The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure

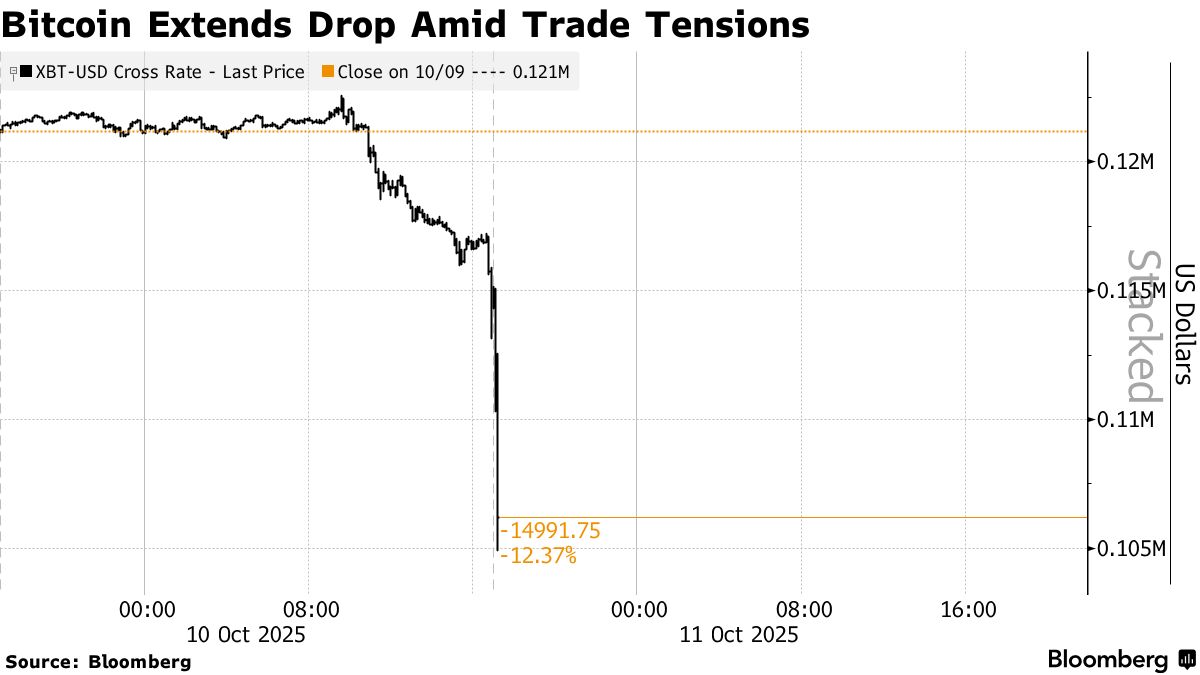

Imagine scrolling through your portfolio on a Friday evening, only to watch Bitcoin—fresh off a $125,000 all-time high—plunge to $101,500 in under two hours. Ethereum craters 18%, Solana memes evaporate 50%, and the total market cap sheds $400 billion. This wasn’t a glitch or a hack; it was a cascade of fear, leverage, and geopolitics colliding in real-time. Welcome to the crypto crash of October 10, 2025—the biggest to date, with $19 billion in liquidations marking the single largest purge in the asset class’s history. As we hit October 11, markets are stabilizing, but the scars run deep. This retrospective isn’t just a recap; it’s a dissection of systemic vulnerabilities in crypto’s maturing ecosystem, drawing parallels to past failures while charting a path forward. For beginners and veterans alike, understanding this event is key to surviving—and thriving—in the next bull leg.

The Spark: Geopolitical Shockwaves Ignite the Fire

At the heart of this meltdown was a single, seismic announcement from U.S. President Donald Trump: a 100% tariff on all Chinese goods, effective November 1, 2025, layered atop existing duties, coupled with export controls on critical U.S. software. Posted on Truth Social late Friday, the rhetoric framed China as “hostile,” escalating fears of a full-blown trade war redux. China’s swift retaliation—curbs on rare earth exports and chip tech—sent global risk assets into freefall. Stocks tumbled (Dow -2.9%, Nasdaq -3.4%), the VIX fear index spiked 35%, and the U.S. Dollar Index (DXY) surged 1.8%, squeezing liquidity from high-beta plays like crypto.

Why did this hit crypto hardest? Unlike traditional markets with circuit breakers, crypto’s 24/7 nature amplifies knee-jerk reactions. Whales—large holders—dumped positions amid thin weekend liquidity, triggering algorithmic margin calls. On-chain data from Coinglass shows exchange inflows of 120,000 BTC in hours, fueling a sell-off that erased gains since August. It’s a stark reminder: crypto isn’t isolated; it’s tethered to macro forces, acting as a “flight-to-safety” barometer until it isn’t.

