Crypto Weekly Snapshot – Volatility, Outflows, and Hopes for 2026 Recovery

2025’s Treacherous Close and Bitcoin’s Year-End Slump

The crypto market is ending 2025 in a challenging phase, characterized by persistent weakness and investor caution as Bitcoin struggles below $90,000 and the broader sector erases significant gains from earlier highs.

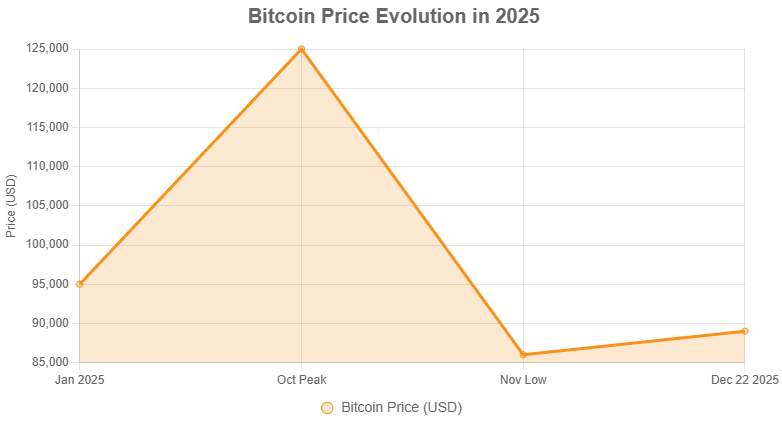

As 2025 draws to a close, cryptocurrency investors are facing a stark reality: the anticipated bull run fizzled, leaving Bitcoin down approximately 10% year-to-date and wiping out around $1 trillion from the total market capitalization. After peaking above $125,000 in October, Bitcoin has consolidated in the $86,000-$90,000 range, repeatedly failing to break resistance amid low holiday liquidity, ETF outflows, and extreme fear in sentiment indicators. This downturn reflects a combination of profit-taking, reduced institutional momentum, and macroeconomic uncertainties, contrasting sharply with the optimistic start to the year fueled by pro-crypto policies and ETF approvals.

Despite regulatory wins in 2025—including new product launches and a more favorable U.S. administration—the lack of comprehensive market structure legislation has left structural issues unresolved, contributing to sustained bearish pressure. Analysts note weak demand persisting into year-end, with altcoins suffering steeper losses, though long-term forecasts remain bullish, citing potential ETF revivals and monetary easing as catalysts for recovery in 2026.

Other news:

Positive 📈

- DeFi expansion and sector rotation into RWAs, NFTs, and gaming tokens, with platforms showing increased trading share.

- Long-term Bitcoin price targets from institutions like Citi ($143,000 in a year) and Galaxy ($250,000 by 2027).

- Web3 gaming tokens leading December gains on AI integration and utility focus.

Neutral ⚖️

- Bipartisan proposals for stablecoin and staking tax safe harbors.

- Increased portfolio diversification among investors to mitigate volatility.

- Upcoming token unlocks worth over $268 million, including Jupiter (JUP).

Negative 📉

- U.S. spot Bitcoin ETF net outflows and declining inflows.

- Broader market bearish bias with all major cryptos heading for negative 2025 close.

- North Korean hackers stealing record $2 billion in crypto this year.

What coins are moving the most lately?

Lately, amid the broader market slump, Web3 gaming and AI-related tokens have been the top movers, defying the bearish trend with significant gains driven by sector rotation and utility narratives. Standout performers include Audiera (BEAT), which surged over 50% in recent days on AI-powered platform momentum, and other gaming tokens like Midnight showing strong double-digit increases.

While these present speculative opportunities in niche sectors, the overall risk-off environment and lack of broad recovery signal limited buying conviction—no clear broad-market buying opportunities emerge at present, as institutional caution dominates.

For illustration, here is Bitcoin’s price evolution, reflecting the year’s volatility and current consolidation:

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Crypto Weekly Snapshot – Volatility, Outflows, and Hopes for 2026 Recovery

- Tether Executives Acquire Northern Data’s Bitcoin Mining Arm in $200M Deal

- $23.6 Billion Bitcoin Options Set to Expire Next Friday Amid Year-End Volatility

- US Senator Cynthia Lummis, Leading Crypto Advocate, Announces Retirement

- Fresh wins: How Periodic Press Releases Help Your Crypto Project Dominate AI Answers