Crypto Weekly Snapshot – The Crypto Rebound

The crypto market this week was marked by sharp volatility, with a major sell-off erasing significant value before a partial recovery. Bitcoin dominance held at 57%, while Ethereum stayed at 10.1%, and ecosystems like Polkadot and XRP showed relative strength.

The week’s dominant story was the crypto market crash, fueled by ETF outflows, macroeconomic pressures, and a broader risk-off sentiment. Bitcoin plummeted below $70,000, triggering over $1 billion in liquidations and pushing the fear and greed index to extreme fear levels at 15. This downturn, linked to tighter U.S. monetary policy expectations and sell-offs in precious metals, wiped out nearly $410 billion from the market cap in days, raising fears of a new crypto winter. Even permabulls expressed uncertainty over the triggers, with some pointing to global uncertainty and reduced institutional enthusiasm post-ETF hype.

Despite the chaos, signs of bottoming emerged as Bitcoin rebounded 11.1% over seven days to $69,037, suggesting opportunistic buying amid oversold conditions. However, sustained recovery depends on stabilizing macro factors, as ongoing volatility could deter retail investors and amplify regulatory scrutiny.

Other news:

Positive 📈

- XRP received bullish forecasts, potentially hitting $12.50 by 2028 per Standard Chartered.

- Polkadot and XRP Ledger ecosystems led industry gains.

Neutral ⚖️

- Industry leaders discussed crypto’s identity crisis, with figures like Evgeny Gaevoy criticizing a shift to “number-go-up” focus.

- Coinbase’s solo Super Bowl ad emphasized economic freedom through a sing-along format.

- U.S. Senate passed a crypto market structure bill in markup vote.

Negative 📉

- Bithumb’s $40 billion phantom Bitcoin error sparked scrutiny over exchange controls.

- Bitfarms exited Bitcoin mining for AI and Ethereum amid tightening miner margins.

- Xinbi highlighted as a major illicit crypto hub despite crackdowns.

- Sons of Trump officials’ crypto ventures yielded mixed investor results.

Among top coins, Solana led movers with an 18.4% 7-day gain, followed by BNB at 17.8% and XRP at 13.3%, reflecting rebound strength in altcoins. Bitcoin and Ethereum also rose 11.1% and 10.9% respectively over the week, while stablecoins like Tether and USDC remained flat. Given the recent dip to $65,000, Bitcoin presents a potential buying opportunity for long-term holders betting on recovery above $70,000, amid oversold indicators. No standout altcoin buy signals beyond the rebound, but Solana’s momentum could offer entry if it holds above $80.

