Understanding Cryptocurrency Market Crashes: Insights from the 2025 Decline

Navigating the roller coaster ride of cryptocurrency markets

Imagine you suddenly check your cryptocurrency portfolio and see that its value has plummeted, not because of a company collapse or global recession, but because of geopolitical rumors thousands of miles away. This was the reality in October 2025, when total market capitalization fell sharply, resulting in billions in losses and pushing the Crypto Fear & Greed Index into the “fear” zone at 32. Even long-term holders, who are usually the foundation of market stability, began selling their bitcoins, causing further declines despite expectations of a bullish fourth quarter.

But this isn’t just a story of one downturn; it’s a window into the fundamental volatility that defines cryptocurrencies. As a seasoned crypto journalist, I’ve witnessed cycles of boom and bust since Bitcoin’s early days. These events aren’t anomalies—they’re integral to a market still maturing in a world of interconnected global forces. In this article, we’ll unpack the mechanics behind crypto crashes, drawing timeless lessons from the 2025 event to equip beginners and intermediate investors with the knowledge to navigate future turbulence. We’ll explore historical patterns, technical drivers, real-world impacts, risks, and strategies for resilience, all while maintaining a neutral, educational lens focused on long-term understanding rather than short-term speculation.

The Fundamentals of Cryptocurrency Market Dynamics

To grasp why markets crash, we must first understand the bedrock of cryptocurrencies: decentralized, digital assets operating on blockchain technology. Unlike traditional stocks or bonds, cryptocurrencies like Bitcoin aren’t backed by physical assets or corporate earnings. Instead, their value stems from supply-demand mechanics, network utility, and investor sentiment.

What Causes Market Crashes? A Step-by-Step Breakdown

Crypto crashes often unfold like a domino effect, triggered by external shocks and amplified by internal market structures. Let’s break it down step-by-step:

- External Triggers: Geopolitical events, such as the US-China trade tensions in 2025, act as catalysts. When President Trump’s administration imposed fresh tariffs and export controls, it sparked risk aversion across global markets. Cryptocurrencies, highly correlated with equities (often around 0.9 with assets like gold during shocks), suffer as investors flee to safer havens like government bonds or gold. Think of it as a flock of birds scattering at the first sign of danger—the initial sell-off creates panic.

- Leverage and Liquidations: Modern crypto trading amplifies volatility through leveraged positions on exchanges like Binance or Coinbase. In 2025, over $19 billion in leveraged bets were liquidated in a single weekend, the largest event on record. Here’s how it works: Traders borrow funds to bet on price rises (longs) or falls (shorts). If prices move against them, automated liquidations kick in to cover loans, forcing sales at market rates and driving prices lower in a cascade. This “deleveraging” was evident when Bitcoin dropped to $102,000 amid thin liquidity.

- Holder Behavior and On-Chain Metrics: Long-term holders (LTHs)—those who’ve held for over 155 days—typically provide stability. But in 2025, they sold over 300,000 BTC since June, with 100,000 in recent days alone, as profits tempted exits despite seasonal bullish expectations. On-chain data from Glassnode reveals accumulation by smaller investors while whales (holders of >10,000 BTC) distribute, signaling a shift from euphoria to caution. Analogize this to a crowded theater: when a few key people head for the exits, others follow, creating a stampede.

- Market Sentiment and Indicators: Tools like the Relative Strength Index (RSI) dropped to oversold levels (below 43 in 2025), hinting at potential rebounds. Yet, bearish options trading, with $1.15 billion in Bitcoin puts, reflected downside bets.

