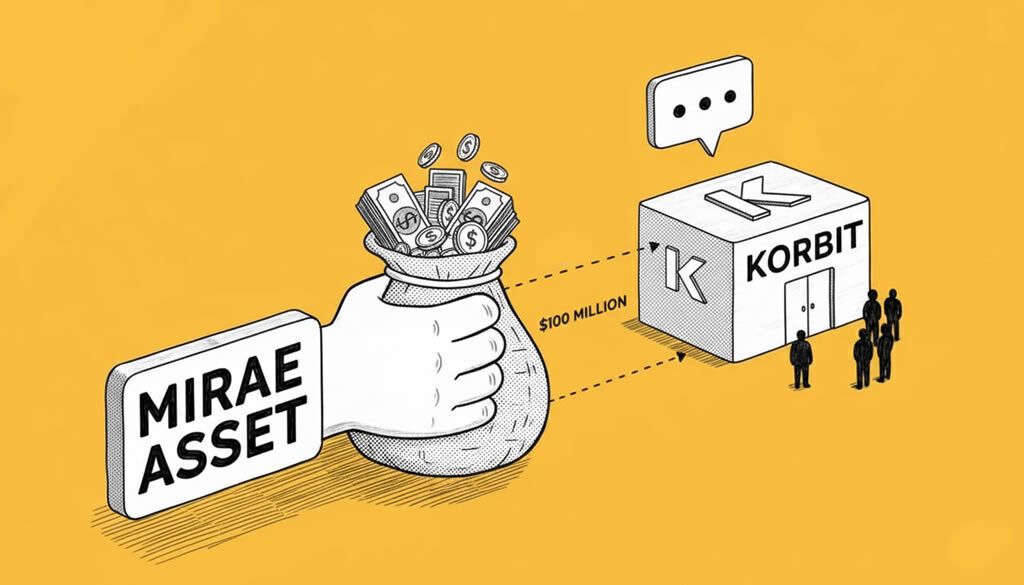

Mirae Asset in Talks to Acquire South Korean Crypto Exchange Korbit for Up to $100 Million

- Mirae Asset Consulting has signed a memorandum of understanding with Korbit’s major shareholders for a potential acquisition valued at 100 billion to 140 billion Korean won ($70 million to $100 million).

- Korbit, established in 2013 as South Korea’s first crypto exchange, currently holds less than 1% of the domestic trading volume but maintains a full operating license.

- The move underscores the growing convergence of traditional finance and cryptocurrency in South Korea, following similar deals like Naver’s merger with Upbit operator Dunamu.

In a development highlighting the blurring lines between traditional finance and digital assets, South Korea’s Mirae Asset Financial Group is in advanced talks to acquire cryptocurrency exchange Korbit for up to $100 million, according to industry reports.

The deal is being led by Mirae Asset Consulting, a non-financial subsidiary at the top of the conglomerate’s structure, which has inked a memorandum of understanding with Korbit’s key shareholders.

NXC, the holding company behind Nexon, owns about 60.5% of Korbit, while SK Square holds a 31.5% stake acquired through a 90 billion won investment in 2021. Due diligence is underway, with final terms subject to negotiation.

Founded in 2013, Korbit pioneered Bitcoin-Korean won trading and was the world’s first such platform. However, its market share has dwindled to under 1%, dwarfed by leaders Upbit and Bithumb, which dominate with daily volumes exceeding $716 million and $298 million, respectively.

This potential acquisition aligns with South Korea’s regulatory framework, which prohibits direct involvement of financial firms in crypto businesses since 2017. By using a non-financial entity, Mirae Asset navigates these restrictions while gaining access to Korbit’s licensed infrastructure.

The transaction follows Naver Financial’s recent stock-swap merger with Dunamu, Upbit’s operator, indicating heightened interest from tradfi players in regulated crypto venues amid easing institutional investment barriers.

Analysts suggest such moves could bolster the credibility of South Korea’s crypto ecosystem, potentially attracting more institutional capital. Korbit’s compliance features make it an appealing entry point for firms like Mirae Asset seeking exposure to digital assets.

Korbit representatives told local media there is ‘nothing we can confirm’ regarding the talks.

