SEC Amends Binance Lawsuit, Drops Security Claims for Solana and Other Cryptocurrencies

- The SEC has decided to amend its lawsuit against Binance, dropping security claims for Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), and COTI (COTI).

- The decision comes after a recent court order and discussions between the SEC and Binance regarding the classification of these cryptocurrencies as securities.

- The amended complaint will focus on other aspects of the case, such as allegations of unregistered securities offerings and inadequate disclosure of risks.

- The outcome of this lawsuit could have significant implications for the regulatory landscape of cryptocurrencies in the United States.

Background and Context

The Securities and Exchange Commission (SEC) has been actively pursuing cases against cryptocurrency exchanges and projects that it believes are in violation of securities laws. The SEC has decided to amend its lawsuit against Binance, one of the world’s largest cryptocurrency exchanges, dropping security claims for several cryptocurrencies, including Solana, Cardano, Polygon, Filecoin, Cosmos, The Sandbox, Decentraland, Algorand, Axie Infinity, and COTI.

Breaking: #Solana $SOL is no longer defined as a security by the SEC – July 29th – The @SECGov #SEC moves to amend complaint against @binance – seeks to no longer prove tokens such as @solana are securities.

— MartyParty (@martypartymusic) July 30, 2024

The SEC informed Defendants that it intends to seek to amend its… pic.twitter.com/V36PQOdkec

The SEC’s Decision to Amend the Lawsuit

The SEC’s decision to amend the lawsuit comes after a recent court order and discussions between the SEC and Binance regarding the classification of these cryptocurrencies as securities. The SEC’s original complaint alleged that these cryptocurrencies were unregistered securities, but the amended complaint will focus on other aspects of the case, such as allegations of unregistered securities offerings and inadequate disclosure of risks.

The outcome of this lawsuit could have significant implications for the regulatory landscape of cryptocurrencies in the United States. If the SEC is successful in proving that Binance and other cryptocurrency exchanges have violated securities laws, it could lead to increased regulatory scrutiny and enforcement actions against other exchanges and projects. On the other hand, if Binance and the other cryptocurrencies prevail, it could provide more clarity and certainty for the industry regarding the regulatory status of cryptocurrencies.

Market Reaction and Investor Sentiment

The news of the SEC’s decision to amend the lawsuit has had a mixed reaction in the cryptocurrency market. While some investors see this as a positive development, others remain cautious about the potential implications of the lawsuit. The prices of the affected cryptocurrencies have been volatile in response to the news, with some experiencing significant price fluctuations.

Experts in the cryptocurrency industry have weighed in on the SEC’s decision to amend the lawsuit. Some believe that this is a positive development, as it could provide more clarity and certainty for the industry regarding the regulatory status of cryptocurrencies. Others, however, are concerned that the SEC’s decision to focus on other aspects of the case could lead to increased regulatory scrutiny and enforcement actions against other exchanges and projects.

The SEC’s decision to amend its lawsuit against Binance, dropping security claims for several cryptocurrencies, is a significant development in the ongoing regulatory battle between the cryptocurrency industry and the SEC. The outcome of this lawsuit could have far-reaching implications for the industry, and investors and industry participants will be closely watching the case as it progresses.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

- Diversification in Crypto: Building a Resilient Portfolio

- North Dakota Partners to Launch State-Backed Stablecoin

- SEC Chair Atkins Targets Formal Innovation Exemption Rulemaking by End of 2025

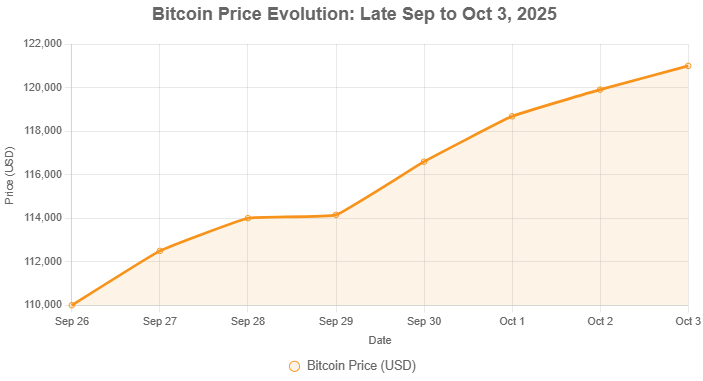

- Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

Related

- The SEC’s Latest Move: Targeting Ethereum Liquid Staking The SEC has taken legal action against Consensys in connection with the MetaMask wallet and betting services....

- Crypto Prices Plummet as SEC Sues Binance, Shaking the Market The crypto market experienced a significant downturn as the SEC filed a lawsuit against Binance, accusing the exchange of deception and mishandling investors' assets....

- Major altcoins fall by 20% after SEC lawsuit The SEC lawsuit against Binance and Coinbase has caused major altcoins to fall 20% in value....

- Avalanche accused of using lawsuits to cripple rivals In undercover videos released Friday, an attorney brags about his ties to Avalanche and says he filed frivolous lawsuits against competitors....