Solana ETFs Draw $70 Million Inflows Amid Broader Crypto Market Outflows

- Solana ETFs saw $70 million in net inflows over the past day, contrasting sharply with outflows from major crypto funds.

- This influx suggests growing investor interest in higher-beta assets like Solana amid fatigue in Bitcoin and Ether.

- Bitwise’s Solana ETF led the charge, highlighting resilience in the Solana ecosystem despite price declines.

Solana ETFs Buck Market Trend

In the last 24 hours, Solana exchange-traded funds (ETFs) have attracted approximately $70 million in inflows, standing out against a backdrop of outflows in the broader cryptocurrency market. This movement indicates a potential shift by investors toward higher-beta assets, as fatigue sets in among major cryptocurrencies like Bitcoin and Ether.

According to a report from Bitcoin News, Solana ETFs drew $70 million in new capital while Bitcoin and Ether funds experienced over $300 million in outflows. The inflows reflect diversification strategies, with investors eyeing Solana’s high-growth potential in Layer-1 protocols.

Bitwise Leads the Inflows

The Bitwise Solana Staking ETF (BSOL) has been particularly notable. As detailed in Decrypt, the Solana Bitwise ETFs recorded $70 million in net inflows yesterday, even as the SOL token price dropped 8%. This resilience underscores Solana’s appeal amid market volatility.

Market analysts point to broader sentiment shifts, with the Crypto Fear & Greed Index entering “extreme fear” territory. The rotation to Solana may stem from its strong on-chain activity and ecosystem developments, offering higher risk-reward compared to majors.

Balanced Perspective on Risks

While the inflows are positive for Solana, experts caution about ongoing market pressures. Long-term holders selling Bitcoin and declining memecoin performance signal broader fatigue, potentially impacting altcoins. Regulatory scrutiny on ETFs remains a key risk factor.

Community sentiment on platforms like X shows mixed views, with some praising Solana’s performance while others warn of short-term corrections. Investors should monitor on-chain metrics and funding rates for sustained trends.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

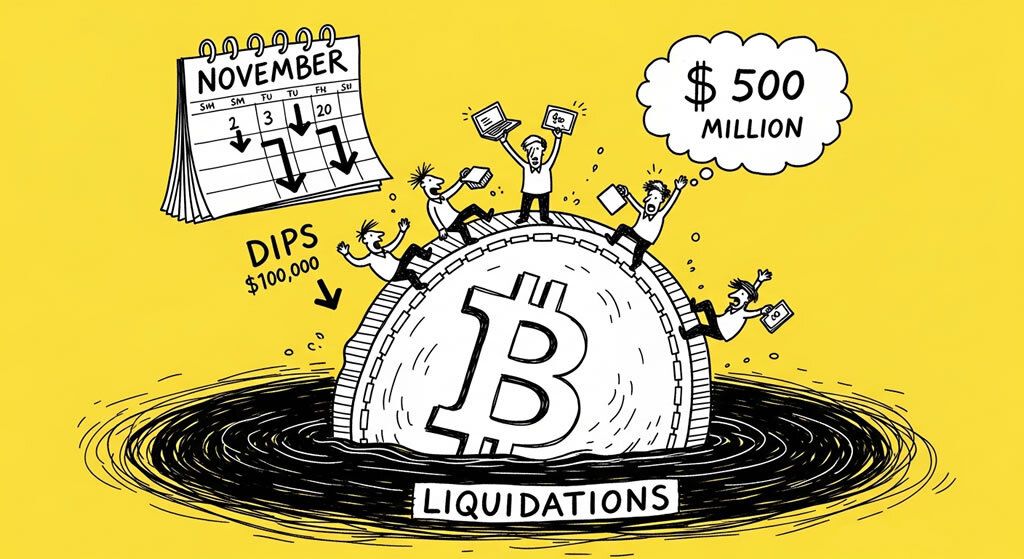

- Bitcoin Plunges Below $95,000 Amid Massive Liquidations and Record ETF Outflows

- Strategy Buys Bitcoin Every Day This Week Amid Dip, Saylor Denies Sale Rumors

- What is the Revenue Meta in Crypto?

- Bitcoin Dips Below $100,000 for Third Time in November as Liquidations Top $500 Million

- Why Lighter’s LLP is Defying Dilution in Perp DEXs (34%+ Yield Vault)

Related

- Bitcoin and Ethereum Lead 2025’s $7.5B Crypto Fund Rally Crypto Funds Hit $7.5B in 2025 Inflows as Institutional Appetite Grows....

- X Payments Enters Limited Beta, Sparking Crypto Speculation Elon Musk’s X Money Beta Launches with Crypto Speculation....

- Ether ETFs Debut with Over $1 Billion in Trading Volume The first US ETFs investing directly in Ether achieved overall net inflows of $107 million on their first day of trading....

- Ether ETFs Record Nearly $788 Million in Weekly Outflows, Driven by Grayscale’s ETHE Ether exchange-traded funds (ETFs) experienced significant outflows of $787.9 million last week, primarily led by Grayscale's Ethereum Trust (ETHE), signaling cautious investor sentiment....