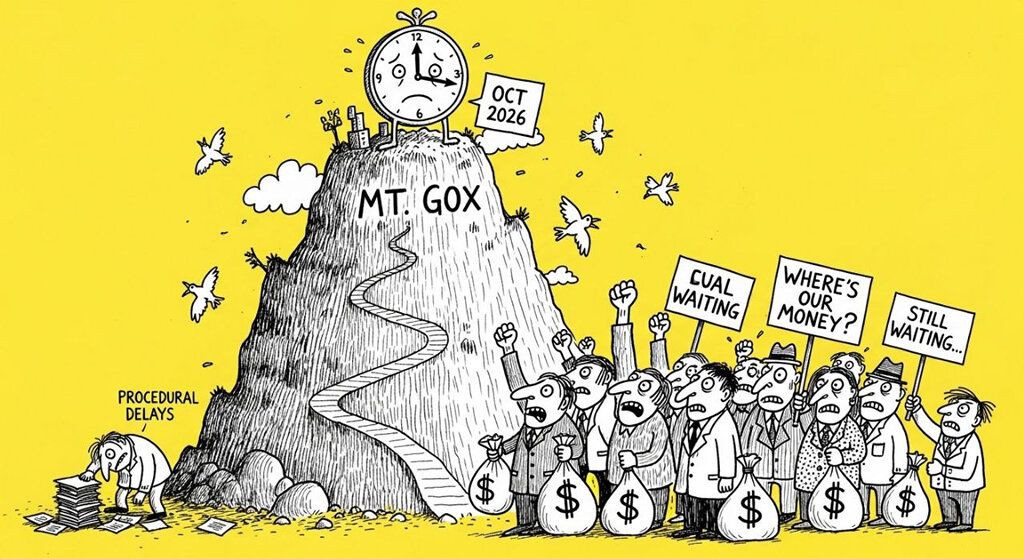

Mt. Gox Extends Creditor Repayment Deadline By One Year

- Mt. Gox has extended its repayment deadline for creditors from October 31, 2025, to October 31, 2026.

- The delay stems from incomplete procedures for many creditors and the need for secure distribution processes.

- This move may reduce immediate selling pressure on Bitcoin, with roughly 34,700 BTC still awaiting distribution.

The defunct cryptocurrency exchange Mt. Gox has once again delayed its creditor repayments, pushing the deadline back by a full year to October 31, 2026.

In an announcement from rehabilitation trustee Nobuaki Kobayashi, the extension was attributed to the time required for a large number of creditors to complete necessary steps and to ensure safe and accurate distributions.

History of Postponements

This is the third significant delay in the Mt. Gox rehabilitation process. The exchange, which suffered a major hack in 2014 leading to the loss of approximately 850,000 BTC, initially aimed to complete repayments by October 2023, then 2024, and most recently 2025.

Creditors are entitled to receive funds in Bitcoin (BTC), Bitcoin Cash (BCH), and fiat currency. While some distributions have occurred, challenges including international banking coordination and KYC compliance have slowed progress, as noted in reports from CoinDesk.

Potential Market Impact

The postponement could provide short-term relief to Bitcoin markets by deferring potential sell-offs. According to analysis from CryptoSlate, the remaining undistributed amount includes about 34,700 BTC, a figure that might have less impact on prices given Bitcoin’s increased liquidity and market cap in recent years.

The postponement could provide short-term relief to Bitcoin markets by deferring potential sell-offs.

“Due to the fact that it is expected that a large number of rehabilitation creditors will require time to receive repayments, and that it is necessary to make repayments in a safe and secure manner,” Kobayashi explained in the statement, as reported by Cointelegraph.

However, the repeated delays raise questions about the efficiency of crypto bankruptcy proceedings and could affect creditor sentiment.

Current Market Context

The news comes as Bitcoin hovers near recent highs, with traders monitoring broader economic factors such as the upcoming Federal Reserve rate decision. Decrypt highlighted that the delay averts a potential supply shock just days before the original deadline.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Mt. Gox Extends Creditor Repayment Deadline By One Year

- Tokenization of Real Estate: Breakthroughs and Barriers in 2025 Pilots

- US Lawmaker Proposes Crypto Trading Ban for Elected Officials Amid Backlash Over CZ Pardon

- Crypto Market Cap Surges to $3.88 Trillion Amid US-China Trade Deal Optimism

- Democratic Pushback Intensifies Against Trump’s Pardon of Binance Founder CZ

Related

- Bitcoin Market Awaits Impact of Mt. Gox’s 8,200 BTC Transfer Mt. Gox Bitcoin Transfer: Implications for Creditors and Market....

- Mt. Gox Creditors Receive Bitcoin and Bitcoin Cash Repayments: Implications for Crypto Markets Mt. Gox has started disbursing Bitcoin and Bitcoin Cash to its creditors....

- Mt. Gox Repayment and Bitcoin Miners Sell-Off Mt. Gox, once the largest Bitcoin exchange in the world, is preparing to repay creditors starting in July 2024. ...

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....