The Crypto Market – Archive

Crypto Weekly Roundup – Navigating Tariffs, Liquidations, and Rebound Signals

The cryptocurrency market entered a brutal reset this week, capping a volatile October with a flash crash that exposed deep leverage vulnerabilities while underscoring resilient institutional demand. Bitcoin’s plunge from a record $126,223 on Oct 6 to below $110,000 by Oct 12 marked the sector’s sharpest correction since early 2024, driven by macroeconomic tremors rather than internal crypto catalysts. Yet, as prices clawed back toward $115,000…

Weekly Crypto Roundup – Turbulence, Tariffs, Liquidations, and the Road to Recovery

The cryptocurrency market kicked off October 2025 on a euphoric high, with Bitcoin shattering records above $126,000, fueled by the “debasement trade” as investors fled fiat amid ballooning global debts and political instability. Gold mirrored the surge past $4,000, underscoring a broader shift toward hard assets. Yet, this bull run abruptly halted on October 10 when President Trump’s announcement of 100% tariffs on China ignited panic selling…

Crypto Weekly Recap: Uptober ATH Blitz

Bitcoin’s Record Rally in Turbulent Times The crypto market cap neared $4.2 trillion by October 6, with Bitcoin (BTC) spearheading a risk-on rebound despite U.S. government shutdown extensions delaying key economic data. BTC climbed 2.5% over the weekend to a fresh all-time high of $125,506, extending its October gains to 10% from $114,000 starts, as Q4 seasonality—averaging 22% BTC returns historically—intersects with Fed rate cut bets at 9…

Fed Rate Resumption Drives Crypto Recovery

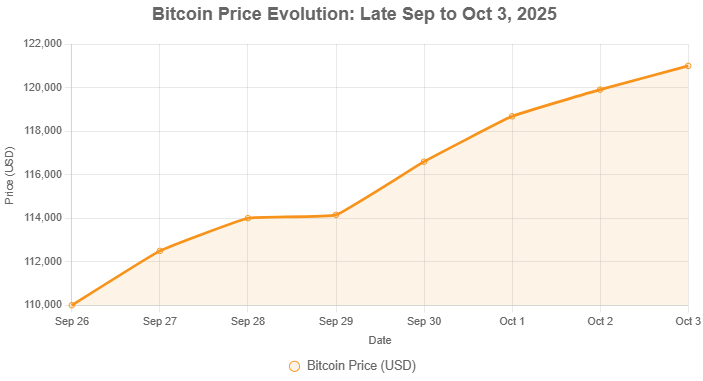

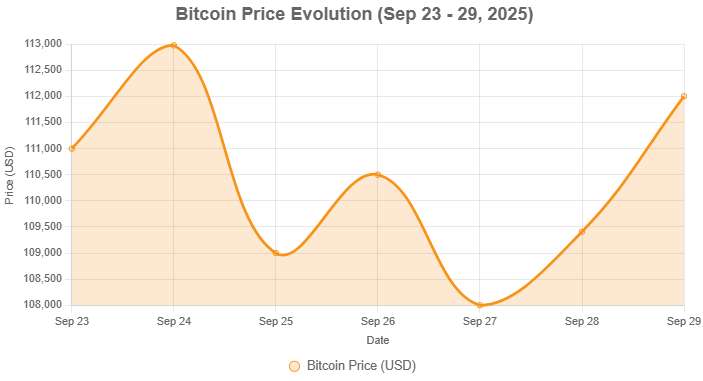

Fed Rate Cut Resumption Boosts Market The U.S. Federal Reserve resumed its rate-cut cycle on September 29, 2025, implementing another reduction to bolster a softening labor market, which has positively influenced risk assets including cryptocurrencies. This move led to a 2.3% increase in total crypto market capitalization to $3.95 trillion, with 24-hour trading volume at $134.7 billion, reflecting heightened activity. Bitcoin climbed to $112…

| Bitcoin, Crypto market, SEC

Stablecoins and Institutional Adoption Drive Crypto Optimism

Nasdaq and SEC Push for On-Chain Finance The announcement that Nasdaq plans to tokenize stocks, coupled with the SEC’s push to bring all financial systems on-chain, marks a pivotal moment for the crypto market. These developments signal a shift toward mainstream blockchain adoption, bridging traditional finance with decentralized systems. Nasdaq’s move to put stocks on-chain could enhance liquidity, transparency, and accessibility, potential…

Latest Content

- Bitcoin Dips Below $110K as Powell Tempers Expectations for December Rate Cut

- Bitwise Solana ETF Surges to $72 Million Volume on Second Trading Day

- Mt. Gox Extends Creditor Repayment Deadline By One Year

- Tokenization of Real Estate: Breakthroughs and Barriers in 2025 Pilots

- US Lawmaker Proposes Crypto Trading Ban for Elected Officials Amid Backlash Over CZ Pardon