Crypto Weekly Snapshot – End-of-Year Consolidation

The crypto market closed 2025 in a phase of consolidation, with prices largely range-bound despite significant structural progress throughout the year. As of December 29, the total market capitalization stood near $3 trillion, reflecting thin holiday liquidity and mixed macro signals.

Bitcoin Tops $90,000 in Late Surge

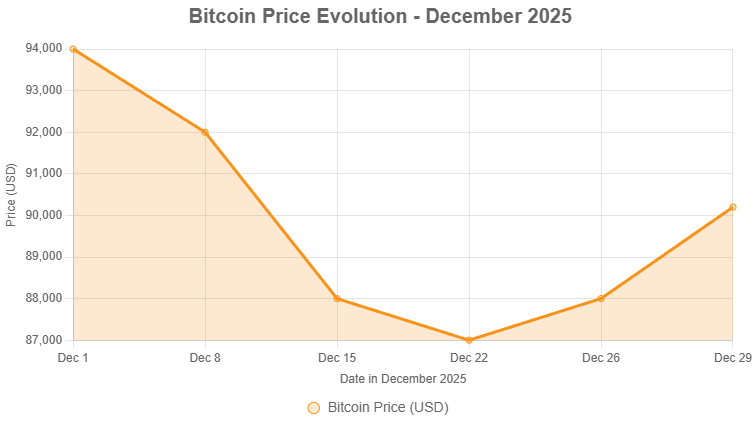

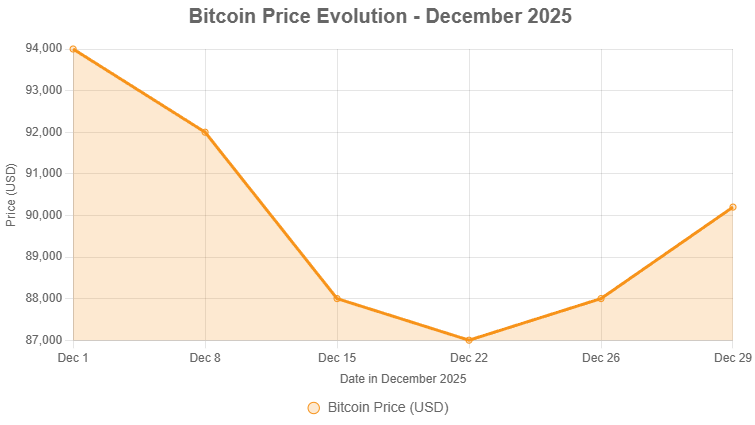

Bitcoin climbed above $90,000 on December 29, rising over 2% in a single session as geopolitical tensions—specifically diminished hopes for a Russia-Ukraine peace deal—boosted risk-off assets and correlated moves in oil and crypto. This breakout from the $85,000–$90,000 range that dominated December came amid short liquidations and renewed dip-buying. The move signaled potential for a year-end rebound, especially after BTC traded as low as $87,000 earlier in the week due to tax-loss harvesting and deleveraging. Analysts note this resilience supports a bullish outlook into 2026, with reduced derivatives leverage creating healthier market conditions following late-2025 liquidations.

Broader altcoins joined the rally, with Ether, XRP, and Solana posting 3%+ gains, highlighting rotation into higher-beta assets in low-volume trading. This late momentum contrasts with 2025’s theme of stagnant price action despite institutional milestones and TVL growth.

Other news:

Positive 📈

- Altcoins like XRP, Solana, and Dogecoin outperformed BTC in weekend trading, showing selective strength.

- Metaplanet secured approval for massive BTC accumulation plan targeting 210,000 coins by 2027.

- Reduced enforcement and new U.S. crypto legislation marked regulatory wins for the industry.

- Coinbase highlights perpetual futures and stablecoins as growth drivers for 2026.

Neutral ⚖️

- Market remained range-bound most of December with low volatility and holiday liquidity.

- Year-end reviews note divergence: strong network usage but flat/negative returns for many L1 tokens.

- Precious metals rallied to records, shifting some macro focus from crypto.

Negative 📉

- BTC dipped below $87,000 mid-week amid broader risk-off moves.

- Many large-cap tokens ended 2025 flat or down despite institutional adoption.

- Leverage sharply reduced after late-year liquidation events.

What coins are moving the most lately?

In the final week of 2025, major movers included Solana (SOL), XRP, and Dogecoin (DOGE), which outperformed Bitcoin with 3%+ gains amid the late rally. Privacy-focused coins showed revival earlier in the month, but recent action centered on established altcoins in thin trading. Overall, the crypto market saw limited explosive moves due to holiday consolidation. No clear standout buying opportunities emerged in the closing days, as prices reflected year-end tax-loss selling and deleveraging. Instead, Bitcoin’s evolution illustrates the week’s key dynamic: a rebound from mid-week lows to above $90,000, offering stability but no aggressive dips for entry.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitwise Files for 11 Altcoin Strategy ETFs with SEC, Targeting AI and DeFi Tokens

- Bitcoin and Ether Plunge Over 22% in Q4 2025 Amid Failed Santa Rally

- Metaplanet Boosts Bitcoin Holdings with $451M Q4 Purchase

- Crypto Weekly Snapshot – End-of-Year Consolidation

- Mirae Asset in Talks to Acquire South Korean Crypto Exchange Korbit for Up to $100 Million