REX-Osprey Set to Launch First U.S. Spot XRP ETF This Week Under ’40 Act Framework

- REX Shares and Osprey Funds will launch the XRPR ETF on Thursday, marking the first spot XRP product in the U.S.

- The ETF uses a Cayman Islands subsidiary and an ETF-of-ETFs model to hold XRP directly while investing in related funds, registered under the Investment Company Act of 1940.

- This launch follows a similar approach to the firms’ Solana staking ETF and comes amid pending approvals for other altcoin ETFs.

Investment firms REX Shares and Osprey Funds announced plans to launch the REX-Osprey XRP ETF (XRPR) this week, providing U.S. investors with a regulated vehicle for spot XRP exposure. The product is slated to list on Thursday, September 18, after a delay from its original September 12 target.

Unlike Bitcoin and Ethereum spot ETFs, which hold underlying assets in reserves, the XRPR ETF employs a hybrid structure to navigate regulatory challenges. It will hold XRP directly as its primary asset, while allocating at least 40% of its portfolio to shares of other XRP-focused ETFs or exchange-traded products (ETPs). This setup is facilitated through a wholly-owned Cayman Islands subsidiary, “REX-Osprey TM XRP (Cayman) Portfolio S.P.,” ensuring compliance under the Investment Company Act of 1940.

The framework mirrors the one used for the REX-Osprey SOL Staking ETF, which debuted in June 2025 and marked a breakthrough for non-Bitcoin assets. At least 80% of the fund’s assets will be invested in XRP or instruments tracking its performance, with the remainder in derivatives, U.S. Treasuries, or cash equivalents for liquidity.

The REX-Osprey™ XRP ETF, $XRPR, is coming this week!$XRPR will be the first U.S. ETF to deliver investors spot exposure to the third largest cryptocurrency by market cap, $XRP.

— REX Shares (@REXShares) September 15, 2025

From REX-Osprey™, the team behind $SSK.@OspreyFunds

View Fund Prospectus:… pic.twitter.com/qMdKhfBZ0e

Management fees and exact expense ratios remain undisclosed, but the structure may introduce tracking discrepancies compared to pure spot holdings. “Investors look to ETFs as trading and access vehicles,” said Greg King, founder and CEO of REX Financial. “The digital asset revolution is already underway, and to be able to offer exposure to spot XRP and other crypto returns within the protections of the US ’40 Act ETF regime is something Rex-Osprey is proud of and has worked diligently to achieve.”

Bloomberg Intelligence analyst James Seyffart highlighted the innovative workarounds in the filing, noting it differs from traditional spot ETF proposals awaiting SEC decisions. Over 90 altcoin ETF applications, including those for XRP, Solana, and Dogecoin, are pending, with approvals viewed as likely by late 2025.

This launch coincides with a similar Dogecoin ETF from the same sponsors, potentially expanding retail access to altcoins amid Bitcoin’s surge above $115,000. Risks persist, including regulatory scrutiny over XRP’s ongoing SEC litigation and potential liquidity issues in early trading.

The XRPR ETF could catalyze XRP’s price, currently trading around $2.50, by drawing institutional inflows similar to those seen in Bitcoin ETFs, which locked in $2.3 billion last week. Investors should monitor the SEC prospectus for full details.

For more on XRP fundamentals, see XRP on Cryptopress.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Senate Crypto Framework Bill Stalls Amid Democrats’ Counterproposal on DeFi Regulations

- Bitcoin and Ethereum ETFs Record $755M Outflows Amid Escalating US-China Trade Tensions

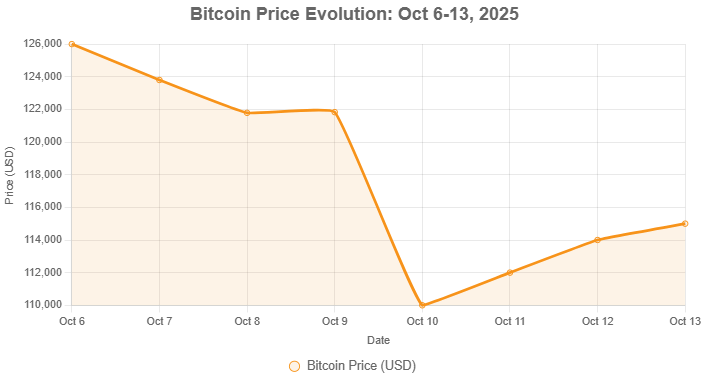

- Weekly Crypto Roundup – Turbulence, Tariffs, Liquidations, and the Road to Recovery

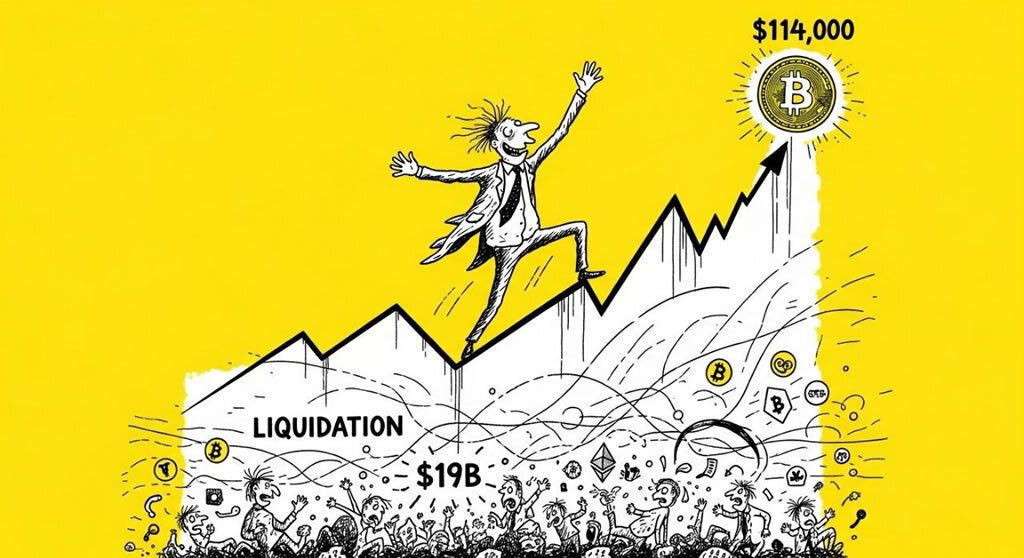

- Bitcoin Rebounds Above $114,000 After Historic $19B Crypto Liquidation Wipeout

- The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure

Related

- First U.S. Solana Staking ETF Draws Strong Investor Interest at Launch The ETF attracted $12 million in net inflows and $33 million in trading volume on its first day, signaling robust investor interest....

- First U.S. Solana ETF with Staking Could Debut This Week The ETF uses a C-corporation framework, bypassing traditional SEC filing hurdles, enabling faster market entry....

- First US Dogecoin ETF Set to Debut This Week, Ushering in Memecoin Era The Rex-Osprey DOGE ETF (DOJE) is poised to launch on September 11, providing direct exposure to Dogecoin and highlighting growing institutional interest in speculative memecoins....

- 21Shares Files for Spot Dogecoin ETF 21Shares Files for Spot Dogecoin ETF, Aims to Bring Meme Coin to Mainstream Investors....