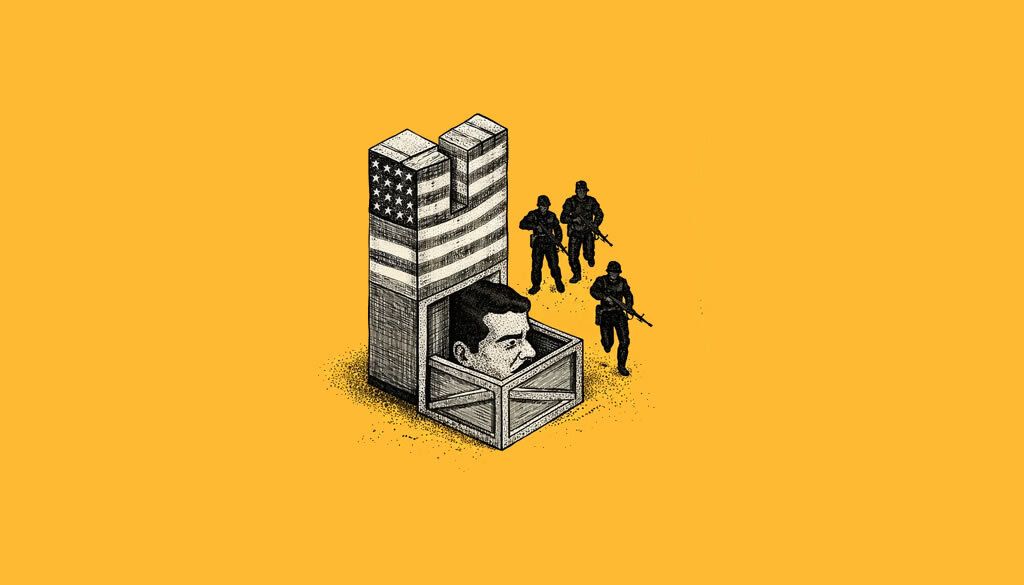

US Forces Capture Maduro in Swift Raid. Activity on Polymarket Skyrockets Over Possible Outcomes

- Swift US Raid Ends Maduro’s Rule: Elite forces captured Venezuelan President Nicolás Maduro and his wife in a pre-dawn operation on January 3, 2026, marking a dramatic geopolitical shift.

- Polymarket Bets Pay Off: The event resolved prediction markets with over $56 million in volume, turning long-shot wagers into substantial profits.

- Insider Trading Concerns Emerge: Suspicious trades ahead of the announcement have prompted Rep. Ritchie Torres to propose legislation banning federal officials from exploiting nonpublic information on prediction platforms.

US commandos executed a rapid operation to capture Venezuelan President Nicolás Maduro, abruptly ending his tenure and sending shockwaves through global markets, including crypto-based prediction platforms.

The raid, dubbed Operation Absolute Resolve, involved over 150 aircraft and Delta Force units, neutralizing Venezuelan defenses before extracting Maduro and his wife, Cilia Flores, from a military complex near Caracas. The mission was completed in under three hours, with Maduro unable to secure a safe room despite reaching its door.

President Donald Trump announced the capture via Truth Social, posting a photo of Maduro in custody and stating he would face trial in New York on charges including narco-terrorism and drug trafficking. The operation followed years of US pressure, culminating in a $50 million bounty on Maduro.

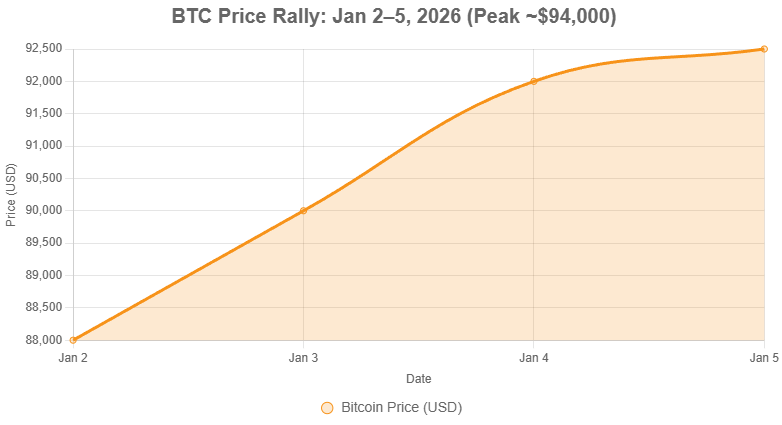

In the crypto sphere, the event had immediate repercussions on Polymarket, a decentralized prediction market. Contracts betting on Maduro’s removal by January 31, 2026, which traded at low probabilities just hours before, resolved at full value. The flagship market saw over $56 million in trading volume, with ‘Yes’ shares surging from 5-7 cents to $1.