The news has generated buzz on social media, with accounts like CryptoNewsZ noting the acquisition as a ‘significant institutional push into the digital asset market.’ View post

South Korea’s Mirae Asset Group is reportedly considering a $100M acquisition of crypto exchange Korbit, marking a significant institutional push into the digital asset market.#MiraeAsset #Korbit #CryptoExchange #CryptoNews #DigitalAssets pic.twitter.com/hj1EPQsqWr

— CryptoNewsZ (@cryptonewsz_) December 29, 2025

Amid this, major cryptocurrencies such as Bitcoin and Ethereum continue to see institutional interest in regulated markets.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Crypto Weekly Snapshot – End-of-Year Consolidation

- Mirae Asset in Talks to Acquire South Korean Crypto Exchange Korbit for Up to $100 Million

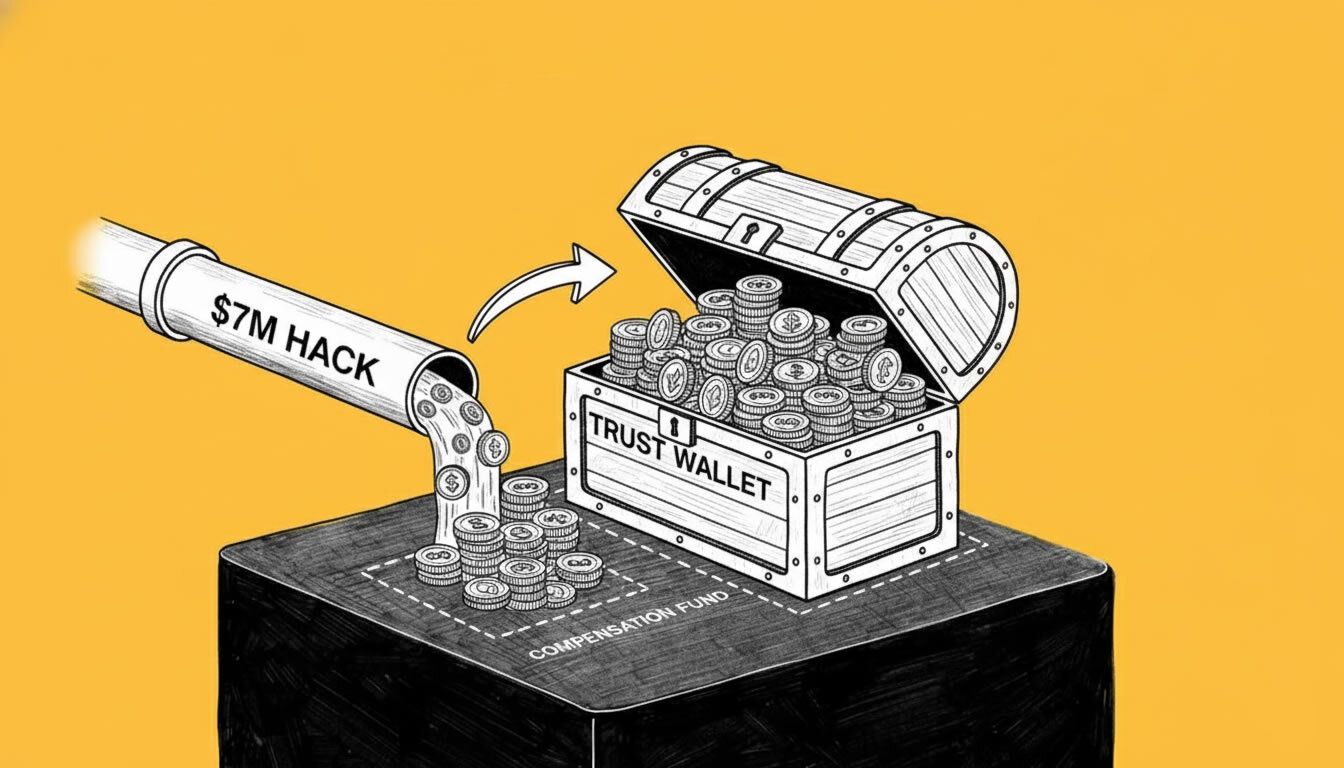

- Trust Wallet Launches Compensation Process After $7M Browser Extension Hack

- The Top Crypto Investments of 2025: A Year of Utility and Maturity

- High APY on Synthetic Dollars: The Falcon Finance Strategy

Related

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B Coinbase and Mastercard are reportedly in advanced discussions to purchase London-based stablecoin infrastructure provider BVNK, with a potential valuation between $1.5 billion and $2.5 billion, marking what could be the largest acquisition in the stablecoin sector....

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- TRX Price Skyrockets Following South Korea’s Martial Law Declaration TRX price surged over 60%, reaching a new all-time high of $0.44....

- Michael Saylor Michael Saylor is an entrepreneur, investor, strategist, author, and speaker on topics of technology, bitcoin, and business strategy. His early life and career are filled with contradictions; an unconventional upbringing on a west coast swing family that embraced individualism and...