Trump-Backed World Liberty Financial Launches WLFI Token Amid Market Volatility and Token Burn

- WLFI token debuted on major exchanges, reaching a high of $0.331 before dropping over 30% to around $0.23.

- Project burned 47 million tokens (0.19% of circulating supply) to reduce supply and potentially stabilize prices.

- Trump family holds 22.5 billion tokens, representing 22.5% of the 100 billion total supply, with paper value in the billions.

- Proposal for ongoing buyback and burn program using protocol fees aims to benefit long-term holders.

World Liberty Financial, a decentralized finance platform backed by the Trump family, officially launched its governance token, WLFI, on September 1, 2025. The token, built on the Ethereum (ETH) blockchain, enables holders to vote on protocol changes and governance decisions. Trading commenced on exchanges such as Binance, OKX, and Bybit, marking a significant entry into the crypto market for the politically linked project.

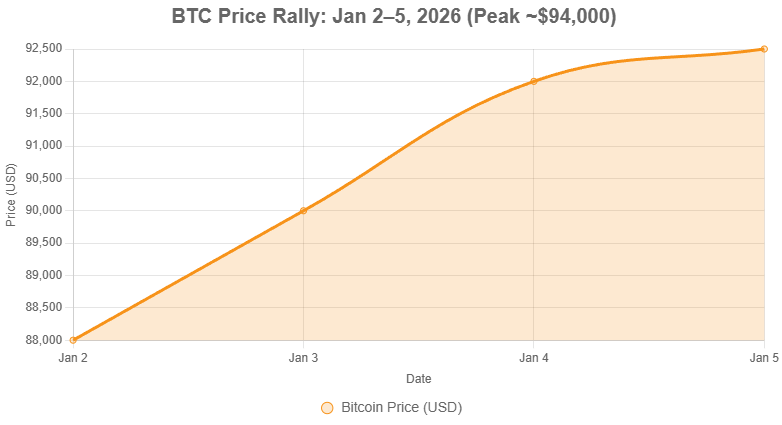

The debut saw volatile price action. WLFI initially surged to $0.331 but quickly retreated, trading at approximately $0.23 by September 3—a decline of about 31% from its peak. The market capitalization hovered around $6-7 billion, ranking it among the top 50 cryptocurrencies briefly. Early sales to accredited investors were priced at $0.015 per token, offering substantial gains for initial buyers despite the dip.

In response to the price slide, World Liberty Financial executed a burn of 47 million WLFI tokens on September 2, permanently removing them from circulation. This move reduced the total supply to just under 100 billion and was intended to increase scarcity. An Etherscan transaction confirmed the burn, representing 0.19% of the circulating supply.

The project also proposed a buyback and burn program, allocating fees from protocol-owned liquidity to repurchase and destroy tokens. This aims to reward long-term holders by gradually increasing their ownership percentage. A community poll showed strong support, with a formal vote expected soon.

The Trump family, including Donald Trump as co-founder emeritus and his sons, holds 22.5 billion WLFI tokens through DT Marks DEFI LLC. At current prices, this stake is valued at roughly $5 billion on paper, though tokens remain locked pending community decisions on vesting. The family receives 75% of net revenues from token sales.

“Speculative trading damages trust in crypto, which is opposite to building a resilient financial system.”

Kevin Rusher

Analysts have noted challenges. Kevin Rusher, founder of blockchain advisory firm RAAC, commented that the hype surrounding WLFI highlights crypto’s maturity issues: “Speculative trading damages trust in crypto, which is opposite to building a resilient financial system.” Mangirdas Ptašinskas, head of marketing at Galxe, pointed out that the launch spiked Ethereum gas fees, with transfers costing up to $50, indicating the ecosystem’s unreadiness for mainstream adoption.

