Nobel Laureate Predicts Bitcoin’s End

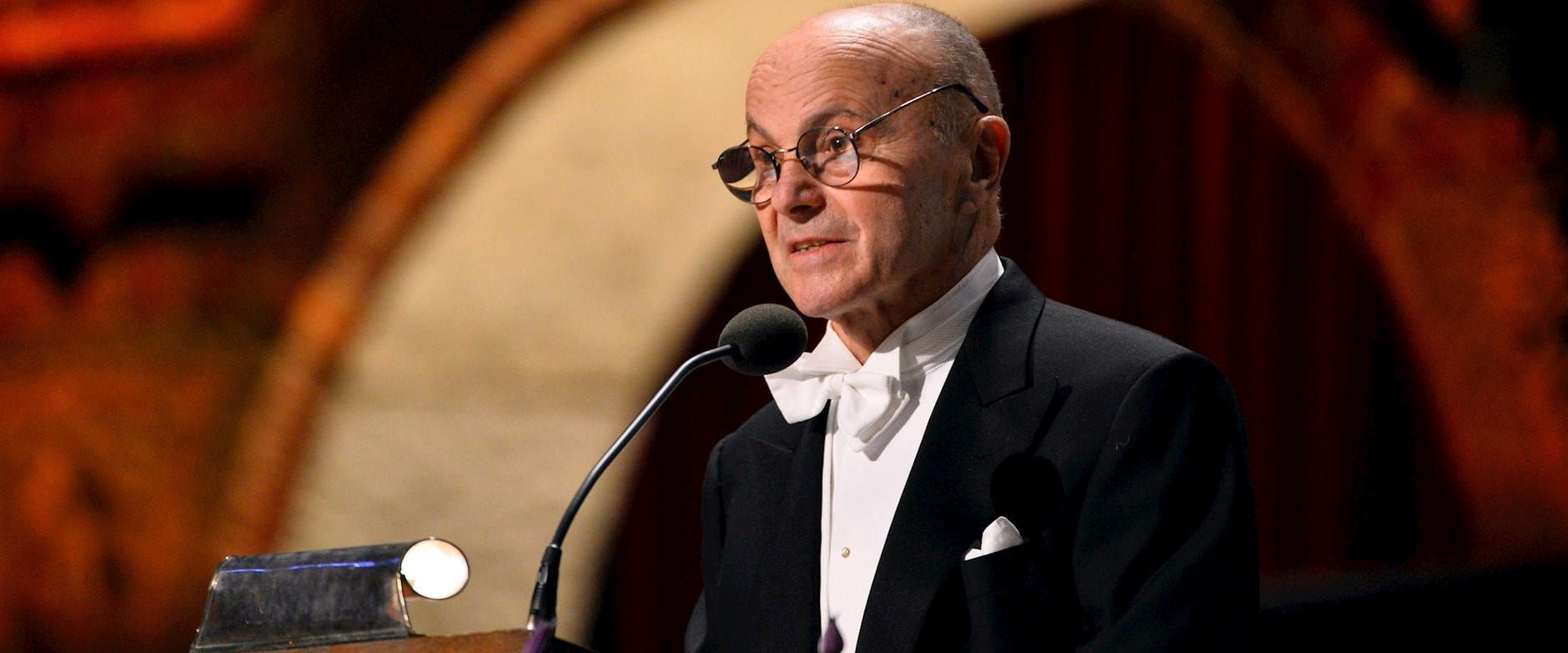

- Nobel Laureate Eugene Fama predicts Bitcoin will become worthless within the next decade.

- Despite numerous predictions of its demise, Bitcoin continues to grow, recently hitting a record high.

- Fama’s skepticism is rooted in Bitcoin’s volatility and lack of intrinsic value as a medium of exchange.

Nobel Laureate Eugene Fama, often referred to as the “Father of Modern Finance,” has added his name to the list of skeptics predicting the end of Bitcoin. In a recent podcast, Fama stated that he believes there’s “close to a 100% probability” that Bitcoin’s value will plummet to zero within the next 10 years.

Fama argues that Bitcoin fundamentally violates the principles of a stable medium of exchange, pointing out its extreme volatility and lack of intrinsic value. “Cryptocurrencies are such a puzzle because they violate all the rules of a medium of exchange,” Fama explained. He further emphasized that Bitcoin’s real value is too variable to sustain it as a reliable currency, suggesting that if it doesn’t collapse, it would force a rethink of monetary theory itself.

The Resilience of Bitcoin

But here’s the kicker – Bitcoin has been declared “dead” over 400 times, yet it persists and even flourishes. Despite these grim predictions, Bitcoin’s market cap soared to $2 trillion in December 2024, making it one of the top global assets by value. This resilience is largely due to its decentralized nature and the growing acceptance among institutions and retail investors alike.

Bitcoin’s volatility is indeed a double-edged sword. On one hand, it has provided astronomical returns for early adopters; on the other, it poses significant risks. Over the past year, Bitcoin’s price has seen swings from a high of $109,000 to significant drops, influenced by market sentiment, regulatory news, and macroeconomic factors.

As of early 2025, Bitcoin’s market capitalization stands at approximately $2 trillion, showcasing its significant presence in the financial ecosystem despite volatility.

- High Volatility: Bitcoin’s price can change by over 5% in a single day, far more than traditional assets.

- Lack of Intrinsic Value: Unlike gold or real estate, Bitcoin’s value is based purely on demand and speculative interest.

- Regulatory Risks: Governments around the world are still grappling with how to regulate cryptocurrencies, which can lead to sudden market shifts.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Unlock Bitcoin Yields: Earn Up to 0.23% APR with Babylon Labs Staking

- Bitcoin Tops $111K, European Stocks Rise as Trump-Xi Meeting Confirmed Amid Trade Tensions

- Senate Democrats Reaffirm Commitment to Crypto Market Bill

- BlockDAG Nears $600M Goal as DOGE Targets $0.30 and HBAR Builds Momentum Toward $1 Breakout

- Beluga and Veera join hands to Power Next-Generation Crypto Experiences

Related

- Crypto Predictions for 2023: The Year Ahead Crypto Predictions for 2023: What to Expect from the Market....

- Will Bitcoin ever die? Bitcoin is going through a huge transition right now. Bitcoin has been used in transactions all over the world, and it continues to grow in popularity. Many people wonder if Bitcoin will ever die, just like people used to wonder...

- Crypto Predictions 2024: the Main Narratives for the Year Ahead Here's what top crypto analysts think....

- How Many Bitcoins Are Truly Available For Sale Today? Unveiling the Bitcoin Supply Quandary....