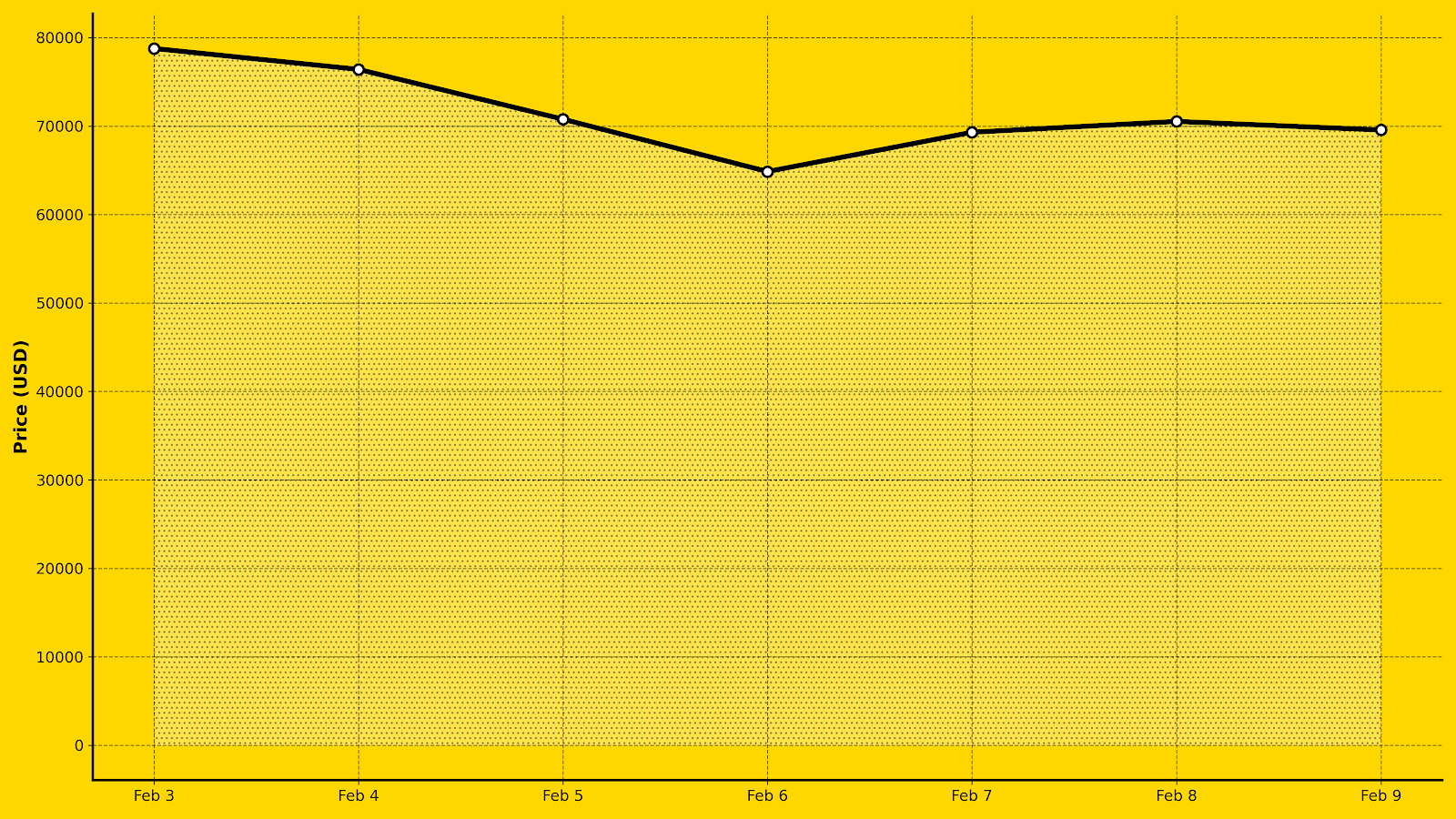

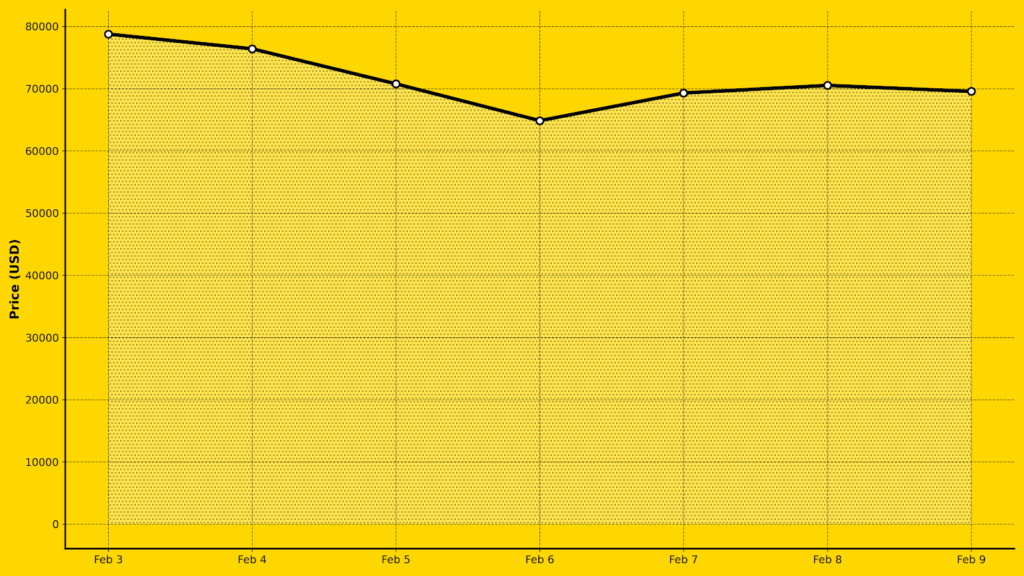

Bitcoin Price Evolution (Last 7 Days)

| Date | Price (USD) |

| Feb 3, 2026 | $78,766.83 |

| Feb 4, 2026 | $76,405.83 |

| Feb 5, 2026 | $70,770.99 |

| Feb 6, 2026 | $64,856.11 |

| Feb 7, 2026 | $69,296.96 |

| Feb 8, 2026 | $70,520.40 |

| Feb 9, 2026 | $69,557.32 |

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bernstein Reaffirms $150,000 Bitcoin Target, Calling Current Dip ‘Weakest Bear Case’ in History

- Crypto Weekly Snapshot – The Crypto Rebound

- Bitcoin Mining Difficulty Drops 11% in Largest Negative Adjustment Since China’s 2021 Ban

- Bithumb Recovers Majority of $43 Billion in Bitcoin After Promotional Distribution Error

- Bitcoin Recovers to $70,000 As Altcoins Rally