Weekly Crypto Roundup – Turbulence, Tariffs, Liquidations, and the Road to Recovery

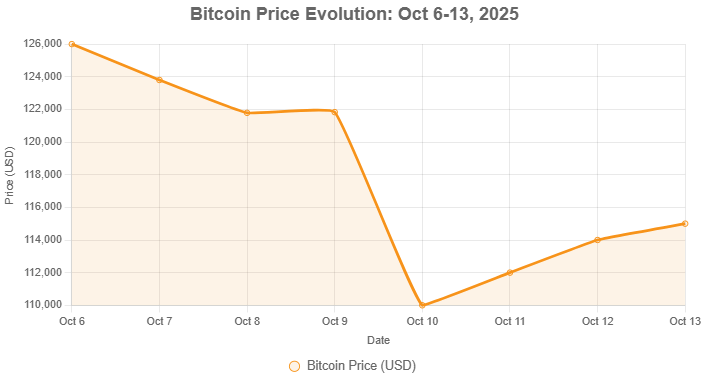

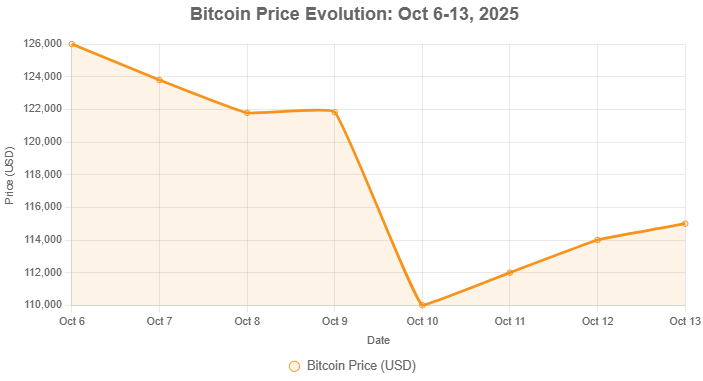

The cryptocurrency market kicked off October 2025 on a euphoric high, with Bitcoin shattering records above $126,000, fueled by the “debasement trade” as investors fled fiat amid ballooning global debts and political instability. Gold mirrored the surge past $4,000, underscoring a broader shift toward hard assets. Yet, this bull run abruptly halted on October 10 when President Trump’s announcement of 100% tariffs on China ignited panic selling, transforming a routine Friday into crypto’s “Black Friday.” The event, detailed in a Forbes analysis, exposed deep-seated vulnerabilities: overleveraged longs, thin liquidity on weekends, and flawed exchange pricing oracles that amplified a minor macro shock into a cascade failure.

Main News: The Historic $19B Liquidation Cascade

What began as a geopolitical tweetstorm quickly escalated into the most devastating liquidation event in crypto’s 16-year history, liquidating $19.13 billion in positions—surpassing the $1.6 billion FTX collapse and the $1.2 billion COVID crash combined, per Coinglass data. Bitcoin plummeted 10% in a single day, etching a unprecedented $20,000 red candle and dipping below $110,000 for the first time since September. Ethereum (ETH) fared worse, crashing 15-30% alongside Solana (SOL) and XRP, as $16.7 billion in long positions evaporated versus just $2.5 billion in shorts—a 6.7:1 imbalance that revealed dangerously one-sided market positioning. A whale’s timely $192 million short on Binance, coinciding with Trump’s 4:30 p.m. announcement, exacerbated the frenzy; within 90 minutes, 1.6 million traders were margin-called, erasing nearly $800 billion in total market cap.

This wasn’t mere tariff fallout—though U.S.-China trade fears, with Polymarket odds at 10% for November implementation, provided the spark. Deeper issues like Binance’s delayed reporting and oracle inaccuracies turned a 7.58% spot volume spike into a self-reinforcing doom loop, as noted in a CoinDesk report. For Ethereum, the crash marked one of its deepest funding rate drops ever, while altcoins like those in AI and DeFi sectors saw double-digit hemorrhaging. Yet, this purge could prove cathartic: it reset extreme leverage (open interest hit $187 billion pre-crash) and flushed weak hands, setting the stage for a V-shaped recovery. By October 13, as Trump softened his rhetoric—”I don’t want to hurt China, I want to help”—markets clawed back, with Bitcoin reclaiming $115,000 and total cap rebounding to $4 trillion. Analysts now eye $130,000 as the next target if ETF inflows resume, but lingering trade jitters and weekend liquidity gaps warn of more volatility ahead. In essence, October 10 wasn’t a death knell but a brutal reminder: in crypto, macro lightning strikes hardest on overextended soil.

Other News:

Positive 📈

- Bitcoin mining firm MARA Holdings scooped up 400 more BTC for $46M, signaling unwavering institutional conviction amid the dip.

- Morgan Stanley’s GIC greenlit crypto allocations in $2T portfolios, accelerating mainstream adoption.

- Dogecoin ETF odds soared to 80% post a crypto-friendly law signing, injecting fresh hype into memes.

- Layer-2 rebound led by Mantle (MNT) at +38%, with Celestia (TIA) and Zora (ZORA) up 15-25% on renewed DeFi optimism.

Neutral ⚖️

- U.S. ETH ETFs logged $175M outflows on October 10, a brief pullback after $15B cumulative inflows earlier in the month.

- Pump.fun meme platform rallied 37%, underscoring DeFi’s Q4 momentum without broader altcoin lift.

- Starknet rolled out BTC staking with STRK rewards, adding utility but not yet moving prices significantly.

- Kazakhstan debuted Central Asia’s first crypto fund, a regulatory nod amid global ETF wave buildup.

Negative 📉

- Ethereum ETFs bled $80M from BlackRock alone on October 10, highlighting post-ATH profit-taking.

- Filecoin (FIL) shed 7% under intensified selling pressure, lagging the broader recovery.

- Hedera (HBAR) dropped 6% despite volume spikes, caught in altcoin “evisceration” per hedge fund CIOs.

- Chainlink (LINK) fell 4% on persistent selling, as oracle reliance came under scrutiny post-crash.

Top Movers and Opportunities

Lately, the market’s biggest movers reflect the week’s whiplash: post-liquidation rebounds favored Layer-2 and DeFi plays. Top gainers include Mantle (MNT) +38%, Zora (ZORA) +25%, and Celestia (TIA) +15%, driven by sector rotation into scalable infrastructure. On the downside, alts like Filecoin (FIL) -7% and Chainlink (LINK) -4% lagged, victims of broad purge. Bitcoin stabilized at ~$115K, up 4.85% daily but still nursing a 9% weekly bruise.

Buying opportunities abound in the reset: oversold Layer-2 tokens like MNT offer entry below pre-crash levels, with potential 20-30% upside on DeFi revival. For risk-averse plays, Bitcoin itself screams value after flushing $12B in shorts above $125K—analysts forecast $130K by mid-month if tariffs fizzle. Avoid overleveraged memes for now; focus on fundamentals like MARA’s accumulation signaling miner resilience.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Dips to 15-Week Low as Regional Bank Woes Trigger $1.2B in Crypto Liquidations

- Understanding Cryptocurrency Market Crashes: Insights from the 2025 Decline

- Senate Crypto Framework Bill Stalls Amid Democrats’ Counterproposal on DeFi Regulations

- Bitcoin and Ethereum ETFs Record $755M Outflows Amid Escalating US-China Trade Tensions

- Weekly Crypto Roundup – Turbulence, Tariffs, Liquidations, and the Road to Recovery