: Uptober ATH Blitz

- Bitcoin Hits New All-Time High Above $125,000 Amid Institutional Inflows and Market Uncertainty

- Unlock Sky-High Yields: Noon Capital’s 8.74% APY Stablecoin Secret

- US Government Shutdown Freezes Crypto ETF Approvals: Solana, Litecoin in Limbo

- Meme Economy: Inside MemeCore’s Viral Revolution