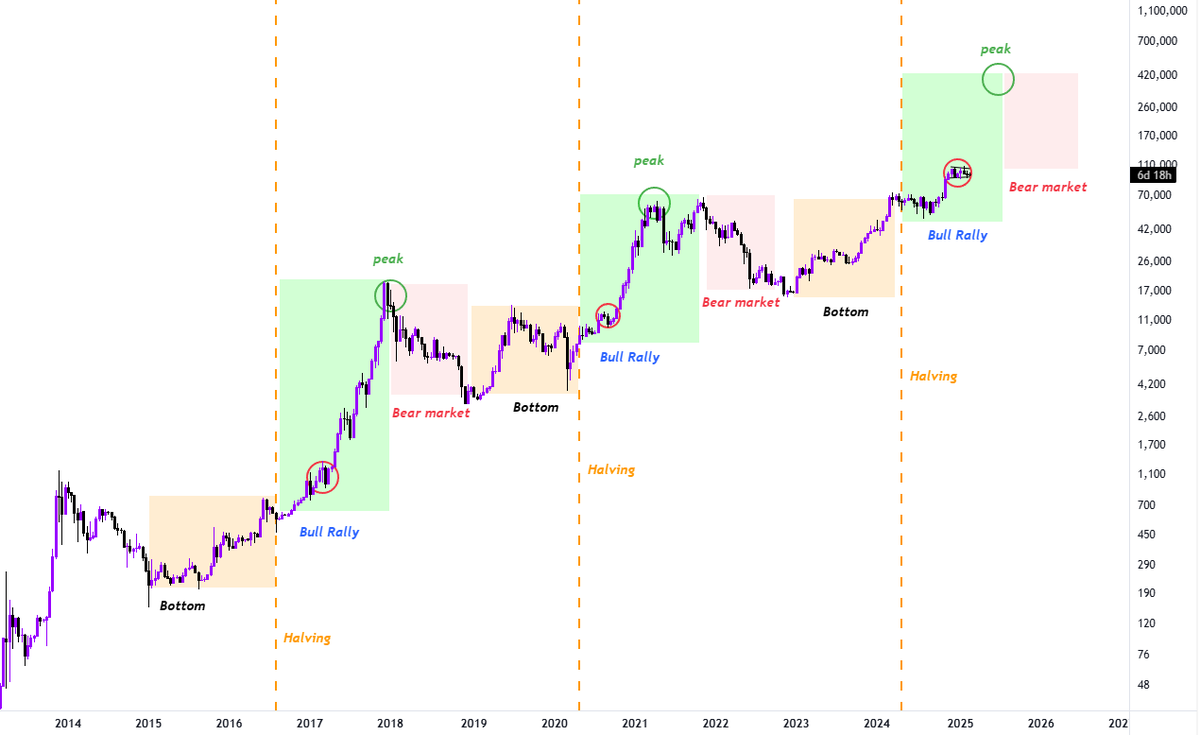

As shown in the graph below, Bitcoin’s price history illustrates these cycles, with marked halvings often preceding recoveries after crashes.

Line graph of Bitcoin price history from 2011 to 2025 highlighting major crashes halving events and recovery phases bytwork.com

Historical Context: Lessons from Past Crashes

Cryptocurrency history is riddled with crashes that offer evergreen insights:

- 2011 Mt. Gox Hack: Bitcoin fell 90% from $32 to $2 due to a security breach, teaching the importance of exchange risks and self-custody.

- 2018 ICO Bust: After a 2017 boom, overregulation and failed projects led to an 80% market wipeout, emphasizing due diligence on hype-driven assets.

- 2022 Terra-Luna Collapse: A stablecoin depeg caused $40 billion in losses, highlighting algorithmic risks and the dangers of interconnected DeFi protocols.

The 2025 decline mirrors these, blending geopolitics (like 2022’s Ukraine war impact) with internal pressures, but with a twist: Bitcoin’s “digital gold” narrative strengthened its correlation to macro events.

Key Takeaways:

- Crashes are cyclical, often following euphoria phases.

- Recovery typically follows halvings (Bitcoin’s supply reduction every four years), with Q4 historically bullish.

- Diversification beyond BTC (e.g., into Ethereum or stablecoins) can mitigate losses.

Real-World Applications and Case Studies

Cryptocurrencies aren’t abstract—they power real innovations, but crashes test their resilience.

How Crashes Affect Adoption and Use Cases

During downturns, practical applications shine. For instance:

- Remittances and Cross-Border Payments: In volatile economies like Venezuela or Argentina, Bitcoin serves as a hedge against inflation. The 2025 crash saw increased stablecoin usage (e.g., USDT) for everyday transactions, underscoring crypto’s utility beyond speculation.

- Decentralized Finance (DeFi): Platforms like Aave or Uniswap allow lending/borrowing without banks. In 2025, DeFi total value locked (TVL) dipped but rebounded as users sought yields amid low bank rates.

As shown in the table below, top DeFi protocols experienced TVL fluctuations during market crashes, with data approximated based on 2025 reports (pre-crash from Q3 end ~$161B total TVL, post reflecting declines).

| Protocol | TVL Pre-Crash ($B) | TVL Post-Crash ($B) | Recovery Time (Days) |

|---|---|---|---|

| Lido | 38.3 | 30 | 60 |

| Aave | 38.7 | 25 | 45 |

| Uniswap | 6.1 | 3.7 | 30 |

| Curve Finance | 2.7 | 2.1 | 50 |

| Compound | 2.2 | 1.8 | 40 |

Case Study: The 2025 US-China Trade Tensions Impact

This event exemplified how global politics intersects with crypto. Tariffs threatened supply chains for mining hardware (China dominates ASIC production), raising costs and reducing hash rates temporarily. Bitcoin steadied near $111,000 as traders assessed retaliation risks, with Ethereum and Solana following suit. Positive outliers? AI tokens like ChainOpera AI surged 56%, showing sector-specific resilience.

