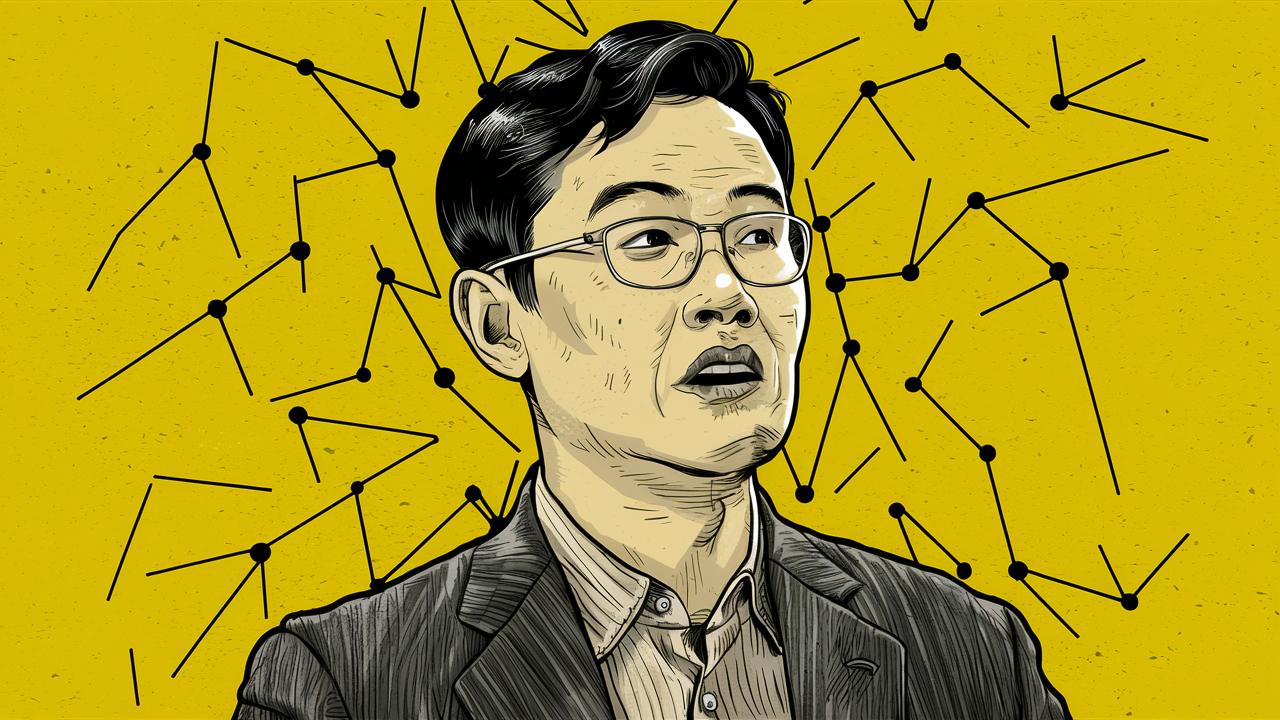

Terraform Labs and Founder Do Kwon Found Liable for $40 Billion Fraud

- A Manhattan jury has found Singapore-based Terraform Labs and its founder, Do Kwon, liable for civil fraud charges related to their stablecoin, TerraUSD.

- The Securities and Exchange Commission (SEC) accused Terraform Labs and Kwon of misleading investors about the stability of TerraUSD and falsely claiming that Terraform’s blockchain was used in a popular Korean mobile payment app.

- The collapse of TerraUSD in 2022 resulted in investors losing over $40 billion, impacting the broader crypto market.

- Kwon, who was arrested in Montenegro in March 2023, did not attend the trial.

- The SEC seeks civil financial penalties and orders barring Kwon and Terraform from the securities industry.

In a landmark verdict, a Manhattan jury has delivered a resounding blow to Terraform Labs and its founder, Do Kwon. The case revolves around allegations of fraud, deception, and the collapse of TerraUSD, a stablecoin that once promised stability but ultimately left investors reeling.

The Verdict: Built on Lies

The jury’s decision is clear: Terraform Labs and Do Kwon are liable for civil fraud charges. But what led to this momentous ruling?

1. TerraUSD’s Shaky Foundation

TerraUSD, designed to maintain a value of $1, was the cornerstone of Terraform’s ecosystem. Investors believed in its stability, but the truth was far murkier. The SEC accused Terraform Labs and Kwon of misleading investors about TerraUSD’s robustness. The platform’s success story, it turns out, was “built on lies.”

2. False Claims and Misleading Statements

The deception didn’t stop there. Terraform Labs claimed that its blockchain technology powered a popular Korean mobile payment app. But the SEC argued that this was a fabrication. Investors were led to believe that Terraform’s influence extended far beyond reality.

3. The $40 Billion Collapse

In May 2022, TerraUSD’s peg to the dollar snapped. Investors lost more than $40 billion across TerraUSD and Luna, another token closely linked to TerraUSD. The fallout reverberated throughout the crypto market, affecting even Bitcoin’s value. Several companies filed for bankruptcy as a result.

The Aftermath: Seeking Justice

Kwon, once a visionary behind TerraUSD, now faces extradition requests from both the US and South Korea. His arrest in Montenegro in March 2023 marked a turning point. Terraform Labs, despite the setback, aims to rebuild and make purchasers whole.

Conclusion: Lessons Learned

The TerraUSD saga serves as a cautionary tale for the crypto industry. Transparency, honesty, and accountability are paramount. As regulators tighten their grip, projects must tread carefully. Terraform Labs’ downfall reminds us that even in decentralized finance, trust is fragile, and consequences are real.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with professionals before making investment decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin and Ethereum ETFs Record $755M Outflows Amid Escalating US-China Trade Tensions

- Weekly Crypto Roundup – Turbulence, Tariffs, Liquidations, and the Road to Recovery

- Bitcoin Rebounds Above $114,000 After Historic $19B Crypto Liquidation Wipeout

- The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

Related

- Interpol red-lists Terra creator Do Kwon Interpol has issued a red warning for the creator of Terraform Labs, a South Korean national named Do Kwon....

- All the crypto companies that went bankrupt in 2022 [so far] We had to make a list to follow along with the thread. Full list inside. ...

- Forking LUNA to Create Terra Classic: Terra Ecosystem Revival Plan 2 Do Kwon is trying to save Terra, and the community seems to accept his last survival plan....

- UST Update: Sustaining $1 Parity Amidst Macro Turmoil Terra ecosystem stablecoin has struggled to maintain parity with the dollar....