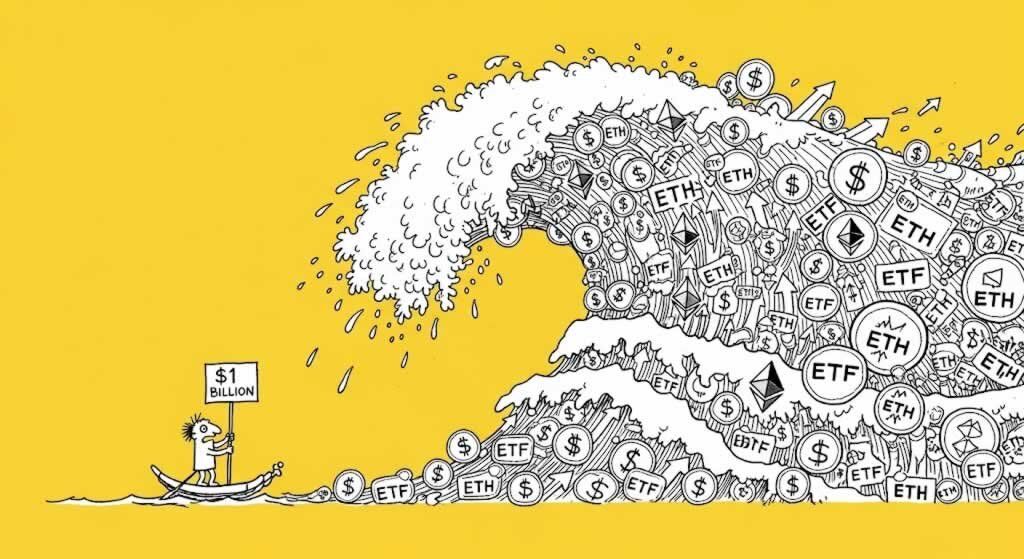

Spot Ether ETFs Hit Record $1B Daily Inflows Amid Surging Institutional Interest

- Spot Ether ETFs saw $1.02 billion in net inflows on Monday, the highest single-day figure since launch.

- BlackRock’s ETHA led with $640 million, followed by Fidelity’s FETH at $277 million.

- Cumulative inflows now exceed $10 billion, signaling strong institutional adoption.

U.S. spot Ethereum ETFs have achieved a new milestone, recording over $1 billion in net inflows in a single day for the first time. According to data from Farside Investors, the nine ETFs attracted $1.01 billion on Monday, surpassing previous records and outpacing Bitcoin ETF inflows of $178 million on the same day.

BlackRock’s iShares Ethereum Trust (ETHA) topped the list with $640 million in inflows, while Fidelity’s Ethereum Fund (FETH) followed with $277 million, both setting new daily highs. Other contributors included Grayscale’s Mini Ether Trust with $67 million and smaller flows from Bitwise, 21Shares, Franklin Templeton, and VanEck.

This surge comes amid a 45% rise in ETH price over the past month, trading around $4,300. Analysts attribute the inflows to growing recognition of Ethereum’s role in decentralized finance and tokenized assets. “Investors are increasingly recognizing Ethereum’s value as both a store of value and a foundational layer for decentralized finance and Web3 innovation,” said Nick Ruck, Director at LVRG Research.

The event has sparked discussions on X, with users highlighting institutional buying sprees and whale accumulations. One post noted a crypto whale acquiring $1.34 billion in ETH, outpacing recent ETF inflows (X). Community sentiment is bullish, with references to Ethereum treasury companies and regulatory tailwinds fueling demand.

🚨 HUGE ETH MOVE AHEAD OF INFLATION DATA

— TheCoinZone.com (@thecoinzonecom) August 12, 2025

A crypto whale just snagged $1.34B (312K $ETH) before key US inflation reports drop.

Outpacing all recent US Ether ETF inflows by $300M

Are we on the cusp of an ETH rally back to $4,890?

Source: @lookonchain pic.twitter.com/bANjbRrd5I

However, Ethereum co-founder Vitalik Buterin cautioned against overleveraging in corporate ETH treasuries, describing it as a potential risk.

Latest related notes from Cryptopress.site:

– Ether Surges Over 21% Amid Volatility Spike

– Ethereum Soars Past $3300: Institutional Inflows Drive Momentum

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, investment, or financial advice. Readers should conduct their own research before making investment decisions. We use AI to help us research and enhance the text or visual aids, which are then edited by our team.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Understanding Cryptocurrency Market Crashes: Insights from the 2025 Decline

- Senate Crypto Framework Bill Stalls Amid Democrats’ Counterproposal on DeFi Regulations

- Bitcoin and Ethereum ETFs Record $755M Outflows Amid Escalating US-China Trade Tensions

- Weekly Crypto Roundup – Turbulence, Tariffs, Liquidations, and the Road to Recovery

- Bitcoin Rebounds Above $114,000 After Historic $19B Crypto Liquidation Wipeout

Related

- Leveraged Ether ETFs Launch in the U.S.: A Deep Dive into the Impact and Implications Volatility Shares launches the first 2x leveraged Ether ETF in the U.S. on June 4, 2024....

- Ether ETFs Debut with Over $1 Billion in Trading Volume The first US ETFs investing directly in Ether achieved overall net inflows of $107 million on their first day of trading....

- SEC Grants Final Approval To Spot Ether ETFs What It Means for Investors and the Future of Crypto....

- Can Ethereum Reclaim Its Glory? 2025’s ETF Surge and Tech Upgrades Ethereum’s 2025 Revival: ETF Inflows, Pectra Upgrade Drive $5,000 Price Predictions....