Pros of Crypto in Crises:

- Borderless access for underserved populations.

- Hedging against fiat devaluation.

Cons:

- High volatility deters mainstream adoption.

- Regulatory backlash, as seen in post-2022 scrutiny.

Another example: Kenya’s 2025 crypto legislation amid the crash boosted African adoption, proving policy can counter market woes.

Challenges and Risks in Crypto Markets

No discussion of crashes is complete without addressing pitfalls.

Key Risks Explained

- Volatility and Leverage: As seen in 2025’s $150 billion wipeout, over-leveraging turns minor dips into catastrophes. Solution: Stick to spot trading and set stop-losses.

- Regulatory and Geopolitical Uncertainties: Trade wars or bans (e.g., China’s 2021 mining crackdown) can trigger sell-offs. Diversify geographically and monitor news.

- Psychological Factors: FOMO (fear of missing out) drives bubbles; FUD (fear, uncertainty, doubt) fuels crashes. Use tools like on-chain analysis to stay objective.

- Security Threats: Hacks or exchange failures exacerbate downturns. Always use hardware wallets for long-term holdings.

Societal Impacts: Crashes can lead to wealth inequality, as retail investors suffer most, while institutions buy dips. Economically, they highlight crypto’s role in global finance, with Bitcoin’s market cap rivaling major corporations.

Mitigation Strategies

- Dollar-Cost Averaging (DCA): Invest fixed amounts regularly to average out volatility.

- Portfolio Diversification: Balance BTC (store of value) with ETH (smart contracts) and stablecoins.

- Education and Research: Follow credible sources like whitepapers or CoinMarketCap for data-driven decisions.

Future Outlook: Building Resilience in Uncertain Times

Looking ahead, crypto’s trajectory remains upward despite crashes. Bitcoin’s halving cycles suggest potential highs of $150,000–$180,000 in future bull runs, driven by institutional adoption (e.g., ETFs inflows of $755 million even in downturns). Emerging trends like real-world asset (RWA) tokenization and AI integration (as in 2025’s AI token gains) promise growth.

However, challenges persist: Evolving regulations, environmental concerns with proof-of-work (PoW), and competition from central bank digital currencies (CBDCs). Forward-thinking analysis: If correlations with traditional markets decrease, crypto could become a true diversifier.

