XRP Rockets 11% to $2.40 as ETF Inflows Hit Record Highs and RLUSD Gains Regulatory Edge

- XRP surged 11% to nearly $2.40, outperforming major tokens amid institutional buying.

- Spot XRP ETFs recorded $48 million in daily inflows, pushing cumulative totals past $1 billion since November 2025 launch.

- Ripple’s RLUSD stablecoin receives national bank-grade oversight, positioning it for broader institutional use.

- Analysts forecast potential upside to $8 by end-2026, citing regulatory clarity and ecosystem growth.

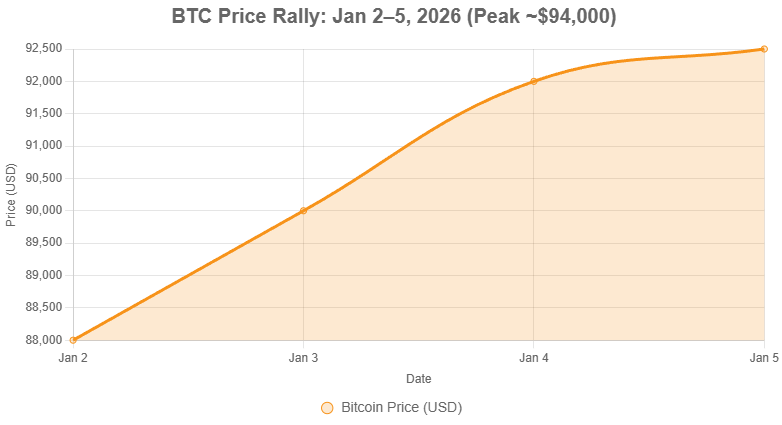

In a robust kickoff to 2026, XRP has climbed 11% to approach $2.40, capitalizing on surging institutional interest and regulatory advancements in Ripple’s ecosystem. This move extends a 17% weekly gain, with trading volumes spiking on key exchanges. The rally aligns with broader market optimism, though XRP remains 40% below its all-time high of $3.84.

ETF Inflows Fuel Momentum

Spot XRP ETFs, launched in November 2025, have attracted over $1.3 billion in net inflows, including $483 million in December alone. These funds have locked up 746 million XRP, tightening supply and supporting price action. In contrast, Bitcoin and Ethereum ETFs faced outflows, highlighting XRP’s relative strength. Data from CoinDesk shows $48 million in daily inflows, marking 30 consecutive positive days until late December.

RLUSD Stablecoin Bolsters Institutional Appeal

Ripple’s RLUSD, launched in December 2024, has reached $1.3 billion in circulation and now benefits from national bank-grade oversight. This regulatory milestone enhances its suitability for institutional payments and settlements. As noted in Bitcoin.com News, the oversight combines with multichain expansion to meet demand in DeFi and cross-border transactions.

Regulatory Wins and Future Outlook

The August 2025 SEC settlement, reducing fines to $50 million, has cleared hurdles for growth. Ripple’s application for a U.S. bank charter, pending in 2026, could further integrate XRP into traditional finance. Standard Chartered predicts XRP reaching $8 by year-end, a 277% rise, driven by ETF demand and RLUSD scaling. “The end of the SEC lawsuit and institutional adoption via XRP ETFs are key drivers,” said Geoffrey Kendrick, Head of Digital Assets Research at Standard Chartered, per The Crypto Basic.

Balanced Risks

While on-chain metrics show supply tightness from escrow relocks, risks include potential ETF outflows and competition from other stablecoins. Technical analysis from Cryptonomist suggests resistance at $2.45–$2.50, with support at $1.63–$1.70. Investors should monitor ODL volumes, currently at $15 billion annually.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Dogecoin Leads Meme Coin Surge as Sector Kicks Off 2026 with Strong Gains

- Metaplanet Shares Hit Three-Month Premium After MSCI Shelves Exclusion Plan for Bitcoin Treasury Firms

- XRP Rockets 11% to $2.40 as ETF Inflows Hit Record Highs and RLUSD Gains Regulatory Edge

- Crypto Weekly Snapshot – Strong Start to 2026

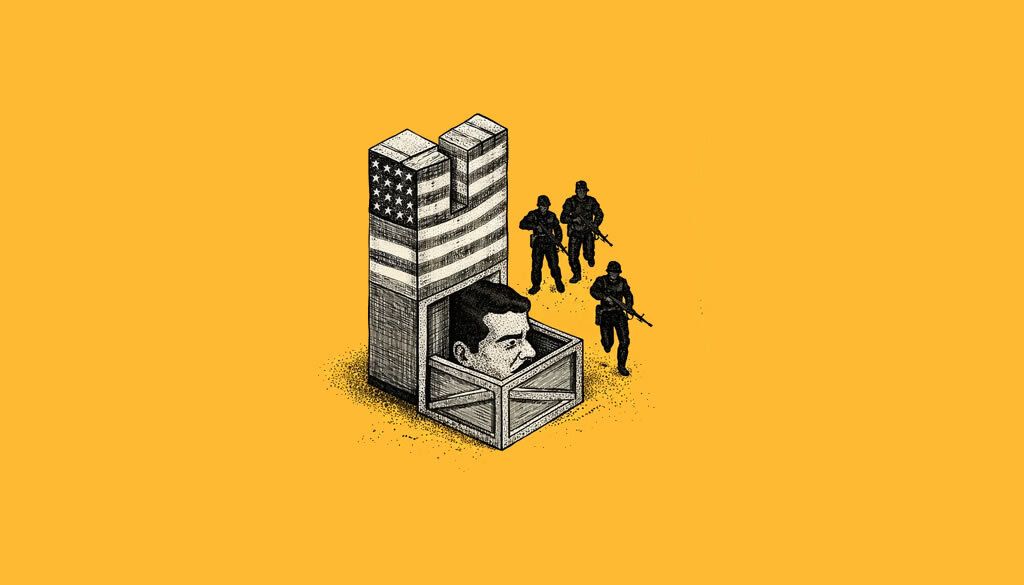

- US Forces Capture Maduro in Swift Raid. Activity on Polymarket Skyrockets Over Possible Outcomes

Related

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- A List of Available Bitcoin ETFs List of Bitcoin ETFs: current Bitcoin ETFs available....

- Franklin Templeton Debuts Spot XRP ETF Franklin Templeton has launched its spot XRP ETF on NYSE Arca, driving a price surge in XRP and highlighting growing institutional interest in altcoin funds....

- WiseCryptoNews Portal Launches While Polymarket Puts XRP ETF Approval Odds at 79% XRP ETF approval odds rise to 79% on Polymarket as Ripple wins legal relief and investors eye SEC's next moves on pending ETF applications....