| Fact | Detail |

|---|---|

| Contract Address | 0xda5e1988097297dcdc1f90d4dfe7909e847cbef6 |

| Current Price | $0.23–$0.25 USD (as of Sep 3, 2025) |

| Market Cap | $6.89 billion |

| 24-Hour Trading Volume | $32.17 million |

| Total Supply | 100 billion tokens |

| Circulating Supply | 24.7 billion tokens |

| Token Burn | 47 million tokens (~$11 million, 0.19% of supply) |

| Number of Holders | 61,180 |

| Supply Centralization | ~60% controlled by fewer than 10 wallets |

| Trump Family Holding | 22.5 billion tokens (~$5 billion) |

| Governance Proposal | 100% of protocol fees for buyback and burn |

| Whale Activity | Justin Sun: 5.289M WLFI ($1.19M); net selling ~$11.7M |

| On-Chain Insights | $1.6B+ internal transfers, $411M exchange inflows |

Security concerns emerged early, with reports of phishing exploits targeting WLFI holders using Ethereum’s EIP-7702 standard. The project responded by blacklisting suspicious addresses onchain to block hack attempts. Critics, including ethics experts, have raised potential conflicts of interest given President Trump’s influence on crypto regulations.

While WLFI draws comparisons to other celebrity-backed tokens, its ties to political figures add unique risks, including regulatory scrutiny. Market observers suggest the project’s success will depend on delivering functional DeFi features beyond initial speculation. For context, similar market dynamics have affected tokens like Bitcoin (BTC), though WLFI’s governance focus sets it apart.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Dogecoin Leads Meme Coin Surge as Sector Kicks Off 2026 with Strong Gains

- Metaplanet Shares Hit Three-Month Premium After MSCI Shelves Exclusion Plan for Bitcoin Treasury Firms

- XRP Rockets 11% to $2.40 as ETF Inflows Hit Record Highs and RLUSD Gains Regulatory Edge

- Crypto Weekly Snapshot – Strong Start to 2026

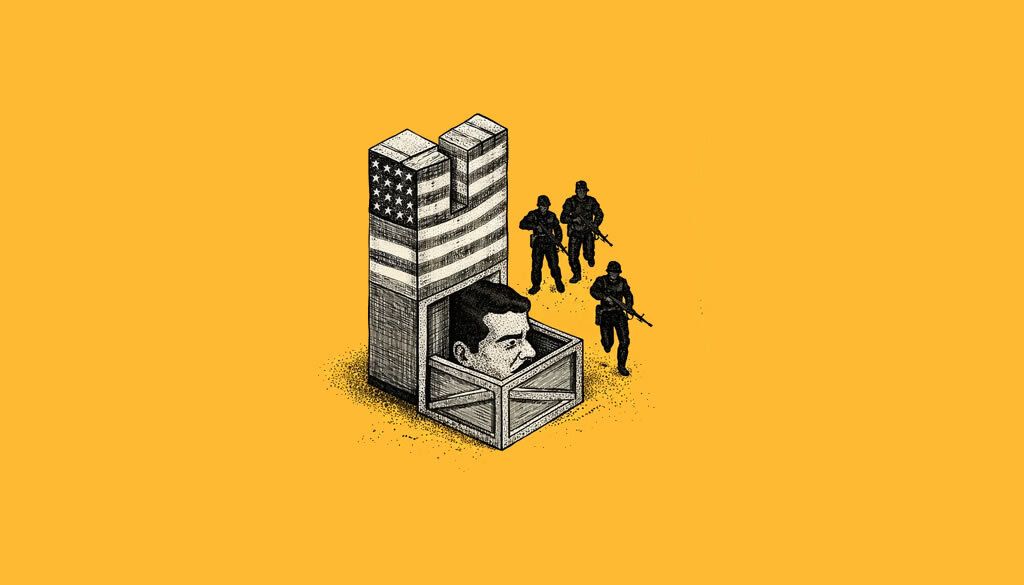

- US Forces Capture Maduro in Swift Raid. Activity on Polymarket Skyrockets Over Possible Outcomes

Related

- Trump-Backed WLFI Token Launches with High Volatility and Multi-Billion Valuation Amid Unlock Event The Trump family's World Liberty Financial (WLFI) token launched on September 1, 2025, achieving a $30 billion+ valuation but facing immediate price drops and regulatory scrutiny in the crypto market....

- What is $STRF? What is this investment opportunity and how it works?...

- WLFI’s ETH Sale The sale resulted in an estimated unrealized loss of $125 million....

- Governance On-chain governance is a decentralized system for managing blockchain governance conflicts....