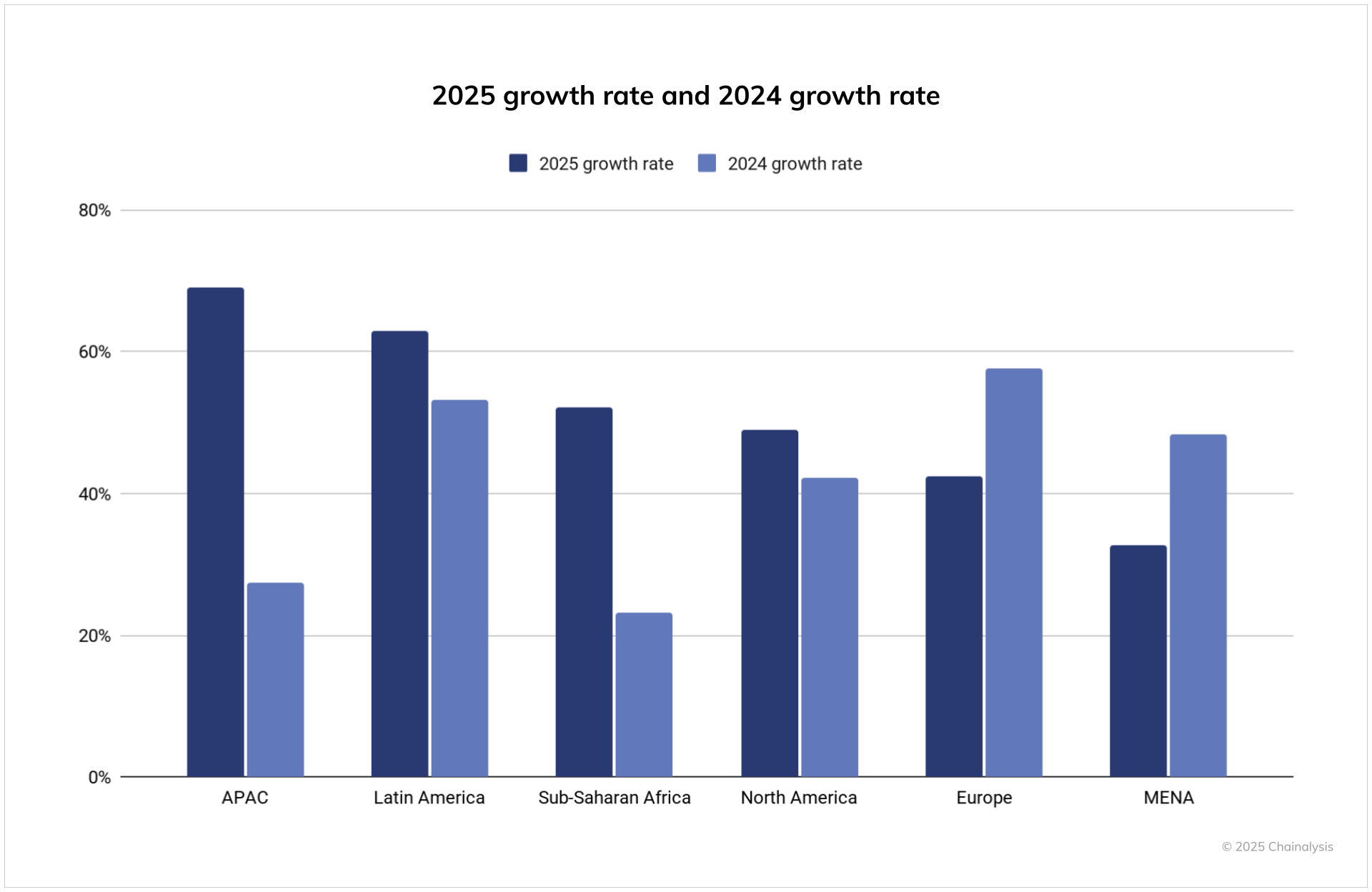

As illustrated in the graph below, adoption rates have grown steadily even amid volatility spikes.

Bar graph showing global cryptocurrency user adoption growth from 2020 to 2025 compared to volatility indices – chainalysis.com

Practical Advice: Start small, learn jargon like “halving” (Bitcoin’s supply cut), and focus on fundamentals. For intermediates, explore on-chain tools like Glassnode for holder insights.

Conclusion: Embracing the Crypto Journey

Cryptocurrency market crashes, like the 2025 decline amid US-China tensions and holder sell-offs, are stark reminders of the asset class’s youth and volatility. Yet, they also underscore its potential as a transformative force in finance. By understanding the mechanics—from liquidations to geopolitical influences—you can turn fear into opportunity, building a resilient portfolio grounded in education rather than emotion.

Remember, the most successful investors view dips as entry points, not exits. Subscribe to Cryptopress.site for more insights on blockchain fundamentals and market analysis. Explore related articles like “Cryptocurrency: A Beginner’s Guide in 2025” or “Diversification in Crypto: Building a Resilient Portfolio” to deepen your knowledge.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Understanding Cryptocurrency Market Crashes: Insights from the 2025 Decline

- Senate Crypto Framework Bill Stalls Amid Democrats’ Counterproposal on DeFi Regulations

- Bitcoin and Ethereum ETFs Record $755M Outflows Amid Escalating US-China Trade Tensions

- Weekly Crypto Roundup – Turbulence, Tariffs, Liquidations, and the Road to Recovery

- Bitcoin Rebounds Above $114,000 After Historic $19B Crypto Liquidation Wipeout

Related

- Crypto fear and greed index hits 20: the reasons behind the fear Recent events, like the Bybit hack losing $1.5 billion and unclear government crypto policies, have contributed to this fear....

- What Is The Fear Index? And How Can It Be Used For Crypto Investing? Fear is a powerful motivator. The fear index seeks to gauge how worried investors are about the financial markets. ...

- The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure On October 10, 2025, the crypto market suffered its largest-ever liquidation event, wiping out $19 billion amid Trump's China tariff shock. This in-depth retrospective unpacks the mechanics, impacts, and lessons for investors—why it happened, what it means, and how to...

- Crypto portfolios of top analysts and influencers in June 2025 The portfolios of prominent crypto analysts and influencers play a key role in shaping public sentiment and investment decisions. (This is not financial advice.)...