Suspicions of insider trading quickly surfaced. A newly created Polymarket account wagered around $32,000 on Maduro’s ouster, netting over $400,000 in profits within 24 hours, per The Verge. Similar patterns in other accounts fueled online debates about access to nonpublic information.

Investor Joe Pompliano commented on X: “Insider trading is not only allowed on prediction markets; it’s encouraged.” This highlights a core feature of such platforms—aggregating information efficiently—but also underscores risks of abuse.

A newly created Polymarket account invested over $30,000 yesterday in Maduro's exit. The US then took Maduro into custody overnight, and the trader profited $400,000 in less than 24 hours. Insider trading is not only allowed on prediction markets; it's encouraged. https://t.co/EtZyW1IWTa pic.twitter.com/MzsU9kOU73

— Joe Pompliano (@JoePompliano) January 3, 2026

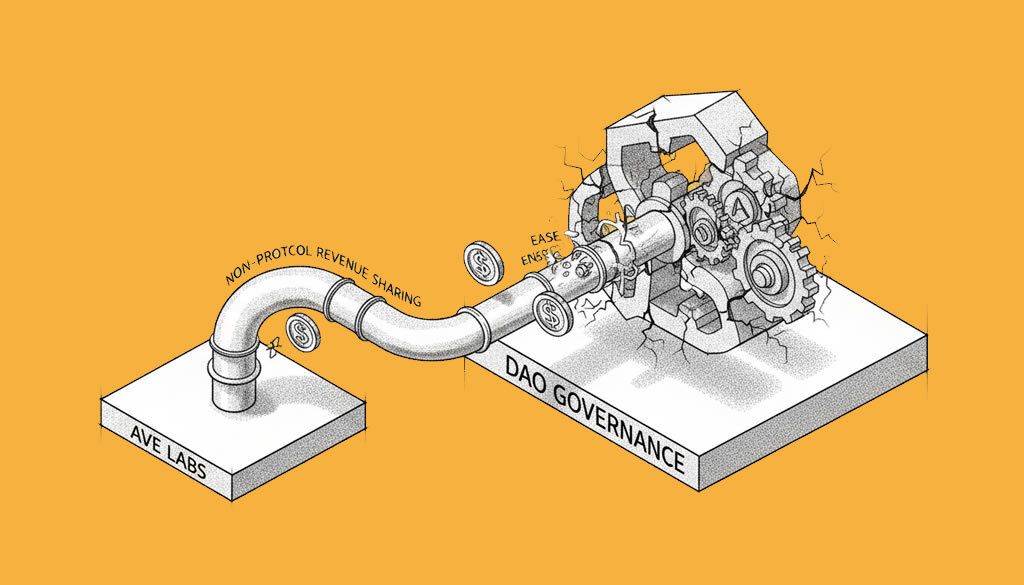

Regulatory response is already underway. US Rep. Ritchie Torres plans to introduce the Public Integrity in Financial Prediction Markets Act of 2026, extending STOCK Act principles to bar federal officials from trading on government-related contracts using privileged information.

The incident raises balanced concerns: while prediction markets like Polymarket provide real-time insights into geopolitical events, the potential for insider exploitation could undermine trust and invite stricter oversight. Analysts note that decentralized finance tools, often settled in stablecoins like USDC, amplify the speed of such resolutions but require safeguards against manipulation.

For context on prediction market profits in political events, see this related article from Cryptopress.site.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- XRP Rockets 11% to $2.40 as ETF Inflows Hit Record Highs and RLUSD Gains Regulatory Edge

- Crypto Weekly Snapshot – Strong Start to 2026

- US Forces Capture Maduro in Swift Raid. Activity on Polymarket Skyrockets Over Possible Outcomes

- Cross-Chain Bridges: The Gateways of Blockchain Interoperability

- Shiny Coins #3 – Bloodbath Survivors Rise from the Ashes

Related

- What is Polymarket? What Is Polymarket? Unveiling the Crypto Secret Behind $4 Billion in Election Bets....

- Polymarket’s Historic Surge: Election Betting Propels Crypto Market to New Heights Polymarket, a decentralized prediction market platform, records its strongest month ever as election season heats up....

- Trump’s Election Win: Millions Made on Polymarket The betting success stories highlight the growing influence of prediction markets in political forecasting....

- Cryptocurrency Betting Favors Harris Over Trump in 2024 Presidential Race Bets in favor of Trump fell to less than 50% from more than 70% in July....