To visualize the immediate carnage, consider Bitcoin’s hourly chart from Bitstamp. What started as a modest dip snowballed into a 16% flash crash, with volume spiking 300% as panic spread.

Houly BTC/USD chart on Bitstamp, October 10-11, 2025: From $122K peak to $101K trough in hours. news.bitcoin.com

Houly BTC/USD chart on Bitstamp, October 10-11, 2025: From $122K peak to $101K trough in hours. news.bitcoin.com

This wasn’t random volatility; it was a textbook liquidity shock, where fear flipped opportunity in minutes.

Core Mechanics: How Leverage Turned a Dip into Disaster

Crypto’s Achilles’ heel? Leverage. Perpetual futures on exchanges like Binance and HTX allowed traders to bet 100x on upside, but when prices ticked down, it unleashed a domino effect. The math is brutal: A 1% adverse move on a 100x long wipes out your position entirely. On October 10, 78% of the $19 billion liquidated were longs—bullish bets vaporized in a risk-off stampede.

Break it down step-by-step:

- Initial Trigger (8:00 PM UTC): Trump’s post hits feeds. BTC slips 2% to $119K as arbitrage bots unwind correlated positions across equities and crypto.

- Cascade Ignition (9:00-10:00 PM UTC): Whales offload $50K BTC batches. Thin order books (liquidity at 20% of peak) cause slippage—sells execute 5-10% below market, accelerating the drop to $114K.

- Liquidation Avalanche (10:00-11:00 PM UTC): Platforms auto-close undercollateralized trades. BTC liquidations alone: $1.8B; ETH: $1.2B. Total hits $6B in the first hour, ballooning to $19B by dawn. Stablecoins like USDe briefly depegged to $0.9996 under redemption pressure.

- Contagion Spread: Alts, with lower liquidity, fared worse. Solana (SOL) -22% to $180; Dogecoin (DOGE) -50% flash to $0.11 before rebounding to $0.19. Memecoins on Sui and Solana? Some dipped 70%+, with one opportunistic buy netting 284,900% in minutes on ATOM.

The liquidation heatmap tells the story: A vertical spike dwarfing past events like the 2022 FTX collapse ($1.6B) or 2020 COVID crash ($1.2B)—nearly 20x larger.

$19B liquidation event: Hourly breakdown showing the unprecedented spike on October 10, 2025.

Technically, this exposed the “blockchain trilemma” in action: Scalability (high TPS on L1s like Solana) meets security, but decentralization falters under centralized leverage hubs. On-chain metrics held firm—no mass ETF outflows beyond $500M, and realized losses were below April 2025 stress levels—suggesting this was mechanical, not conviction-driven.

| Asset | Pre-Crash Price | Low During Crash | % Drop | Liquidations ($B) |

|---|---|---|---|---|

| BTC | $122,000 | $101,500 | -17% | 1.8 |

| ETH | $4,500 | $3,700 | -18% | 1.2 |

| SOL | $230 | $180 | -22% | 0.4 |

| DOGE | $0.22 | $0.11 | -50% | 0.2 |

| Total Market Cap | $4.4T | $3.8T | -14% | 19 |

Table 1: Key asset impacts from the October 10 crash. Data aggregated from Coinglass and CoinGecko. 99bitcoins.com

Ripple Effects: From Exchanges to Ecosystems

The blast radius extended beyond prices. Binance users reported frozen accounts and failed stop-losses, sparking outrage and brief USDT depegs on spot markets. DeFi TVL dropped 12% as yield farmers fled to stables, hitting protocols like Aave and Uniswap. NFTs? Floor prices on OpenSea sank 25%, with blue-chip collections like Bored Apes testing 2024 lows.

Real-world case: Somnia Network (SOMI), a hyped EVM L1 for gaming, cratered 62% to $0.69 from $1.84 ATH, despite 1M TPS scalability. Why? Concentrated wallets and low liquidity amplified the purge, turning a -7.5% BTC-correlated dip into a bloodbath. Yet, post-crash, TVL rebounded to $42.4B on Solana—signaling ecosystem resilience.

On X (formerly Twitter), sentiment swung from euphoria (“Uptober!”) to despair (“Trade war apocalypse!”). Posts like @0xdotss’s breakdown of the “perfect storm”—macro triggers + mechanical cascades—garnered thousands of views, while @CryptoPRio highlighted a $0.001 ATOM flip for massive gains, underscoring crypto’s dual nature: destroyer and creator of wealth.

