Tether Boosts Bitcoin Reserves with 8,888 BTC Purchase

- Tether purchased 8,888 BTC in the fourth quarter of 2025, worth approximately $780 million at current prices.

- The acquisition brings Tether’s total Bitcoin holdings to over 96,000 BTC, positioning it among the top five largest BTC holders.

- This move aligns with Tether’s policy of using up to 15% of quarterly profits to buy Bitcoin for reserve diversification.

Stablecoin issuer Tether has reinforced its commitment to Bitcoin by adding 8,888 BTC to its reserves in the final quarter of 2025. The purchase, valued at roughly $780 million, was confirmed by CEO Paolo Ardoino on X. This strategic accumulation underscores Tether’s evolving reserve management approach amid fluctuating crypto markets.

Reserve Diversification Strategy: Tether’s Bitcoin buys are part of a broader plan to allocate a portion of its net profits to BTC, as outlined in previous announcements. The company aims to balance its holdings with traditional assets like U.S. Treasuries and gold, enhancing long-term stability for USDT holders.

Tether acquired 8,888.8888888 BTC in Q4 2025.https://t.co/vMh1uzv1wO

— Paolo Ardoino 🤖 (@paoloardoino) December 31, 2025

This latest addition pushes Tether’s BTC stash above 96,000 coins, making its wallet one of the largest in the ecosystem. Analysts note that such moves could tighten Bitcoin’s supply during periods of market weakness.

Market Context: The purchase comes as Bitcoin trades in a consolidation phase following a volatile 2025. While some see it as a bullish signal from a major institutional player, others caution about concentration risks in stablecoin reserves.

In a related development, Tether’s increasing Bitcoin exposure has drawn scrutiny, as highlighted in a recent CryptoPress article on S&P’s downgrade of USDT’s stability rating due to volatile asset holdings.

Stakeholder Perspective: Tether CEO Paolo Ardoino announced the transaction on X, linking to the on-chain proof: “Tether acquired 8,888.8888888 BTC in Q4 2025.” (X post). This transparency aims to build trust in Tether’s operations.

Next, a user commented on Ardoino’s post: “I hope your average cost is better than Saylor’s,” to which the CEO responded humorously with a meme and the word “Perhaps.”

— Paolo Ardoino 🤖 (@paoloardoino) December 31, 2025

The move may influence other stablecoin issuers to consider similar strategies, potentially impacting Bitcoin’s role as a reserve asset. However, experts emphasize the need for balanced risk management in crypto treasuries.

Disclaimer:

This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- XRP Rockets 11% to $2.40 as ETF Inflows Hit Record Highs and RLUSD Gains Regulatory Edge

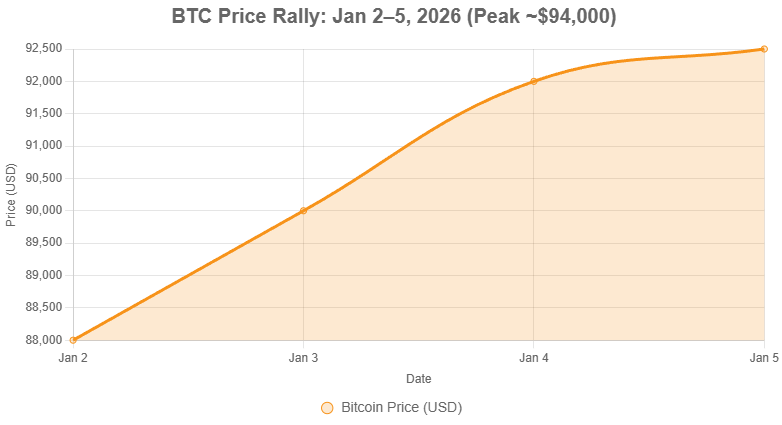

- Crypto Weekly Snapshot – Strong Start to 2026

- US Forces Capture Maduro in Swift Raid. Activity on Polymarket Skyrockets Over Possible Outcomes

- Cross-Chain Bridges: The Gateways of Blockchain Interoperability

- Shiny Coins #3 – Bloodbath Survivors Rise from the Ashes

Related

- Plasma: The Blockchain Challenging DeFi’s Stablecoin Status Quo Plasma aims to offer zero-fee USDT transactions and lightning-fast settlement by leveraging Bitcoin's security and an EVM-compatible environment....

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- Tether CEO Dispels Rumors of Bitcoin for Gold Sale Tether CEO Paolo Ardoino refuted claims on September 7, 2025, that the company sold Bitcoin for gold, asserting Tether's continued holding of both assets....

- Tether Executives Acquire Northern Data’s Bitcoin Mining Arm in $200M Deal Northern Data, majority-owned by Tether, has sold its Peak Mining subsidiary to firms controlled by Tether's top executives, prompting scrutiny over potential conflicts of interest amid ongoing expansions in AI and crypto mining....