🚨 The crypto market blacked out in a matter of minutes.

— Dots💧 (@0xdotss) October 10, 2025

Today (Oct 10, 2025), Bitcoin, Ethereum, Solana, Sui, and nearly every major coin plunged without warning.

SUI even touched $0.50 before bouncing back almost as fast as it fell.

I don’t have the full picture but here’s… pic.twitter.com/vNl1Aq8UBt

Exchanges like HTX saw the single largest wipeout: $87.53M on a BTC/USDT pair. This echoes 2022’s FTX contagion but on steroids—leverage ratios hit 100x across perps, far beyond regulated forex limits.

Challenges and Risks: Exposing Systemic Fault Lines

This crash wasn’t isolated; it revealed crypto’s growing pains. Overleverage remains rampant, with 200K+ traders margin-called in hours—many retail, per X anecdotes. Platforms lack robust circuit breakers, unlike NYSE’s 7% halts. Interconnectivity amplified contagion: 95% asset correlation during stress turns diversification into illusion.

Regulatory Gaps: Trump’s move highlights policy whiplash. While pro-crypto rhetoric (e.g., BTC as “digital gold”) buoyed 2025’s rally, tariffs underscore exogenous risks. Russia’s crypto bank nod contrasts U.S. shutdown delays on jobs data, blurring FOMC rate cut odds (90% for 25bps Oct 29).

Emotional Toll: Fear & Greed Index plunged to 28 (extreme fear), echoing May 2021. Yet, history favors the patient: Post-2018 trade war, BTC dipped 20% then rallied 300%. Best practices? Self-custody, cap leverage at 5x, and DCA through volatility.

Key Risks Post-Crash:

- Break Below $100K BTC: Signals bull cycle end; targets $95K.

- ETF Outflows: $440M BTC, but ETH inflows hold.

- Geopolitical Escalation: 35% recession odds if tariffs stick.

Future Outlook: Purge as Prelude to Resilience

Was this a “systemic failure”? Not quite—on-chain steadiness (below-stress inflows) and quick rebounds (BTC +7.86% to $111K by Oct 11) show maturation. Analysts like VanEck eye $644K long-term if BTC cements as Gen Z gold; short-term, $114K-$118K demand zones beckon.

Opportunities abound: Infrastructure tokens (SOL, HBAR) resilient at -3.5%; miners up 8% on scarcity bets. Q4 rebounds average 25% historically; with FTX refunds ($5.1B) and institutional buys (944K BTC YTD), the bull thesis endures.

Speculatively, this purges weak hands, resetting for adoption waves: CBDCs vs. DeFi, Web3 gaming on SOMI. But watch CPI (Oct 15) and FOMC—volatility lingers.

Conclusion: Lessons from the Abyss

The October 2025 crash—$19B liquidated, $400B erased—was crypto’s starkest stress test yet, born of tariffs but fueled by our own leverage addictions. It wasn’t the end; it was a reset, purging froth from a $4T ecosystem. As has been said: “Every cycle purges. Every purge resets.“

For long-term holders: HODL through cycles, diversify beyond alts, and embrace self-custody (“Not your keys, not your coins”). Beginners: Start small, learn on-chain, avoid 100x traps. Crypto’s promise—decentralized resilience—shines brightest post-purge.

Subscribe to Cryptopress.site for more evergreen deep dives and timely analysis. What’s your take—buy the dip or brace for more? Explore related reads: Crypto and resilience or Top trading mistakes to avoid. Stay informed, trade smart.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Metals Rally to Records as Crypto ETFs See Strong Inflows Amid U.S.-Europe Trade Tensions Over Greenland

- NYSE Develops Blockchain Platform for 24/7 Tokenized Securities Trading

- Crypto Weekly Snapshot – Tariff Fears Hammer Crypto as Inflows Provide Relief

- Bitcoin Dips Below $93,000 Amid U.S.-EU Trade Tensions

- Ethereum Daily Transactions Surge to All-Time High as Gas Fees Fall to Record Lows

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Crypto fear and greed index hits 20: the reasons behind the fear Recent events, like the Bybit hack losing $1.5 billion and unclear government crypto policies, have contributed to this fear....

- What Is The Fear Index? And How Can It Be Used For Crypto Investing? Fear is a powerful motivator. The fear index seeks to gauge how worried investors are about the financial markets. ...

- Mantra OM Token Crash Losing around $5 billion in market cap in less than an hour....